Aspirations can be costly. Goals can be attained. Renewable energy advocates promise that cheap resources will lower the cost of electricity to consumers. The reality is that renewable energy developers do not pass along that cost savings, and accommodating their entry to the grid is also driving up costs.

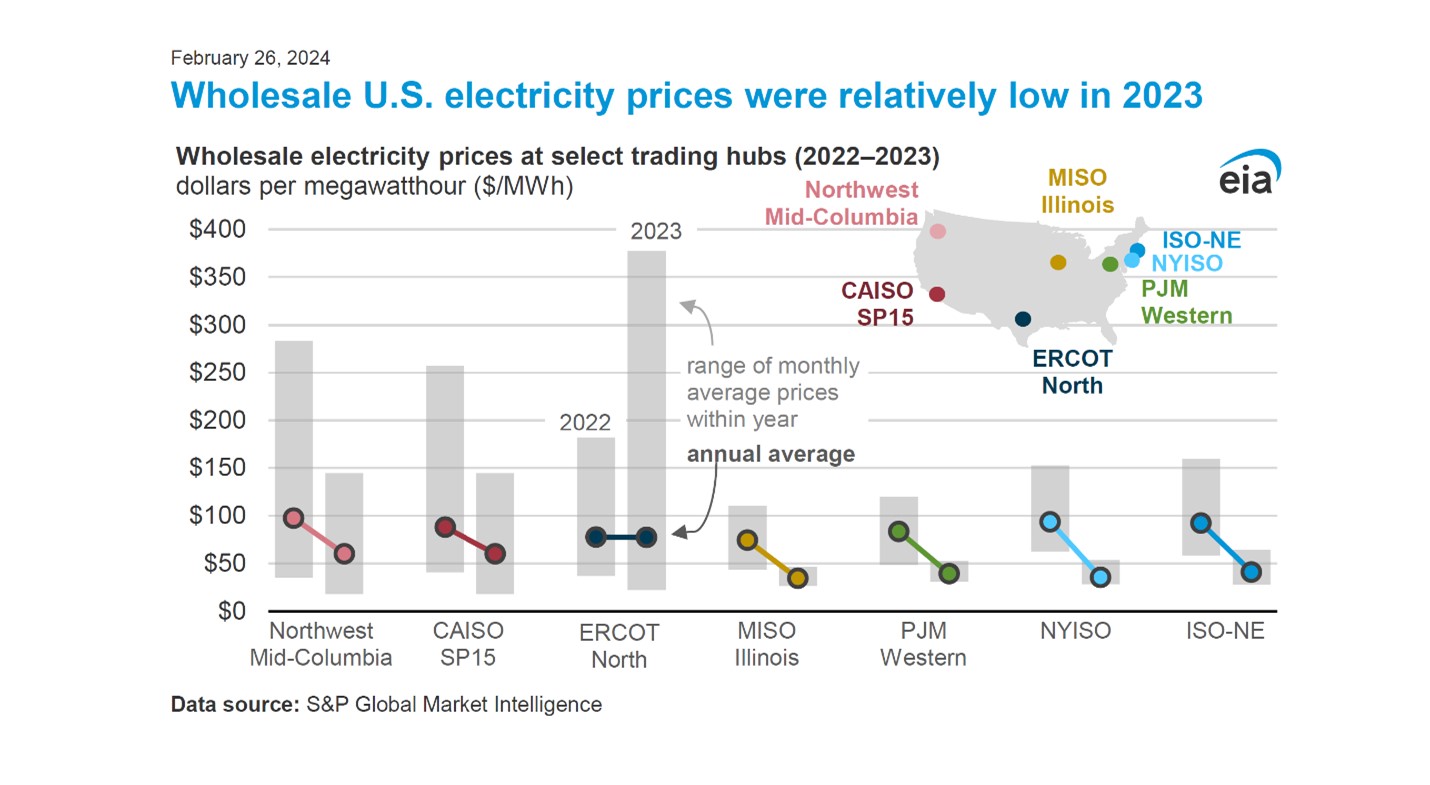

In the Texas grid managed by ERCOT, the Electric Reliability Council of Texas, the fleet of wind and solar farms is the largest in the nation. For 2023, ERCOT also had the highest electricity prices, the most volatile electricity prices and issued more conservation alerts than anywhere else in the nation.

Obstructive spin from activists and incumbent industries obscure the facts about the costs of the energy transition. The consumer is primed to wake up in five years’ time wondering how the promise of the cheap wind and solar morphed into much higher electricity bills. As always, there are several contributing factors.

Electricity from wind and solar farms is intermittent. They are not yet sufficient to fully meet peak demand days for any grid, but they benefit from the pricing set by the last swing producer on any peak demand day, in very much the same way that the price of oil in the Permian Basin is dependent on OPEC+ actions. In Texas, there were numerous occasions in 2023 when the wholesale electricity price jumped to $5,000 per megawatt hour. The renewables developers made fortunes selling power, in addition to the federal production tax credits they received.

Not a straightforward swap

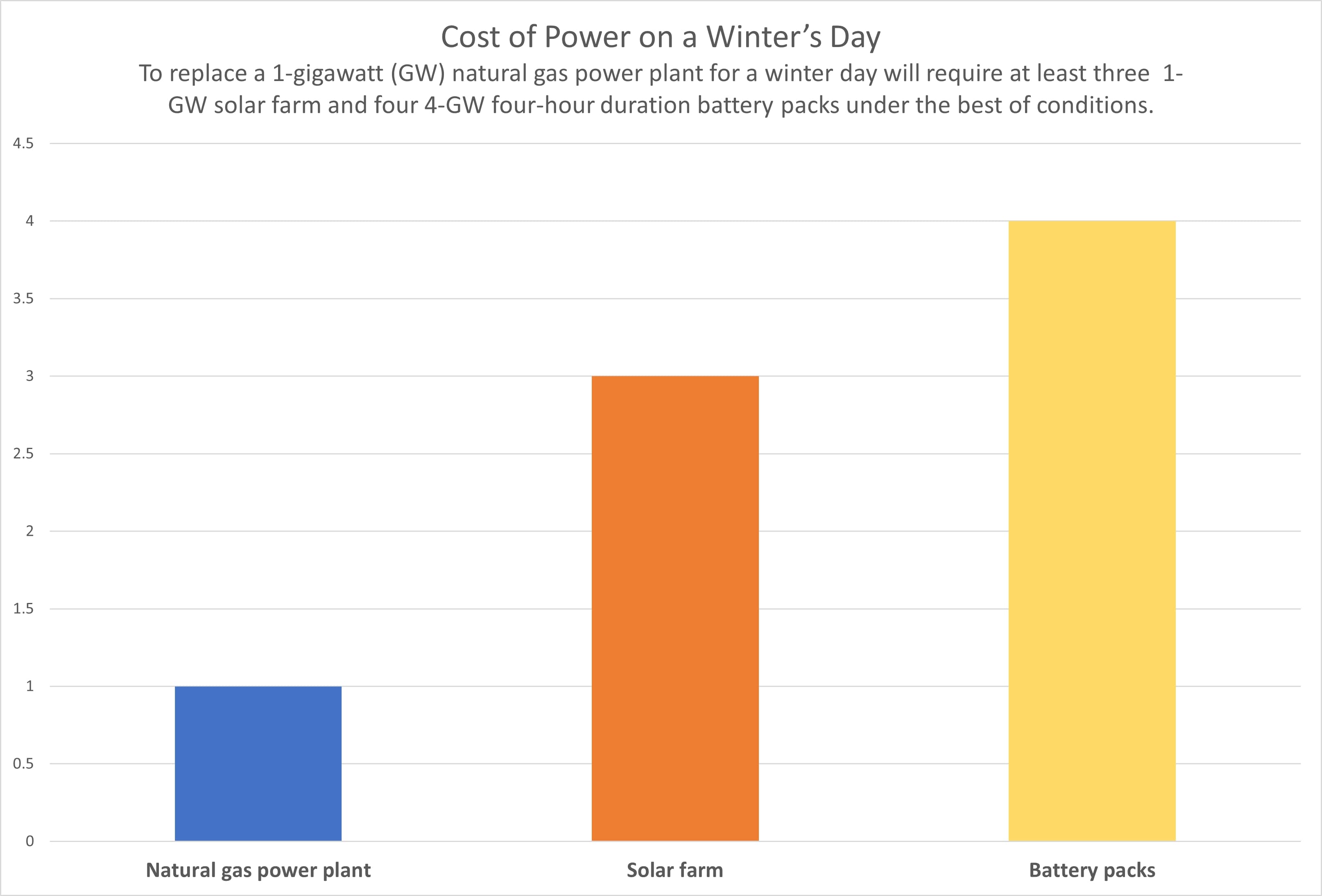

To accomplish the goal of electricity generated from 100% renewable resources, consider a simple example illustrated in the diagram below. Assuming 100% efficiency for everything, what will it take to replace a 1-gigawatt (GW) natural gas power plant?

Currently, solar farms have the cost advantage over wind farms due to relatively lower costs of construction and because the sun shines more frequently than there are favorable winds. On a 12-hour cloudless day—again, assume 100% efficiency—a 1-GW solar farm to power the grid is necessary, in addition to another 1-GW solar farm to charge three state-of-the-art four-hour battery packs to power the grid at night. A winter day with only eight hours of sun will require a third 1-GW solar farm and another battery pack.

Using costs from published Department of Energy data, replacing a $1 billion, 1-GW natural gas power plant will require at least $4.5 billion in solar farm construction costs, plus an additional $6.8 billion in battery packs. To this, one must add the cost of additional interconnects to the grid and additional transmission lines since solar farms, like wind farms, cannot be built in urban areas.

Cost of access and transmission

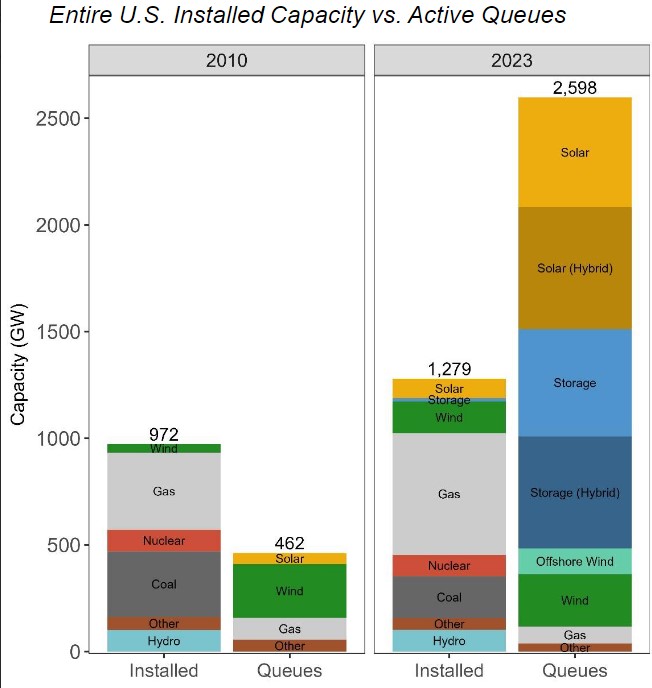

The nation is trying to keep up with the growth of renewable power resources, but before transmission lines can be built, the power plants must first have interconnects with the grid. And the waiting list to join the nation’s grids, or queues, extends years. At the beginning of 2024, Lawrence Livermore Berkeley Lab noted “active capacity in queues (~2,600 GW) is twice the installed capacity of U.S. power plant fleet (~1,280 GW); greater than peak load and installed capacity in all ISOs.”

That’s a lot of potential future power, but even it won’t be enough, as the diagram illustrates.

Most grids now track congestion costs to indicate the cost of inadequate transmission line capacity. For example, congestion costs are incurred when wind farm production is curtailed, and the grid operator must instead obtain electricity from a nearby natural gas power plant. The cost of electricity from that power plant is netted against the offered price from the wind farm to get the “congestion cost.”

The wind farm operator points to the congestion cost to argue that new transmission capacity will be economically viable. It is a fallacious argument. Once a bottleneck is removed in a network, prices across the nodes will converge. The transmission fee is then added to the wholesale cost of electricity for the network. That is, there is no free lunch.

To build out the expanded transmission network, governments or consumers will have to foot the bill. State and federal policies regard transmission lines as common carriers entitled to allowable rates of return determined by tariffs. Because of this, transmission lines were historically built in an orderly manner, where the utilities had planned power plants delivering electricity to growing consumer regions, making it simple to calculate the sizing and cost of the transmission infrastructure.

Now, with the massive growth in distributed power plants across rural America, it is significantly more difficult to size and set the cost of new transmission lines. The new lines will, at least initially, not be fully utilized because of the intermittent electricity provided from new wind and solar farms. Siting batteries at the farms may help balance transmission, but merchant batteries can also be located near consumers.

Before the transition away from fossil fuel power plants began in earnest, grid studies, including one by former CAISO Co-Chair Mason Willrich, estimated that updating just the legacy infrastructure would be a $2 trillion investment for the nation. Additional costs relating to hardening the national electricity infrastructure against electromagnetic pulses (EMP) from nuclear weapons, cyberattacks and climate change would be included.

To this, we now add the cost of building and connecting widely dispersed wind and solar farms. Artificial intelligence data centers running 24/7, electric vehicles, and the push in some communities to go all electric will require an even greater buildout of infrastructure.

In orders of magnitude, as much as a tenfold increase in capital infrastructure is on the table for Americans, via either their taxes or their electricity bills. As Texas illustrates, the energy transition is not free, either in terms of price or service. State and federal policymakers should be honest about this with their voters and consumers.