The baby-boomer oil and gas explorers who wore rose-colored glasses in 2000 and 2001, when the U.S. rig count was near 1,000, apparently have since lost them. Now it appears that independents will continue to view the world with caution this year. That's why it is more important than ever that the new Congress revive and fast-track the energy bill that was tabled at the end of the last session. It is already very clear that tax breaks and royalty holidays jump-started more drilling activity in deeper water. Let's put these incentives to work onshore too. And don't overlook the stripper wells. The number of marginal oil wells that contribute to U.S. production fell in 2001, according to figures released by the Interstate Oil and Gas Compact Commission. Although these 403,459 wells produce very little oil per wellhead, they added up to an impressive 29% of domestic oil production in 2001-for a cumulative total of 316 million barrels of oil. The rationale for incentives is very clear. So, too, is the irony: U.S. production continues to slide on both the oil and gas side, even though federal and state agencies have recently revised upward their estimates of how much is present and could be produced. Salomon Smith Barney's annual exploration and production spending survey, released in mid-December, opens the door to the new year. Step over the threshold and see that companies operating in North America will spend about 1.6% more than they did in 2002. This is not much to crow about, when you consider how high oil and gas prices were at the time the survey was taken. No rose-colored glasses there. Salomon's oil and gas team reduced its forecast for the number of rigs operating in the U.S. to a weekly average of 890 in 2003. This is a modest 7% gain from the 2002 average of 830 rigs, and close to the average we saw in 1998. "Our gas rig count forecast was reduced to 740 from 850, while our oil rig forecast has fallen to 150 from 175." Of course, all it takes is a couple of headline-making wells to unveil the next Ladyfern or Mad Dog or Jeffress Field, and that sets off the surge in AFEs. "North American independents appear reluctant to significantly increase spending. This can partly be explained by the financial woes of energy merchants such as El Paso, Williams and Dominion Resources, which collectively reduced U.S. independents' planned spending growth by an estimated four to six percentage points," say the Salomon analysts. "Additionally, weak balance sheets, a lack of quality prospects, and concerns about a 'war premium' have all contributed to low early expectations." It doesn't help that the nine majors in the survey plan to keep their U.S. spending flat, as does Anadarko Petroleum, which has often led the pack among most-active independents. One interesting footnote is that companies really are eager to spend more and so, they remain unusually sensitive to upside price surprises, "setting the stage for potential outperformance," say the Salomon analysts. Most operators answered, in the survey, that a gas price of $4.20 per thousand cubic feet would be enough to trigger a 10% increase in their spending. This just happens to be close to Salomon's 2003 gas-price forecast of $4.10 per Mcf. So in the end, the chances of the rig count and of spending going up seem more likely than that they will go down. Early predictions may indeed prove too cautious as the year unfolds. "Our U.S. rig-count forecast reflects 7.7% year-over-year growth versus indicated spending growth of just 0.1% in the U.S. in 2003," the Salomon analysts report. Still, the ship doesn't turn around overnight. Says Robert O'Brien, president of Saxet Petroleum Inc., a private Houston producer: "When we start working up a prospect we want to drill it as soon as possible, but that is taking longer to do. We now average 18 months to two years from the time we spend our first dollar to when we spud the well. In that time, gas prices may go from $1.80 per Mcf to $10 and back down to $4, so that affects economics, planning and timing, and the supply and demand of prospects. "There is very little supply right now of really good prospects, although you will have more when prices go up. With this type of uncertainty, people are less willing to drill." There is good news on the gas side: the storage surplus is gone. In mid-December the weekly inventory number fell below the five-year average for the first time since June 2001, resting at 2.79 trillion cubic feet of gas, say analysts at A.G. Edwards & Sons. Gas prices were soaring toward $5.50 or $6 as we headed into January. "Our 2003 forecast of $3.50 per million Btu now has an upward bias," they report. In this new year, we wish an upward move not just for commodity prices, but more important, for investor confidence, productive and economic drilling and smart choices.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

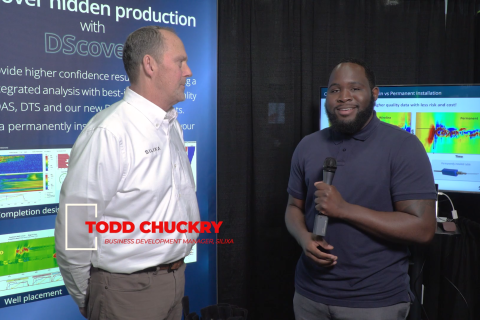

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.