The sale of Halcón’s operated Williston assets continues the company’s transformation into a Delaware Basin-focused E&P. (Source: Hart Energy)

Halcón Resources Corp. (NYSE: HK) said July 11 it is getting rid of certain Williston assets as the Houston-based company continues its transformation into a Delaware Basin-focused E&P.

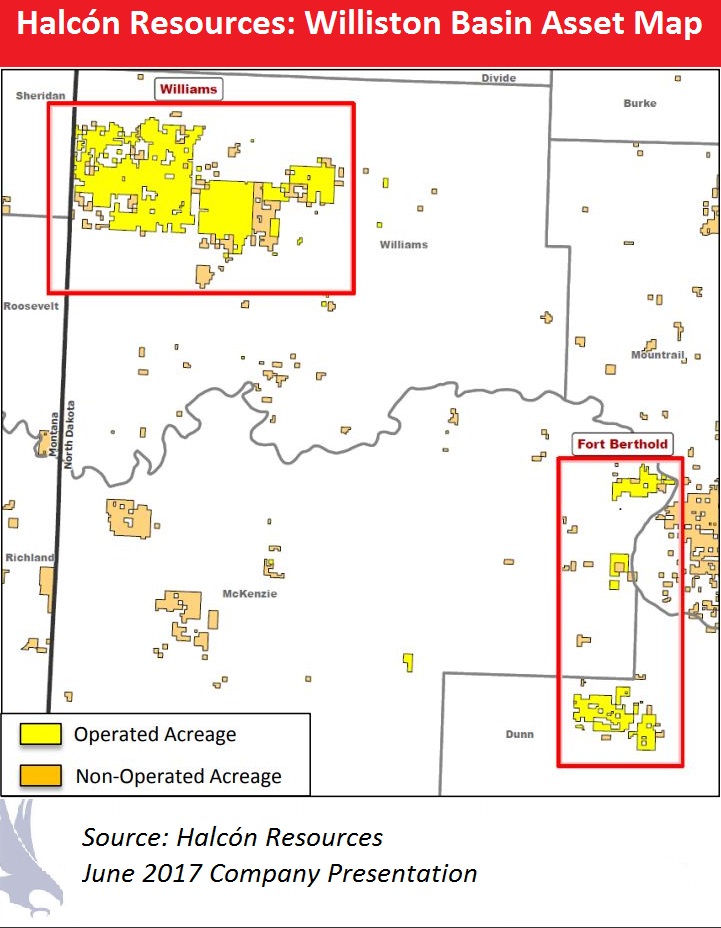

Halcón said it entered an agreement with an affiliate of Bruin E&P Partners LLC, a portfolio company of Arclight Capital Partners, to sell its operated assets in the Williston Basin for $1.4 billion in cash. The assets are producing about 29,000 barrels of oil equivalent per day (boe/d), net.

“The sale of our Williston Basin operated assets transforms Halcón into a single-basin company focused on the Delaware Basin where we have more than 41,000 net acres in Ward and Pecos counties [in Texas] representing decades of highly economic drilling inventory,” Floyd Wilson, Halcón’s chairman, CEO and president, said in a statement.

So far in 2017, Halcón has been on a tear of A&D activity beginning in January when it announced deals to purchase nearly 21,000 net Southern Delaware Basin acres for $705 million and exit its El Halcón position in the East Texas Eagle Ford for $500 million.

In total, Halcón has staked out a 41,600 net acre position in the Delaware Basin through acquisitions that have closed or been announced in 2017. The company said July 11 it plans to run two rigs in the Delaware for the remainder of 2017 and expects to exit the year with production in excess of 13,000 boe/d, net.

Pro forma for the asset sale, Halcón’s current production is about 7,500 boe/d, net.

Halcón will retain its nonoperated Williston Basin assets, which the company said June 1 it expected to sell later in the summer, subject to an acceptable offer.

The company’s nonoperated position in the Williston Basin includes 15,600 net acres and more than 1,000 gross undeveloped locations. The properties were producing about 2,350 boe/d (91% oil), as of June 1.

Halcón said it might still monetize its nonoperated Williston assets in the future. The company is planning to use a portion of proceeds from the sale of its operated Williston assets for debt repurchases and redemptions.

RBC Richardson Barr advised Halcón on the sale of its operated Williston properties, and Intrepid Partners LLC advised the company on the consent process. Latham & Watkins LLP represented ArcLight Capital Partners in the transaction.

The effective date of the transaction is June 1, and Halcón said it expects the deal to close within 60 days.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.

Jerry Jones Invests Another $100MM in Comstock Resources

2024-03-20 - Dallas Cowboys owner and Comstock Resources majority shareholder Jerry Jones is investing another $100 million in the company.

Cardinal Energy Declares April Dividend

2024-04-11 - Canadian oil and gas company Cardinal Energy Ltd. will pay a CA$0.06 (US$0.044) per common share dividend.