“There is also definitely a disconnect or gap between what the policy folks, the aspirational goals that are being set versus the science.” —Bernadette Johnson, senior vice president and general manager for power and renewables at Enverus. (Source: Hart Energy)

Natural gas prices are inching up, with the prediction of long-term Henry Hub pricing ascending to the $5/MMBtu range as the market does “what it needs to do,” Bernadette Johnson said, Enverus’ senior vice president and general manager for power and renewables.

Natural gas storage sits at about 410 Bcf more than compared to the same period last year, which has helped depressed prices. But the market will compensate—and new infrastructure will help, Johnson said during Hart Energy’s America’s Natural Gas conference on Sept. 27.

“The good news is the market works. Price will do whatever it needs to do,” she said during “The Numbers: Supply, Demand & Beating Down that Half-Tcf” session.

“It's not always fun, it's not always comfortable.”

With more infrastructure in place, the price picture begins to look better with pricing in the $5 range, she said. Henry Hub is expected to be around $3/MMBtu in 2023 and 2024, around $4/MMBtu from 2025 to 2027, and finally rises to $5/MMBtu from 2028 to 2030.

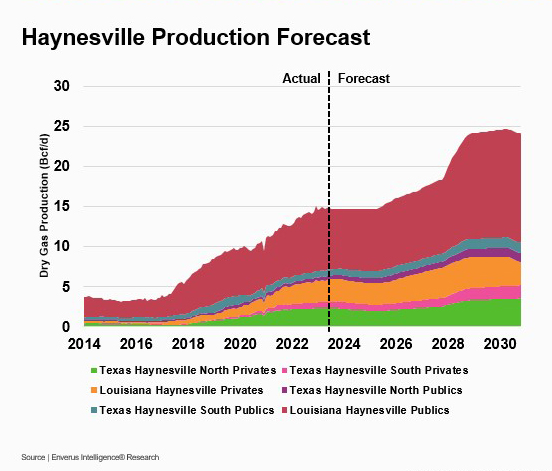

But it will take time to get that infrastructure in place. That’s a big challenge for the Haynesville Shale, she said. So far, the signs point to Haynesville rigs bottoming out with little upside until 2025.

A lot of production growth in the Permian “is coming from associated gas because the oil prices are so high,” she said, but if gas prices rise, production in the Haynesville will grow. “We'll see additional gas start to come out of the region. So this is an area where the market works really well. Very, very elastic, very sensitive to gas prices.”

Haynesville woes

For now, there’s not enough takeaway capacity for more Louisiana gas.

In the Haynesville, “We're waiting on infrastructure, we're waiting on LNG exports. We have a ton of capabilities to produce a lot of gas very quickly,” she said.

Johnson expects a certain amount of gas in the Haynesville to wait on production until the infrastructure is in place, while associated gas can be a different story.

“If you have more associated gas coming out of the ground, it's basically free,” she said.

Equitrans Midstream Corp.'s Mountain Valley Pipeline (MVP), a 300-mile natural gas pipeline in Virginia and Western Virginia, will help with capacity in that region once it’s fully operational. Johnson said she expects that pipeline, which is about 94% complete, to make an impact in 2024 and bring incremental gas from the northeast into the system.

“We're not building in the full expectations for MVP until next winter season,” she said.

The supply of natural gas has never been more crucial.

“Natural gas demand for natural gas fired power generation is up year on year. A lot of that's due to weather” and reflects on how dependent the world and the power sector are on hydrocarbons, she said. “This summer, it was hot. I think a lot of us know that Texas—it felt like it was never going to be cool.”

Prolonged summer heat put the energy grid to the test, especially as this year’s average temperatures year-to-date have been 9 F higher than the 30-year average, she said.

On Sept. 6, “we got very close to resource inadequacy and rolling blackouts,” Johnson said.

The market wins

While renewable resources are contributing to the grid, natural gas remains an important backstop when renewables aren’t available, she said.

“There is also definitely a disconnect or gap between what the policy folks, the aspirational goals that are being set versus the science,” she said, referencing a preference for renewables development over fossil fuels. “It's not going to be without pain, it's not going to be without rolling blackouts. It's not going to be without pretty significant disruptions for a lot of regions.”

That said, Johnson said she believes in the market.

“You can't change science, and eventually the market wins,” Johnson said.

Innovations in battery storage will be crucial to maximize renewable energy as a source to the power grid.

“There are significant political, investor, consumer and microeconomic forces supporting strong, strong tailwinds for renewables. So are they reliable? No, not yet. Are we going to have eventually some breakthroughs in battery technology that start to change that picture a bit? Probably. They're breakthroughs though,” which means they could come next year or in a decade, she said.

Plaquemines

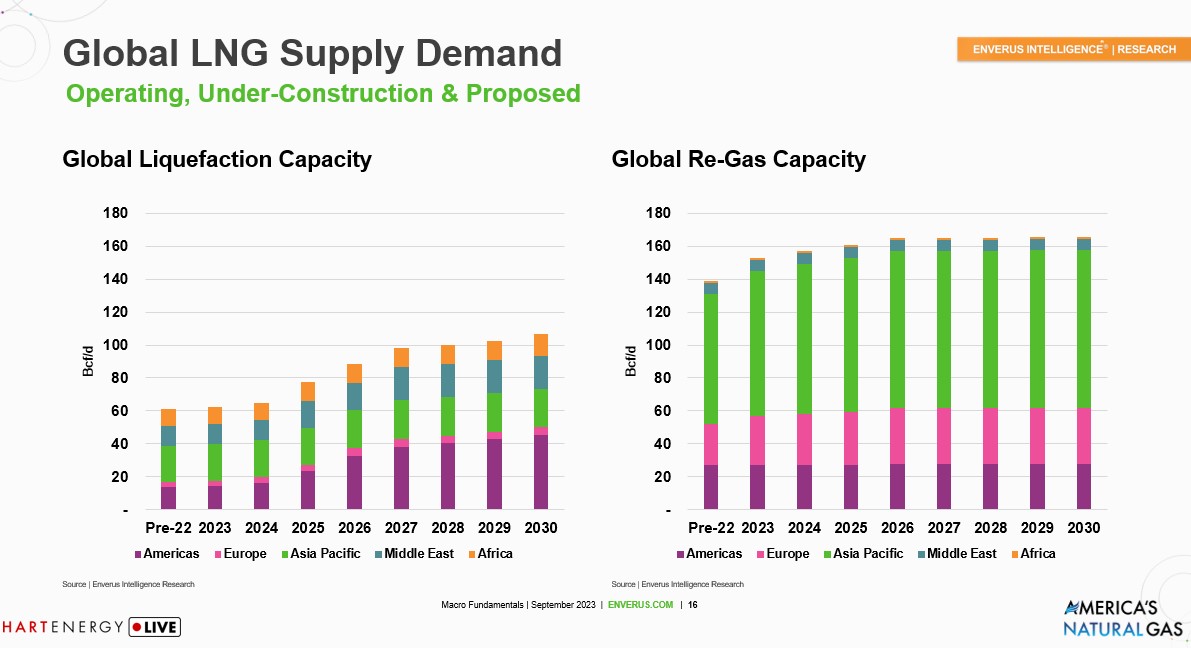

On the LNG front, “significant additional capacity is coming,” Johnson said.

Demand for U.S. supply will approach 30 Bcf/d by 2030 as projects including Golden Pass, Plaquemines, LNG Canada, Port Arthur, Rio Grande and Saguaro come online between the second quarter of 2024 and the end of 2027. Eight other projects—Lake Charles, Calcasieu Pass 2, Driftwood LNG, Commonwealth, Delfin, Sabine Pass Expansion, Saguaro LNG and Cameron Phase 2—are pre-final investment decision.

Around the world, it looks like regasification capacity will be ready when it’s needed, she said.

“Is there demand? Yes, but is it going to be filled up immediately? Are they all going to run full all the time? They're not,” she said.

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.