Increases in Rig Count, but Oil Prices Fall Again

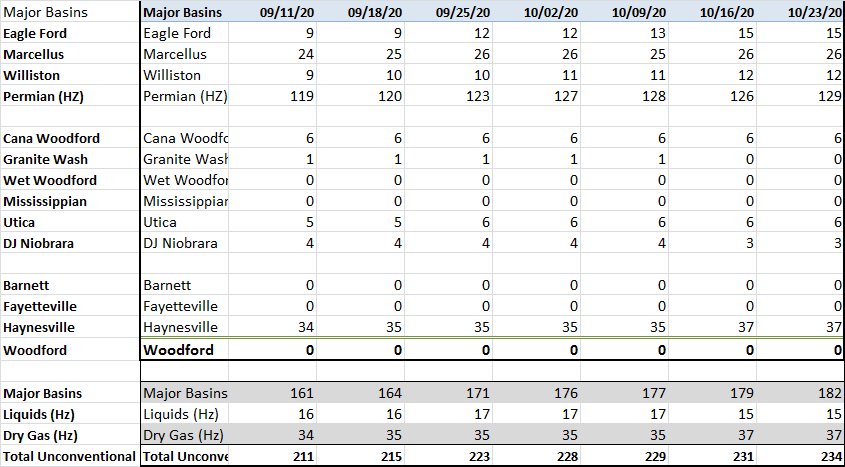

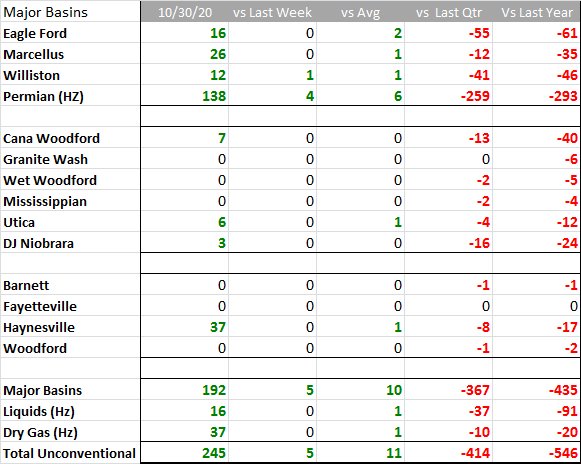

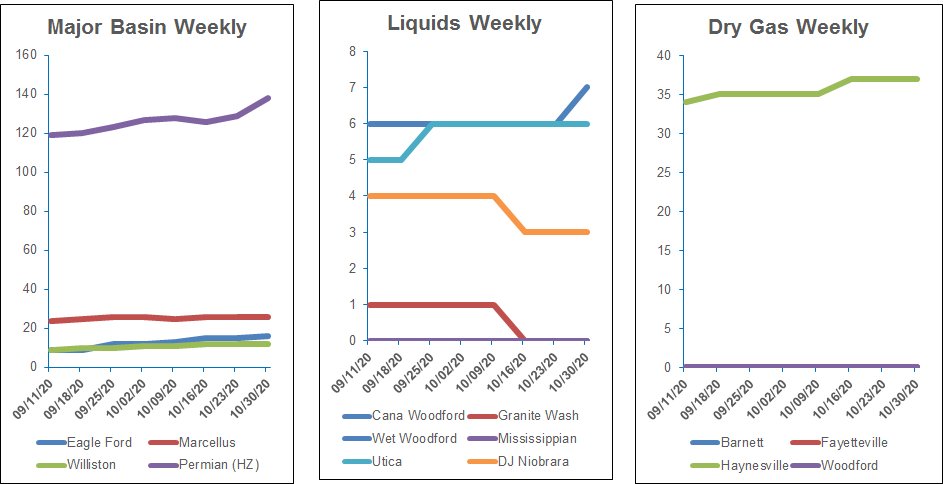

The U.S. rig count rose 11% in October, but down 60% year-over-year.

Enverus reported that the largest week-over-week gains by major basin were in the Gulf Coast (up five to 35) and Permian (up five to 138). In both regions, multiple companies resumed activity after several months of inactivity, and a number of E&P firms spudded wells for the first time in one to two years.

U.S. crude prices fell below $35/bbl in the past week. This is the lowest price recorded since June, after previously holding around $40 for four months since mid-June. Although oil prices were down 42% since the beginning of 2020, they were still up about 88% over the past six months mostly on hopes global economies and energy demand will return when governments lift coronavirus lockdowns.

U.S. oil producers Chevron Corp. and Exxon Mobil Corp., however, cut their spending in the third quarter of 2020 to beat weak trends in fuel demand caused by the COVID-19 pandemic.

Exxon Mobil, the largest U.S. producer by volume, also said it will cut its capital spending for 2021 to between $16 billion and $19 billion, a cut of as much as 30% from this year's plan.

Trends

Recommended Reading

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.

McKinsey: US Output Hinges on E&P Capital Discipline, Permian Well Trends

2024-02-07 - U.S. oil production reached record levels to close out 2023. But the future of U.S. output hinges on E&P capital discipline and well-productivity trends in the Permian Basin, according to McKinsey & Co.

EIA: Oil Prices Could Move Up as Global Tensions Threaten Crude Supply

2024-02-07 - Geopolitical tensions in the Middle East and ongoing risks that threaten global supply have experts questioning where oil prices will move next.