(Source: HartEnergy.com, Shutterstock.com)

The gut punch that crude oil prices took on March 9 was felt by NGL, too, and petrochemicals can expect to suffer body blows, as well.

By mid-morning of March 12, WTI was down 4.6% to $31.47 per barrel (bbl), Brent was down almost 7% to $33.34/bbl and, after trading was halted for 15 minutes for the second time in a week due to a 7% drop in the S&P 500 index, the S&P Oil and Gas index had fallen 12%. The U.S. benchmark Henry Hub price was down 3.2% to $1.818 per million British thermal units (MMBtu)

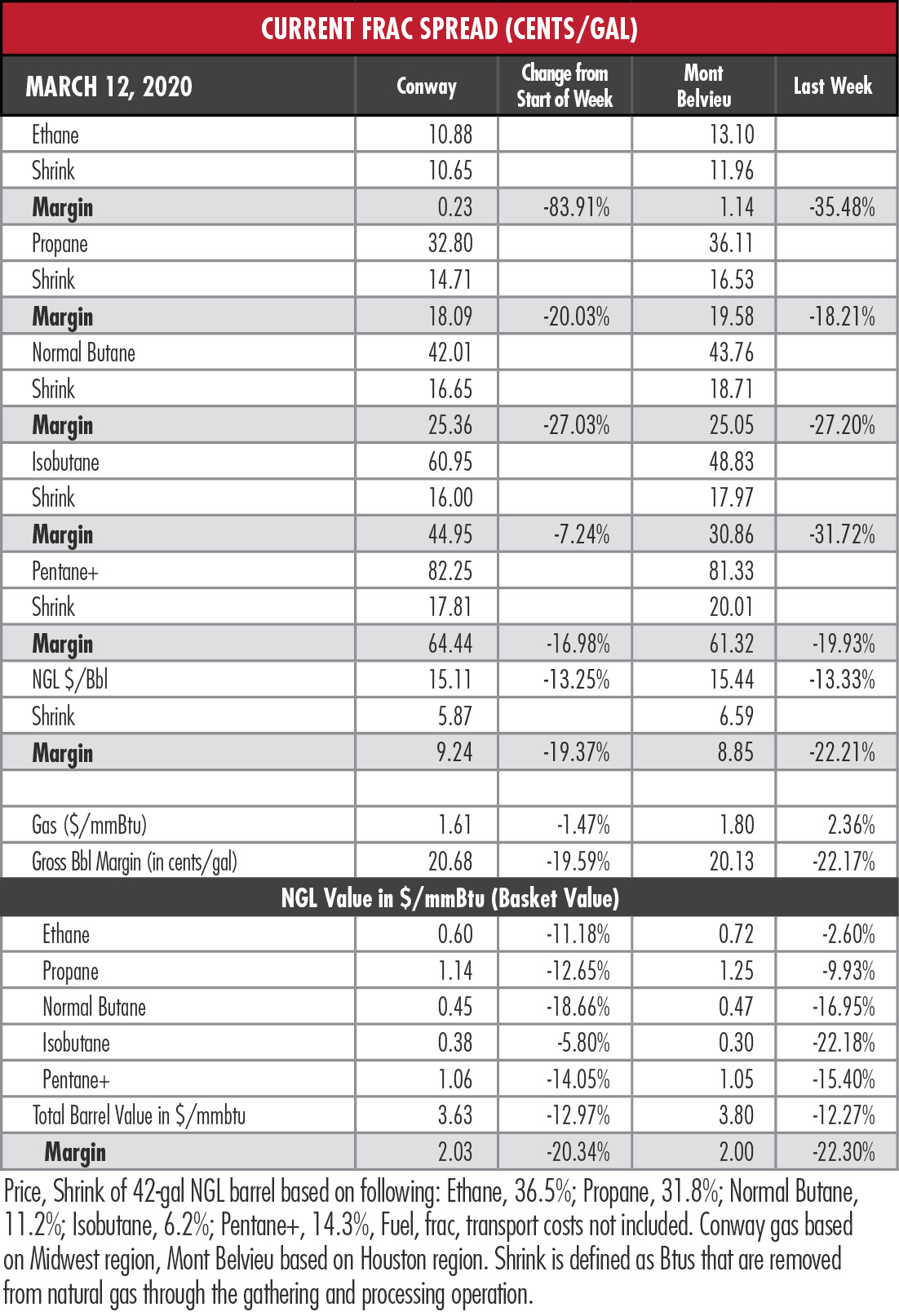

Last week’s hypothetical NGL barrel at Mont Belvieu, Texas, fell to a 50-month low of $15.44. It was a 13.3% week-over-week hit driven mostly by major losses from the butanes and natural gasoline.

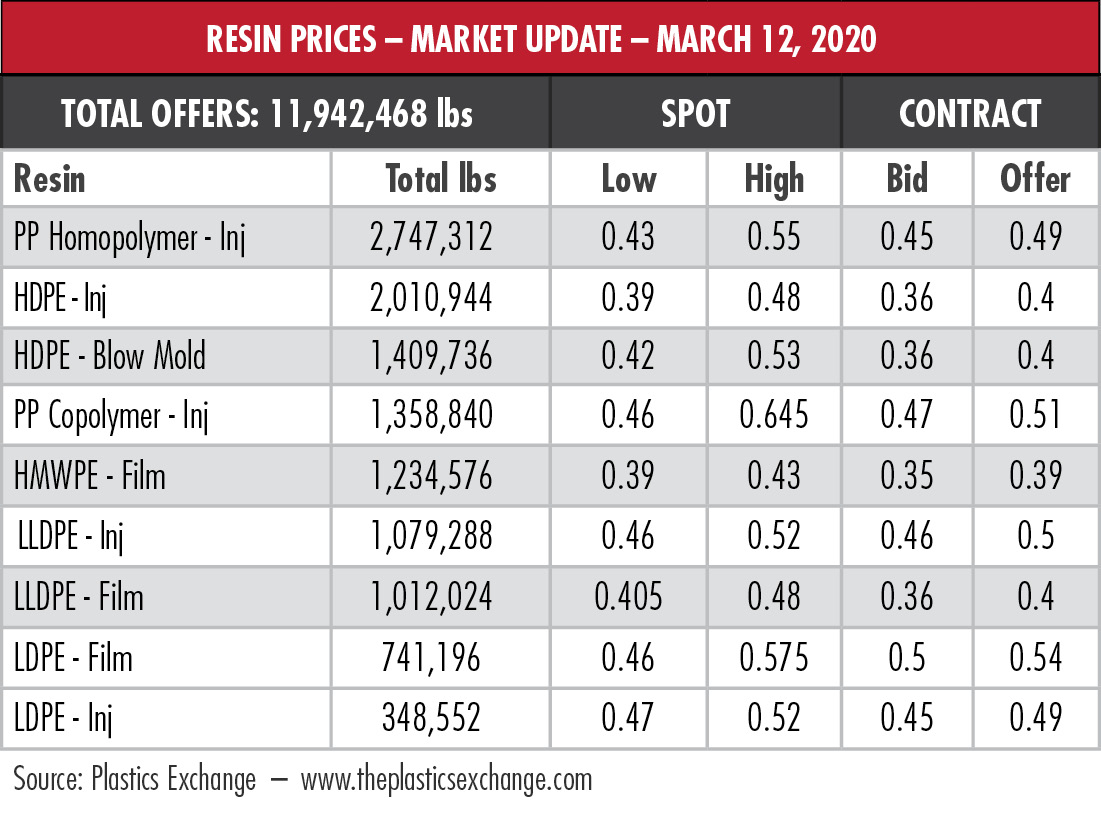

“U.S. producers using cheap NGL feedstock have enjoyed a competitive advantage in polyethylene (PE) production vs. their peers in Europe and Asia which largely use oil-based naphtha,” wrote Joseph Chang, global editor for ICIS Chemical Business. “However, with a major decline in crude oil prices, the U.S. advantage dissipates.”

EnVantage Inc. agrees, noting that “as always, this too will pass at some date but the trip will be treacherous.” The recovery, the analysts said, will be a sharp one when demand returns to an undersupplied market.

But that might take a while.

“During the last price war, OPEC members were surprised by the resilience of U.S. shale producers, and eventually chose to cut their own production instead,” said Mark Finley, fellow in energy and global oil at the Baker Institute’s Center for Energy Studies at Rice University. “This time around, many observers expect U.S. producers to be under greater pressure from investors/lenders.”

OPEC producers will need to keep their own budget deficits in mind as they ramp up production, Finley added.

For now, it appears that they are doing both. The Saudis announced on March 10 they would increase output by 2.5 million barrels per day (bbl/d) beginning April 1. That could force the price of crude down to the low $20s before the global market rebalances, Rystad Energy said on March 11.

“Without OPEC+, the global oil market has lost its regulator and now only market mechanisms can dictate the balance between supply and demand,” said Espen Erlingsen, Rystad’s head of upstream research.

And Energy Intelligence has already reported that the Kingdom is developing an economic strategy should the global price drop into the $12/bbl to $20/bbl range. Or less. But the balance will return.

“Ultimately, this will sow the seeds of a recovery in oil but we’ve got to work through a challenging 2020 first,” Pearce W. Hammond, managing director of midstream and infrastructure equity research at Simmons Energy, told HartEnergy.com.

Before you calculate the damage that single-digit crude prices would do, remember that the U.S. benchmark Henry Hub natural gas price had a pretty good week.

Early on March 9, gas fell to a 21-year low of $1.61/MMBtu but popped up 20% by the following afternoon. By midday March 11, it peaked at $1.99/MMBtu, or 23.6% above its low point. The hike is related to anticipated oil production cutbacks.

“Oil production in the United States has been cut; associated gas production goes along with that oil, so you’re reducing gas production,” Hammond said. “That’s beneficial to the gas market.”

Indeed, Cabot Oil & Gas Corp. and EQT Corp. stocks both enjoyed strong days while other gas producers experienced minor damage to their share prices.

NGL prices follow oil and gas, and the results—with the exception of ethane, which has been in the dumps for a while, anyway—were brutal.

From the close of trading on Friday, March 6 to the close on Monday, March 9, propane lost 14% at Mont Belvieu, Texas; butane lost 16%; isobutane lost 15%; and natural gasoline lost 21%.

For ethane, the concern is the spread of the COVID-19 pandemic in Asia and Europe, EnVantage said. If international ethylene plants purchasing U.S. ethane are forced to scale back, so will U.S. exporters. And reporting by Platts of a surplus in Europe and plant slowdowns in Asia indicate that will be the case.

“The bottom line is that the oversupply of ethane will continue to make it difficult for ethane prices to materially differentiate from natural gas prices,” EnVantage said.

With winter ending, the price of propane can be expected to drop, but like the hypothetical barrel, the Mont Belvieu price collapsed to a 50-month low—hardly an entirely seasonal reason. On the plus side, EnVantage said there were indications that Chinese petrochemical producers have received waivers to import U.S. propane.

Heavy NGL like the butanes and natural gasoline would also be expected to experience price slides with the end of the wintertime gasoline blending season—but not 15% to 22% weekly jolts.

Hang on. This could be a long, tough fight.

In the week ended March 6, storage of natural gas in the Lower 48 experienced a decrease of 48 billion cubic feet (Bcf), the EIA reported, compared to the analyst consensus expectation of a 59 Bcf reduction. The EIA figure resulted in a total of 2.043 Tcf. That is 63.8% above the 1.247 Tcf figure at the same time in 2019 and 12.5% above the five-year average of 1.816 Tcf.

Recommended Reading

OTC: E&Ps Improving Operational Safety with Digitization

2024-05-13 - Artificial intelligence and the digitization of the oilfield have allowed for several improvements in keeping operators out of harm’s way, panelists said during the 2024 Offshore Technology Conference.

Safety First, Efficiency Follows: Unconventional Completions Go Automated

2024-07-18 - The unconventional completions sector has seen a tremendous growth in daily stage capacity and operation efficiencies, primarily driven by process and product innovations in the plug and perf space.

ProFrac, IWS Taking the Garbage Out of Oilfield Data Transfer

2024-07-16 - ProFrac and Intelligent Wellhead Systems’ MQTT protocol promises to speed up communications at the frac site, not only by saving costs but laying the foundation for future technological innovations and efficiencies in the field, the companies tell Hart Energy.

E-wireline: NexTier Taps Oilfield Grid, Automation for Completions

2024-07-23 - NexTier Completion Solutions is using advanced electric-drive equipment, automation-enabled pump down technology and digital connectivity to optimize wellsite operations during shale completions.

Quantum Capital’s View on AI: Lots of Benefits, Pain Points

2024-05-16 - The energy industry is lagging in the race to implement AI, but Sebastian Gass, CTO of Quantum Capital Group, offered a few solutions during Hart Energy’s 2024 SUPER DUG Conference & Expo.