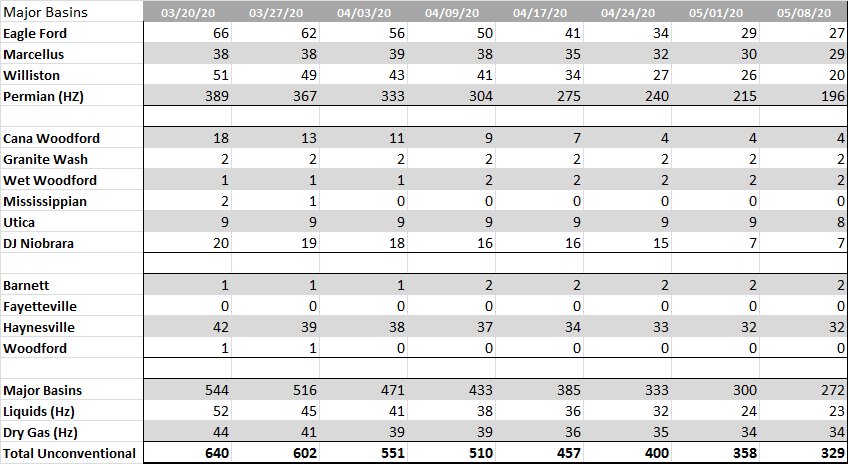

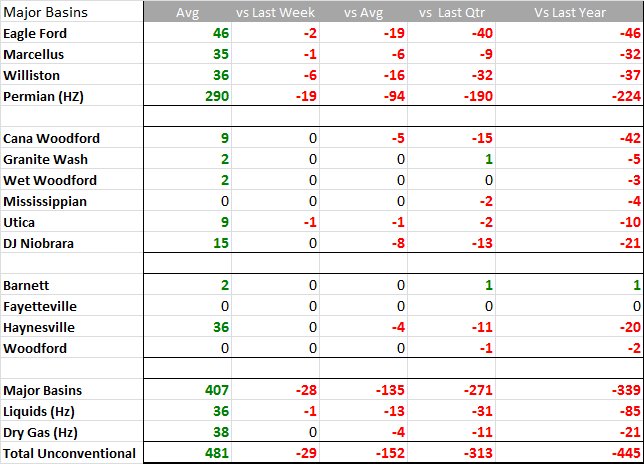

U.S. drops 20 rigs from last week to the current week’s total of 390.

Over the past two weeks, major shale players have announced budget reductions of millions of dollars.

North American oil and gas producers have cut their 2020 spending by nearly 34%, or about $41.6 billion, from their original estimates, according to data compiled by Reuters.

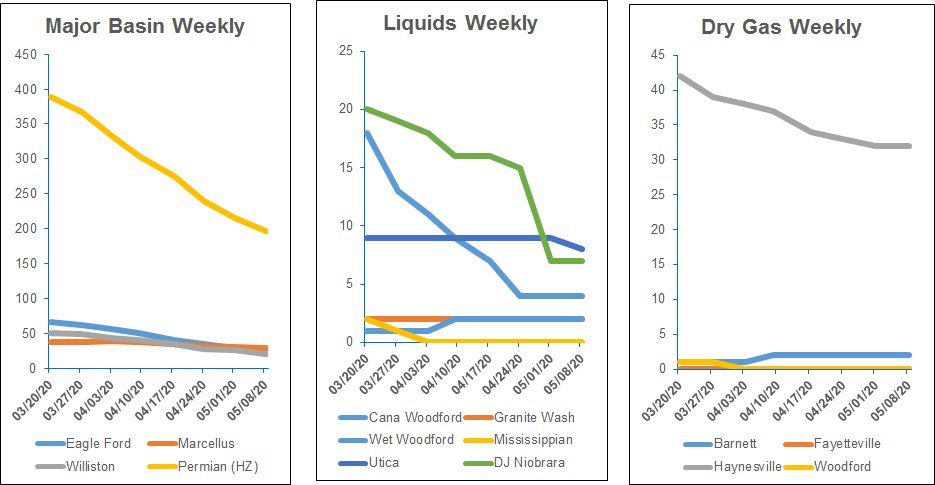

Well starts across the major U.S. shale plays have been the most dramatically affected. According to Enverus, Bakken well starts began falling in February and dropped 12% sequentially in March. Back-to-back sequential declines also occurred in March in the Permian (5%) and Eagle Ford (10%).

Numbers from Oklahoma’s SCOOP/STACK were more peculiar. The Niobrara has managed 1% increases in the last two months, while the SCOOP/STACK fell by 33% in February compared to January, but rose 17% in March.

Over the past 3-4 weeks, Louisiana (Haynesville), Pennsylvania (Marcellus), Ohio (Marcellus and Utica) have had the least significant declines in rig count.

April data is incomplete but currently showing greater-than-50% drops in well starts in all of these plays. According to Enverus Rig Analytics, the U.S. rig count is down by 38% in the last month and 62% in the last year.

Hess, EOG Resources, Oxy USA, Marathon, Devon and Cimarex are among the many that have announced cuts or reductions to their programs.

Weekly

Trends

Recommended Reading

Canadian Railway Companies Brace for Strike

2024-04-25 - A service disruption caused by a strike in May could delay freight deliveries of petrochemicals.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.