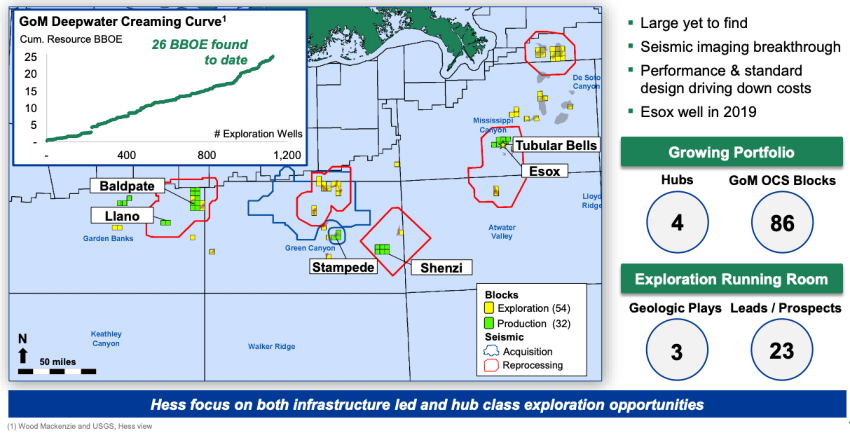

Hess Corp. plans to develop Esox as a tieback to the Tubular Bells production facility. (Source: Hess Corp.)

Hess Corp. said Oct. 29 the Esox-1 exploration well has struck oil in the deepwater U.S. Gulf of Mexico’s (GoM) Mississippi Canyon area.

Working with partner Chevron Corp., New York-based Hess said the well hit about 58 m (191 net ft) of high-quality oil-bearing Miocene reservoirs. The well was drilled in 1,405 m (4,609 ft) of water about 10 km (6 miles) east of Tubular Bells production facility.

Plans are to develop Esox as a tieback to Tubular Bells with first oil anticipated in first-quarter 2020, the company said.

The discovery is another example of how oil and gas companies are adding value offshore using an infrastructure-led exploration (ILX) approach and seismic imaging as the sector continues to recover from spending cuts carried out during the latest market downturn. Subsea tiebacks are also playing a valuable role in developments in the GoM while keeping costs down.

“As a low-cost tieback to existing infrastructure, Esox should generate strong financial returns,” Hess CEO John Hess said in a news release.

The news was well-received by analysts, who viewed the discovery as a positive despite not having details on pre-drill estimates. Analysts with Capital One Securities Inc. estimated the discovery is worth between about $90 million and $225 million based on a gross resource estimate of 30 million to 75 million barrels of oil equivalent (boe) with an in-ground value of $6/boe.

“The notion that Esox was an ILX prospect leads us to believe it may be smaller than the typical 100 million boe rule of thumb minimum pre-drill estimate that is needed to justify deepwater exploration in areas with no infrastructure,” Capital One analysts said in a note. “That said, the 191 net feet of pay is sizable and the development turnaround time is quick. These factors may mean that our estimates for resource size and in-ground value could be too conservative.”

During an investor presentation in December 2018, Hess said Esox—located in a proven Miocene play—could yield more than a 60% internal rate of return with a finding and development cost less than $10/boe.

At the time, Esox was among the 15 or so infill/ILX opportunities that were being matured in the GoM.

Hess has said it sees the GoM as a significant free cash flow generator with high returns plus upside. The company expects to produce about 65,000 boe/d through 2025 via infills and tiebacks in the GoM, generating more than $5 billion in free cash flow between 2019 and 2025 at $65/bbl Brent and $60/bbl WTI, according to an October investor presentation.

In addition to the tieback to Tubular Bells, Hess’ 2019 drilling program of about $290 million includes continued development of the Stampede Field and an already completed tieback at the Royal Dutch Shell Plc-operated Llano Field. Hess serves as operator for both Stampede and Esox.

The company is scheduled to have its third-quarter 2019 earnings call on Oct. 30.

Recommended Reading

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”