Stay-at-home orders drive down

U.S. fuel consumption to lowest level in decades

Over the last three weeks, demand for petroleum products has averaged 14.1 million bbl/d, according to the Energy Information Administration’s (EIA) “Weekly Petroleum Status Report.” Changes in the weeks since then have been more muted, suggesting that consumption is stabilizing at around 14 million bbl/d.

According to IHS Markit, gasoline consumption has declined the most in absolute terms. January-March 2020 gasoline demand averaged 8.9 million bbl/d and since then, gasoline product supplied has fallen by 40% to 5.3 million bbl/d as of the week ending April 17.

U.S. consumption of jet fuel experienced the largest drop in relative terms, declining by 62% to just 612,000 bbl/d on April 17 from a pre-shutdown average of 1.6 million bbl/d.

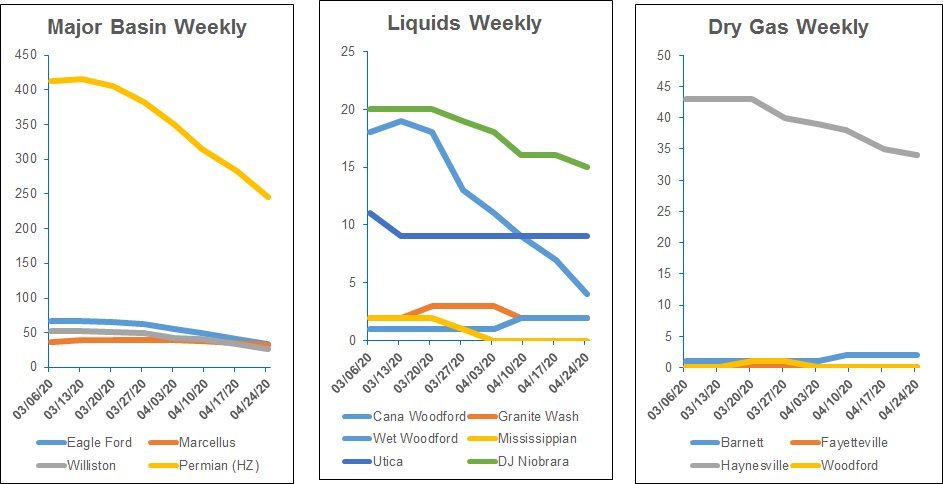

U.S. dry natural gas production averaged a record 92.2 Bcf/d in 2019, according to the EIA. In its April short-term energy outlook, the agency projects volumes will average 91.7 Bcf/d in 2020, falling to 87.5 Bcf/d in December.

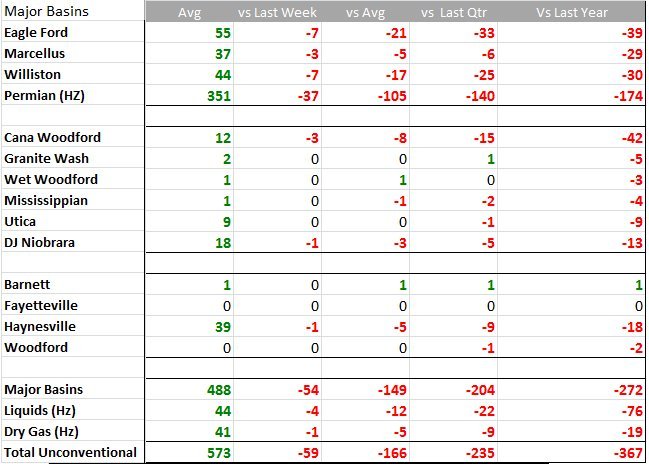

Declines will be most notable in the Permian and Appalachian basins. Reduced oil well drilling in the Permian Basin will lead to a decline in associated gas, and low natural gas prices in Appalachia will drive a decline in the drilling of gas wells. As of April 19, the number of active rigs in the Permian is down 43% year-over-year, while Appalachian rig activity is down 41%, according to Enverus Rig Analytics.

Despite OPEC agreeing to cut production by 9.7 million bbl/d of oil beginning May 1, shrinking demand and growing storage inventories point to a growing glut of oil.

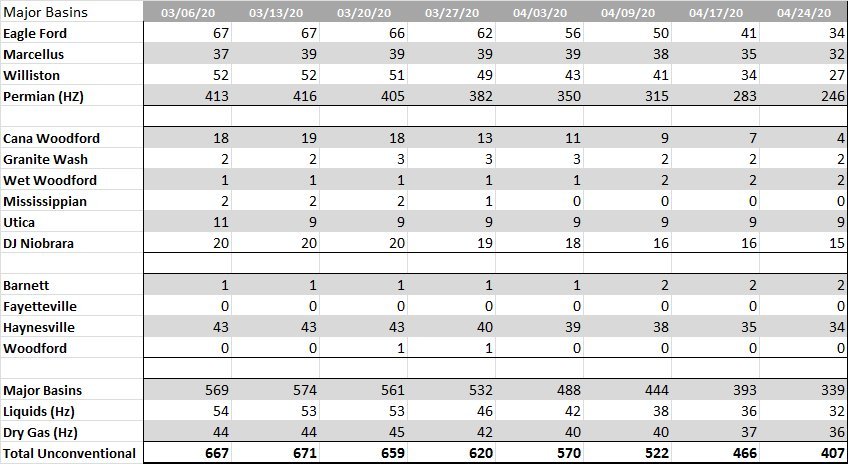

The number of rigs running in the U.S. as of April 22 has fallen by 40% in the last month, according to Enverus. The active rig count is down 55% (year-over-year).

Weekly

Trends

Hart Energy’s exclusive rig counts measure drilling intensity. Our counts exclude units classified as rigging up or rigging down, and also exclude rigs drilling injection wells, disposal wells or geothermal wells. The result is our most accurate assessment of rigs on location working on oil or gas programs as of the sample date. While our process results in a rig tally that is lower than the published numbers from the non-proprietary rig-tracking agencies, Hart Energy believes our product presents the most accurate picture of what is actually occurring in the field.

Recommended Reading

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.