State-owned oil marketing company Bharat Petroleum said on June 28 it approved raising up to 180 billion rupees ($2.19 billion) through an issue of equity shares on a rights basis, underscoring India's push to achieve net zero-emissions goals.

The details of the issue, including the price, right entitlement and timing will be intimated separately after the board approval, it said in an exchange filing.

The company had last week said the funds will be used to achieve "energy transition, net zero and energy security objectives."

The Indian government is set to inject multi-billion-dollar equity in its three big state refiners-Bharat Petroleum, Indian Oil Corp. and Hindustan Petroleum Corp. Ltd.-in return for funding towards the firms' energy transition projects.

The three refiners together aim to invest 3.5-4 trillion rupees to achieve their net zero-emissions goals by 2040, sources told Reuters last week.

Indian Oil, which is also planning to launch a rights issue, on June 24 approved doubling its authorized share capital to 300 billion rupees.

The oil ministry had also asked Hindustan Petroleum to make a preferential share allotment to the government, per the Reuters report.

Recommended Reading

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

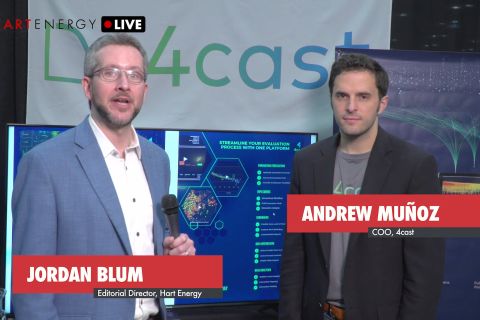

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.