Gulf Canada Resources Ltd. would become one of Canada's five largest independent producers and move into North America's Top 10 with its approximately C$2.3-billion acquisition of Crestar Energy Inc. The deal, which the two Calgary independents announced in early October, includes the assumption by Gulf Canada of approximately C$588 million of Crestar's long-term debt. The companies expect to close the transaction this month. Canadian oil investment analysts considered it a combination where Gulf Canada, which is rich in opportunities but relatively weak financially, is joining with a competitor that is almost completely opposite in those two areas. "Normally, my gut reaction to a transaction's financial aspects is negative. In this case, it's generally positive," says Brian Prokop, who follows independents for Peters & Co. Ltd. in Calgary. "Each company has its merits and shortcomings. As the companies note, the merger magnifies the merits and reduces the shortcomings." He rates Gulf Canada's stock (NYSE and Toronto: GOU) a Buy, with a price target of C$11 per share. "Financially, it makes all kinds of sense," observes Martin P. Molyneaux of FirstEnergy Capital Corp. in Calgary. "It's accretive on an earnings and cash flow basis. There's not much overlap of properties. But strategically, we see synergies that can be derived on an area basis. Our concern in these deals usually involves bringing two different corporate cultures together. In this case, it's a good match. We've been impressed with the plans that we have seen to migrate the two companies' people together." Molyneaux also has a Buy on GOU, with a 12-month price target of C$10.50. During the recent commodity-price run-up, Gulf Canada's stock price lagged its Calgary peer group, trading in a narrow range of C$2 to C$6.19 since January 1999. Why? Beginning in January 1995, Gulf Canada grew rapidly through a series of large, somewhat ill-timed acquisitions, including Clyde Petroleum Plc of the U.K. and three Calgary independents, Pennzoil Canada, Stampeder Exploration Ltd. and Mannville Oil & Gas Ltd. (For more background, see Oil and Gas Investor, January 1996.) Ever since, the company has been restructuring, cutting costs and paying down heavy debt caused by that growth. It elevated longtime employee Dick Auchinleck to chief executive officer and president in February 1998 following the resignation of J.P. Bryan. In 1999 it created Petrovera Resources, a partnership with PanCanadian Petroleum that combined the majority of the two companies' heavy oil assets in western Canada. On October 16, the company said it had made the last of its divestitures, selling the remaining 50% of Gulf Midstream Services to its partner in that venture, KeySpan Corp., the New York utility holding company. Those assets include 14 gas processing plants with capacity of 1.5 billion cubic feet of gas a day. The newly named KeySpan Energy Canada will be one of Canada's largest independent midstream gas companies. Today Gulf Canada thinks it is positioned for disciplined growth again, the merger with Crestar being exhibit one. A stronger balance sheet Not every Canadian oil-investment analyst approves of the deal. Jeffrey Fiell of Canaccord Capital Corp. in Calgary does see some merit in the transaction because it will be cash accretive. "But it's probably not very good for Crestar shareholders. I think Crestar is worth more than Gulf is paying," he says. "The acquisition metrics in terms of price paid for production and reserves are lower than other recent deals." Fiell specifically mentioned Burlington Resources Inc.'s November 1999 acquisition of Poco Petroleums Ltd. (C$3.7 billion, all stock) and Talisman Energy Inc.'s September 1999 purchase of Rigel Energy Corp. (C$1.2 billion, cash and stock). "As a Crestar shareholder, I would not want to do the deal. The stock is trading around C$27 and is worth at least C$30," Fiell says. (Worthy of note: Burlington was criticized for the Poco pricetag.) Other followers of Canadian independents consider Gulf Canada's offering price for Crestar competitive. Ken Croft of HSBC Securities (Canada) Inc. in Calgary pointed out that heavy oil, which normally receives a lower price per barrel, makes up approximately 60% of Crestar's liquids production and reserves. "The transaction gives Gulf a stronger balance sheet and materially improves the company's cash flow and earnings per share," he says. "It more than doubles Gulf's conventional liquids production in western Canada and also doubles its western Canada natural gas production. The combined companies will have 4.5 million net undeveloped acres that give it a large opportunity to increase production in the future." Specifically, Gulf Canada is offering Crestar stockholders 3.333 common Gulf shares plus C$3.25 cash per Crestar share-a C$29.75 value, based on Gulf Canada's preannouncement closing price of C$7.95 on the Toronto Stock Exchange. Gulf Canada has capped the cash portion of the offer at C$185 million. It indicated that its offer represents a 19% premium to Crestar's September 29 closing price of C$25 per share. (Crestar trades on the Toronto exchange as CRS.) The offer is contingent upon at least two thirds of Crestar's shareholders tendering their stock. Crestar's directors have agreed to pay Gulf Canada C$50 million under certain noncompletion conditions. Merrill Lynch Global Securities advised Gulf Canada; RBC Dominion Securities Inc. advised Crestar. The appropriate multiple The acquisition would increase Gulf Canada's total production 59% to 278,000 barrels of oil equivalent per day. Its total proven reserves of crude oil, condensate and natural gas liquids would climb 36% to 586 million barrels, while proven natural gas reserves would rise 45% to 3.3 trillion cubic feet. Gulf Canada's net undeveloped holdings in western Canada would jump 134% to 4.6 million acres. "This makes excellent strategic sense for Gulf," says Auchinleck. "It opens up an enormous range of opportunities and is good for Gulf whichever way you look at it. Crestar is a well-run company and brings great strength in its western Canadian operations and personnel." He adds that the acquisition would complete Gulf Canada's balance-sheet restructuring, end a period of debt reduction and begin "an era of disciplined, focused growth." Crestar president Barry Jackson says the deal would give his company's shareholders access to Gulf Canada's diversified assets, including a 9% interest in Syncrude, the Surmount bitumen project, the Mackenzie Delta, the Canadian East Coast and areas abroad. "It broadens the size and increases the liquidity of the shareholder base, and it creates a critical mass and scope of operations, with the capacity to compete aggressively in the international exploration and production arena," he says. Some 65% of the combined company's production will be in North America, yet Gulf Canada also holds 72% of Gulf Indonesia Resources Ltd. (NYSE: GRL), which owns the former Asamera assets in Indonesia. And, Gulf operates numerous key gas fields in the Dutch North Sea as well. Fiell suggested that the combined companies could derive some benefit simply from becoming one of North America's 10 biggest upstream independents. "That might attract a different set of shareholders and open up a new market for the stock." In terms of proved equivalent reserves, the new company will rank seventh in North America and in terms of net proved and probable reserves, it will be near the very top among Canadian independents. But Croft says that the important question for investors would be the appropriate multiple for the new company. "While the transaction improves Gulf's earnings and cash flow, the issue will be the growth rate for the amalgamated companies from a much larger production base," he says. "Gulf has attractive longer-term assets, such as the oil sands and the McKenzie Delta. But development of these properties will not take place for several years." He expects the new Gulf Canada to receive a discounted multiple until its growth potential becomes more evident to investors. Meanwhile, however, he maintains his Buy on GOU and raised his target price for the stock to C$11.50. Prokop portrays the deal as a winner for both sides. "Crestar was cash-rich and opportunity-poor, not getting recognized in the market and wondering where its growth would come from," he says. "Gulf Canada had a lot of long-term potential, was turning itself around financially and would have had to wait until early next year before it actually could start doing something. The merger means that it can move ahead." M

Recommended Reading

Keeping it Tight: Diversified Energy Clamps Down on Methane Emissions

2024-04-24 - Diversified Energy wants to educate on emission reduction successes while debunking junk science.

Darbonne: The ESG Sword: BlackRock's Life, Death by ESG

2024-04-17 - BlackRock, the $10 trillion investment manager, is getting heat for too much ESG investing, while shareholders are complaining it’s doing too little.

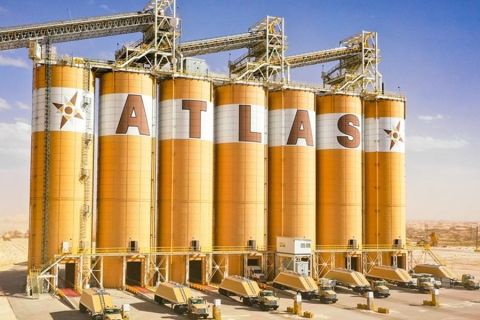

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.