U.S. rig count drops by two

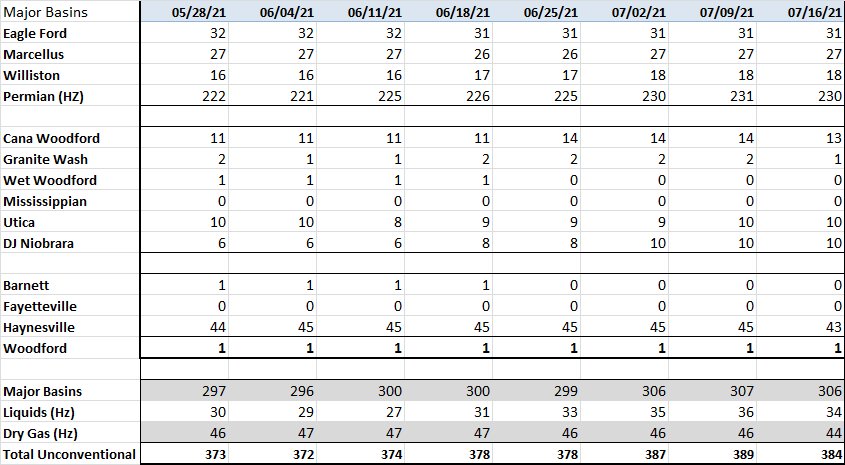

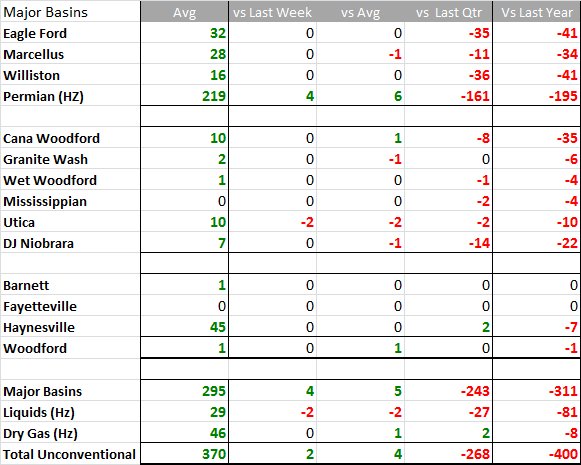

The U.S. rig count dropped by two rigs in the last week to a total of 536 as of July 14, according to Enverus Rig Analytics.

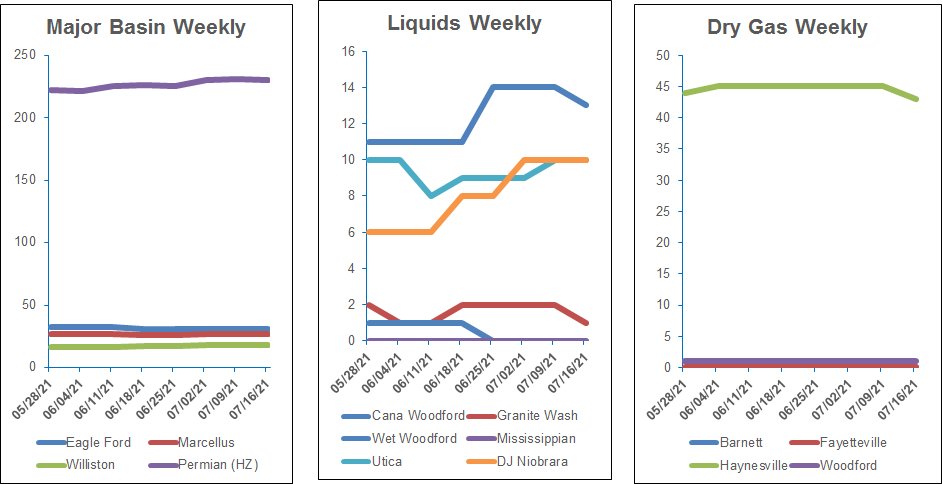

The most notable change in the last week was in the Permian Basin, where active rigs dropped by six. In the last month, the Gulf Coast has seen a 10-rig increase and the Anadarko Basin has added nine.

Henry Hub prices have increased nearly 40% since the end of March. The recovery over the last year in natural gas prices has fueled increased drilling in the Ark-La-Tex region, primarily driven by the Haynesville. The most active operators in the Haynesvill shale play are Aethon Energy (10 rigs), Comstock Resources (seven) and Indigo Natural Resources (six), each running three more rigs than a year ago.

Meanwhile, WTI crude futures in the U.S. were trading around $72/bbl this week, near their lowest in almost a month. Last week, the WTI contract rose to $76.98, its highest since November 2014. Oil prices were still up about 46% so far this year. However, many analysts do not expect that extra spending to boost output at all. Instead, they think it will only replace natural declines in well production.

Overall, U.S. oil production is expected to ease from 11.3 million bbl/d in 2020 to 11.1 million bbl/d in 2021 before rising to 11.9 million bbl/d in 2022, according to government projections. That compares with the all-time annual high of 12.3 million bbl/d in 2019.

Trends

Recommended Reading

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.

Energy Transfer Ups Quarterly Cash Distribution

2024-04-25 - Energy Transfer will increase its dividend by about 3%.

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.