Halliburton repurchased 250 million in its common stock during the first three months of the year. (Source: Shutterstock)

Oilfield services giant Halliburton likes M&A when it comes to buying technology, but not entire corporations, CEO Jeff Miller told analysts during a first-quarter earnings call with analysts April 23.

The firm’s acquisitions calculus is geared toward advancing its own research or accelerating the movement of products to market, he said.

Evercore ISI’s Neil Mehta asked about Halliburton’s M&A plans, given the historic run of the company’s clients in the E&P space and the April 2 announcement that rival SLB intends to spend a cool $7.76 billion in an all-stock deal for ChampionX.

Still, Halliburton is unswayed.

“We see significant organic growth in the businesses that we’re in,” Miller said. “Also, I believe that organic growth generates more value for shareholders. We’ve seen that with other things that we’ve done in terms of small acquisitions that were able to then grow and push our channel.”

And just in case that wasn’t clear enough, Miller added, “We like the space where we compete, and we like the technology and how we develop that. And so you shouldn't expect any change from Halliburton.”

Global growth

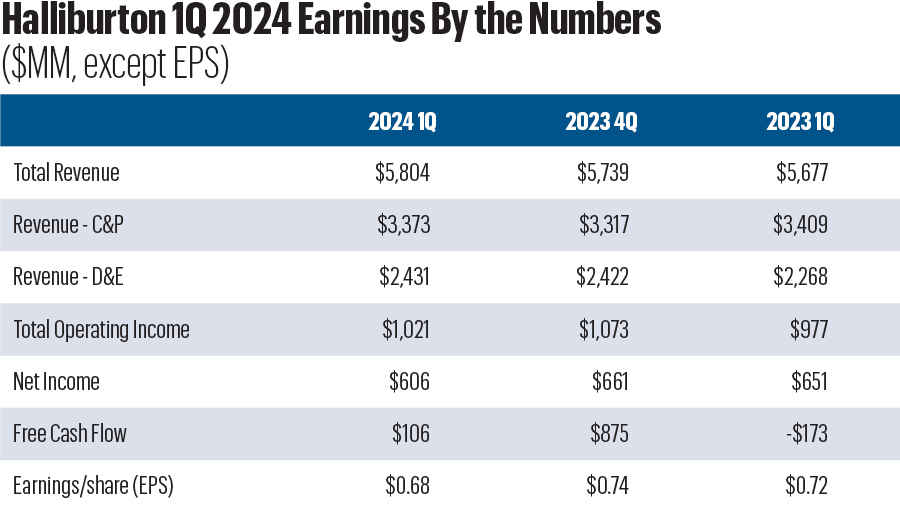

Indeed, Halliburton’s 2024 growth trajectory domestically and around the world is holding its own, first-quarter numbers show.

Halliburton’s international growth increased 12% year-over-year for the period—marking an 11th consecutive quarterly trend—and low double-digit growth is expected for the remainder of the year. Strong adoption and increasing demand for Halliburton’s tools, such as the Earth Star X logging-while-drilling system and its Reservoir Xaminer Formation Testing Service, are both creating meaningful value for customers and driving market growth for the company, Miller said.

“Equally important, the international market remains tight for equipment and people,” Miller said. “Therefore, we expect to see margin expansion” beyond 2023.

Latin American revenue came in at $1.1 billion during the first three months of the year, a 21% increase from the same period in 2023. The improvement was driven primarily by Mexico’s heightened need for drilling-related services and increased software sales; improved pressure pumping services and fluids in Argentina; and increased activity across broad product lines in Brazil and Ecuador.

North American revenue declined 8% year-over-year, a result of less onshore pressure pumping in the U.S. and lower line activity, Miller said. Still, the quarterly figure represents a 5% increase from fourth-quarter 2023.

Unconventional surge

After a long track record in U.S. shale, Miller said he is consistently noticing more global interest in unconventionals.

“I can recall over a decade ago that global scramble to find unconventionals with limited success,” he said.

Markets outside of North America are achieving scale, he said; that creates a new opening for Halliburton.

“The technologies and processes Halliburton developed as the leader in North America over the last three decades have broad applications to unconventional reservoirs throughout the world, which makes this a fantastic long-term opportunity for Halliburton,” he said. “I am confident in the duration of this international upcycle in 2024 and beyond.”

North American revenue is expected to remain flat for the rest of the year after the slight increase since the fourth quarter. The trend is consistent with the “more industrialized approach to asset development” in North America, Miller said.

“While we expect an eventual recovery in natural gas activity driven by demand from LNG expansions, our 2024 plan does not anticipate this recovery overall.”

Future demand

Global energy use is on the rise, with crude forecasted to increase by up to 2.3 MMbbl/d this year, Miller said.

“This demand growth is greatest in non-OECD (Organization for Economic Co-operation and Development) countries where we expect more per capita energy consumption—not less—as they develop their economies and improve their quality of life globally,” he said.

And in the U.S., Miller expects electricity demand to swell by more than 15% by 2030, following two decades of stability. Some 40% of the nation’s electricity is supplied by natural gas.

“We expect strong demand for natural gas as a base fuel well into the future,” he said.

“Everything I see points toward long-term growth for Halliburton’s services.”

Recommended Reading

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

1Q24 Dividends Declared in the Week of April 29

2024-05-03 - With earnings season in full swing, upstream and midstream companies are declaring quarterly dividends. Here is a selection of dividends announced in the past week.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

Why Endeavor Energy's Founder Sold His Company After Years of Rebuffing Offers

2024-02-13 - Autry Stephens', the 85-year-old wildcatter, decision to sell came after he was diagnosed with cancer, according to three people who discussed his health with him.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.