Rig count relatively stable during past week; crude futures up.

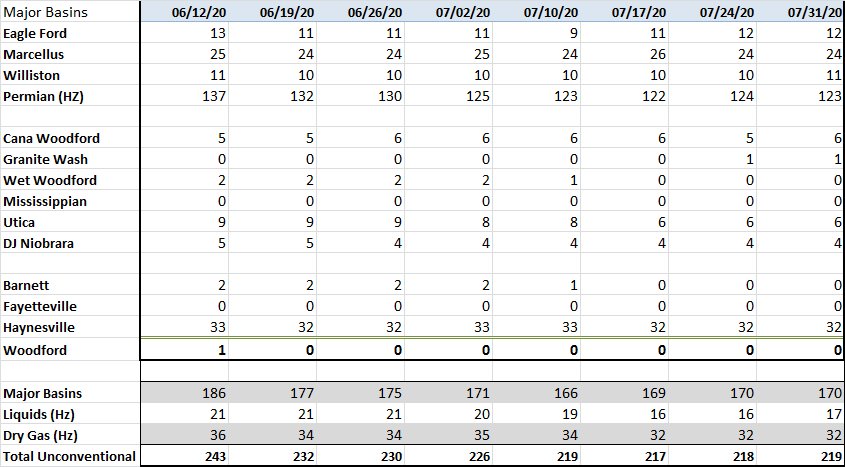

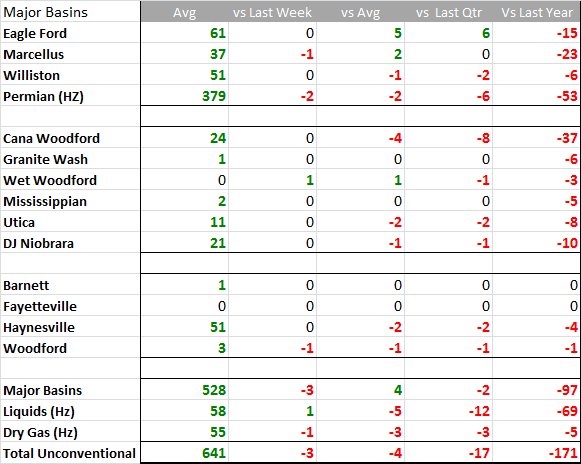

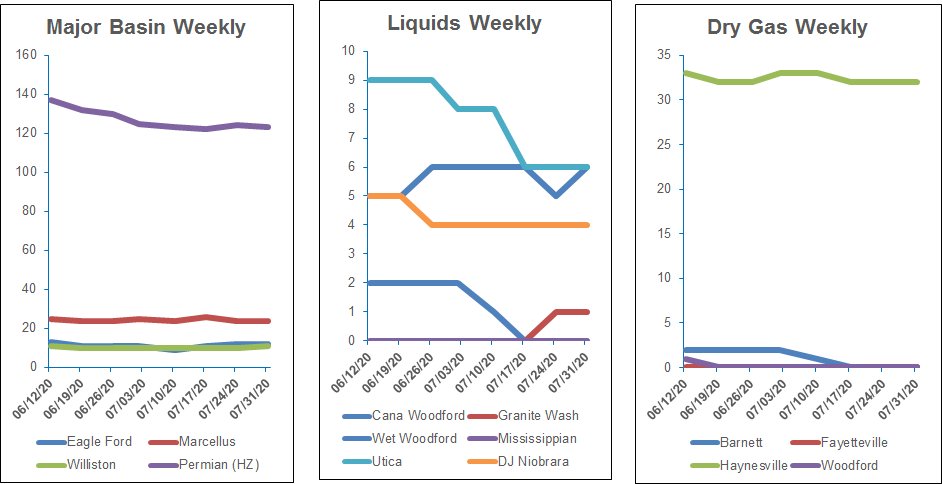

The U.S. gas rig count was stable this past week, but it remained at a record low. July, overall, marked the smallest monthly decline due to a recovery in prices. Before this week, the count had hit all-time lows for 12 straight weeks.

U.S. oil rigs fell by one to 180 this week, while gas rigs increased one to 69.

Crude oil production in the U.S. fell a record 2 million bbl/d during May to 10 million bbl/d, according to Enverus citing the Energy Information Administration’s monthly report.

Also, even though U.S. oil prices are still down about 35% since the start of the year due to coronavirus demand destruction, U.S. WTI crude futures have jumped 112% over the past three months to about $40/bbl on July 31 on hopes global economies and energy demand will snap back as governments lift lockdowns.

Analysts said higher oil prices will encourage energy firms to slow rig count reductions and possibly start adding some units later this year.

Still, Exxon Mobil Corp. cut capex 30% this year to about $23 billion, and the company expects to spend less than $19 billion in next year. That would be the lowest spending for the company since at least 2005.

Weekly

Trends

Recommended Reading

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.

Jerry Jones Invests Another $100MM in Comstock Resources

2024-03-20 - Dallas Cowboys owner and Comstock Resources majority shareholder Jerry Jones is investing another $100 million in the company.

Cardinal Energy Declares April Dividend

2024-04-11 - Canadian oil and gas company Cardinal Energy Ltd. will pay a CA$0.06 (US$0.044) per common share dividend.