The sale of Goodrich Petroleum to an affiliate of Paloma Resources comes at a time when A&D activity in the Haynesville Shale has been heating up. (Source: Hart Energy)

Goodrich Petroleum Corp. recently agreed to a merger with an affiliate of Paloma Resources LLC that would effectively end Goodrich’s tenure as a publicly traded independent E&P company.

According to a company release on Nov. 22, Goodrich entered into a definitive merger agreement pursuant to which a subsidiary of Paloma Partners VI Holdings LLC, an affiliate of EnCap Energy Capital Fund XI LP, will commence a tender to acquire all of Goodrich's outstanding common shares for roughly $480 million in cash.

Upon the completion of the transaction, Goodrich will become a privately held company and shares of Goodrich common stock will no longer be listed on any public market.

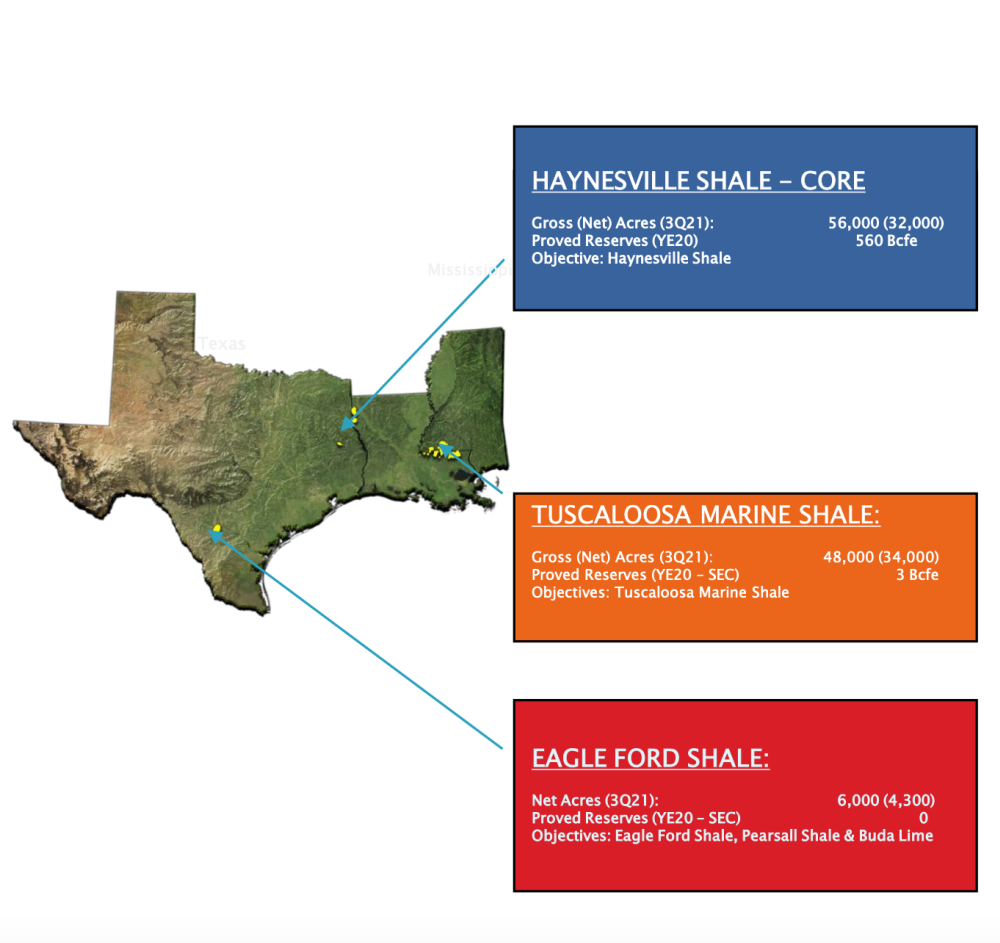

Based in Houston, Goodrich Petroleum engages in the exploitation, development and production of natural gas and crude oil primarily in the Haynesville Shale in North Louisiana and East Texas, the Tuscaloosa Marine Shale in Eastern Louisiana and Southwestern Mississippi and the Eagle Ford Shale trend in South Texas. The company has been led by Walter G. “Gil” Goodrich since 1995.

Due to the oil price environment, Goodrich has recently been concentrating the vast majority of its exploitation and development efforts on natural gas on its existing leased acreage in the core of the Haynesville Shale in North Louisiana where, according to its third-quarter presentation, it holds 32,000 net acres.

The sale of Goodrich comes at a time when A&D activity in the Haynesville Shale has been heating up, including Southwestern Energy Co.’s acquisition of private equity-backed GEP Haynesville LLC in a cash-and-stock transaction valued at $1.85 billion.

Rob Turnham, president and COO of Goodrich Petroleum, commented on the Southwestern GEP transaction and how it relates to Goodrich during the company’s earnings call in early November.

“If you apply those metrics to us, the stock is worth more, that’s not surprising,” said Turnham, according to a transcript of the call by Seeking Alpha.

“We’re certainly still trading well below our peers on an enterprise value to EBITDA multiple and yet, we still have a pristine balance sheet,” he continued. “So we think as we continue to post numbers on the scoreboard, you’re going to see EBITDA grow dramatically.”

“And we feel like we ought to get recognition for that as the numbers are posted. So more good news to come,” he added.

Paloma Partners VI is the latest investment of Paloma Resources, a Houston-based private oil and gas company backed by EnCap Investments LP and Macquarie Americas. Founded in 2004, Paloma has successfully built and sold several iterations throughout the U.S.

Paloma’s tender offer for Goodrich will be priced at $23 per share, which according to the release, represents a 7% premium to the Nov. 19 closing price of Goodrich’s stock and a 47% premium to its year-to-date volume-weighted average price.

The release also noted that Paloma has secured from EnCap equity financing commitments for the entire acquisition, including assumption of debt, to complete the transaction, expected in December.

The offer price in the transaction has been unanimously approved by the Goodrich board of directors. Certain stockholders of Goodrich have also entered into tender and support agreements pursuant to which those stockholders have agreed to tender their Goodrich shares pursuant to the tender offer.

Tudor, Pickering, Holt & Co. is financial adviser to Goodrich and Vinson & Elkins LLP is serving as its legal adviser. Greenhill & Co. is Paloma’s financial adviser and Hunton Andrews Kurth LLP is its legal adviser.

Recommended Reading

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.