Just a few years ago, the natural gas wells in Arkansas were focused primarily in western Arkansas in the eastern portion of the Arkoma basin near the Oklahoma border. In the recent past and continuing to the present, more wells are being drilled in central Arkansas' Fayetteville shale development.

In fact, total wells drilled and completed for production in the Fayetteville shale number more than 3,000 with numerous permits still in process. According to Baker Hughes Inc., an average of 34 to 35 rigs remain active in the play in 2011, highlighting the repetitive "manufacturing approach" to ongoing play development.

Reported area production for 2008, 2009, and 2010 was 273 billion cubic feet (Bcf), 519 Bcf and 777 Bcf respectively, ramping up as additional pipeline capacity became available, according to the Arkansas Oil & Gas Commission.

With over 3 Bcf per day of exiting firm transportation capacity, midstream infrastructure in-place is capable of managing volumes of greater than 1 trillion cubic feet per year.

Manufacturing phase

The current phase of Fayetteville shale development has been described by industry insiders as entering the manufacturing phase, wherein the proven initial drivers—knowledge and technology—have been succeeded by the repetitive processes of optimization and disciplined ongoing operations.

The ongoing upstream development activity remains widely dispersed across the play. In general, upstream activity appears to remain consistent despite lower natural gas prices, higher prices for drilling and completion services, and an overall industry shift away from dry-gas plays such as the Fayetteville shale to oil or wet-gas, liquids-related gas plays.

Gauging its strategy, Southwestern Energy Co., the region's largest operator, reports that its initial production per well to-date in 2011 is down 7% from its more successful results in 2010. If other operators experience similar results in this manufacturing phase, then the overall goal of achieving a long-term, annuity-type production profiles to offset overall area decline will continue to be a challenging task.

Early on, upstream operators recognized the significant resource potential of the Fayetteville. In the past, gas went to markets in Missouri, Iowa, Illinois and Indiana. But today, producers are seeking to maintain the ability to serve those markets as well as move gas to target alternative markets. They have committed to a variety of short-term transportation arrangements on existing Fayetteville area pipeline infrastructure and have contracted for some 3 Bcf of gas per day of new long-term interstate pipeline capacity.

In addition to these long-term interstate pipeline commitments, similar commitments have been made for gathering, compression, dehydration, and treating facilities to ensure that the natural gas is pipeline-quality. Today, the new exit strategy for most of the Fayetteville shale gas volumes is to compete for new capacity on pipelines that serve markets east of the Mississippi River.

Gas gathering

The hills of central Arkansas have seen a significant implementation of upstream and midstream infrastructure during recent years. Gas production tends to be low-pressure, so various stages of compression are necessary. In the Fayetteville area, compression keeps gathering systems operating at low pressure to optimize overall well performance and also provides a pressure boost to gas entering area transmission pipeline systems.

Some major operators initially installed their own gas-gathering systems. Southwestern Energy's Desoto Gas Gathering, the largest area operator, continues to own and operate its own gathering systems, including almost 1,700 miles of gathering lines moving some 2 Bcf per day with more than 50 compressor station locations.

Meanwhile, ExxonMobil Corp.'s subsidiary, XTO Energy, developed a portion of its own gathering assets and in 2010 acquired acreage, producing wells and gathering-line assets from Petrohawk Energy Corp.

Also, Centerpoint Energy Field Services (CEFS) received an acreage dedication from XTO and contractually agreed to provide pipeline, treating and dehydration facilities for up to 0.9 Bcf per day, as well. Via connection of XTO wellhead gathering to multiple CEFS gathering systems throughout the area, volumes can route into Centerpoint Energy Gas Transmission's mainline (CEGT) which can deliver up to 400 million cubic feet (MMcf) per day for XTO's account into Texas Gas' Fayetteville lateral at Searcy, Arkansas.

Elsewhere, Chesapeake Energy Corp. built over 400 miles of gathering capacity to support its initial area gathering efforts. But it recently sold its overall remaining Fayetteville portfolio to BHP Billiton Ltd. After a period of transition, BHP can elect to operate these midstream assets in support of its future activity or monetize their value at a future date by selling to a third party.

One of the larger third-party (non-producer affiliated) gatherers in the Fayetteville shale development is Crestwood Midstream Partners LP. Crestwood recently entered the area with its purchase of five gas gathering systems (0.51 Bcf per day), treating facilities (0.165 Bcf per day) and compression assets (35,000 horsepower) from Frontier Gas Services LLC.

With acreage dedications to these existing area gathering systems, and with the new area entrance of BHP Billiton, which is indicating an aggressive plan to develop additional area resources, Crestwood's midstream assets are poised for potential growth.

One of the area's earliest systems, Spectra Energy Corp.'s 365-mile Ozark Gas Gathering (OGG), provides gathering of certain Fayetteville shale volumes into its Ozark Gas Transmission (OGT). OGG delivers gathered volumes primarily into its Ozark Gas Transmission affiliate. OGG gathers Arkoma production as well as gas from the Fayetteville shale.

Interstate pipelines

Historical flow patterns through the exisiting Fayetteville area interstate pipeline infrastructure were from west-to-east and from south-to-north. Arkoma basin gas and other upstream sources were primariliy delivered to markets in the lower Midwest, such as St. Louis and Chicago.

The primary market targets for Fayetteville gas were the interconnections to pipelines just east of the Mississippi River. Two major interstate pipeline developments have been recently implemented and are providing the majority of that more than 3 Bcf per day of new capacity.

Those are the Fayetteville lateral by Texas Gas Transmission LLC and the Fayetteville Express Pipeline (FEP) joint venture by Kinder Morgan Energy Partners LP and Energy Transfer Partners LP.

Texas Gas' Fayetteville lateral was implemented coincident with a Texas Gas' Greenville (Mississippi) lateral to provide off-system deliveries from the Texas Gas system into pipelines delivering further east to markets in the southeast and eastern U.S. The primary targets were the Texas Eastern Transmission and Southern Natural Gas pipelines.

Texas Gas allowed Fayetteville shippers to contract for firm transportation capacity on both legs, thus providing a seamless pathway to pipelines serving these markets. Because the Fayetteville lateral is also connected to Texas Gas' mainline system, upstream and downstream markets on the Texas Gas system—including its downstream storage facilities—are available to shippers on a secondary firm basis.

The Fayetteville Express Pipeline (FEP) also crosses the Mississippi River to provide multiple downstream pipeline interconnections into ANR Pipeline Co., Trunkline Gas Co. LLC, and Texas Gas Transmission's mainline. Shippers on FEP can access downstream markets and storage in the upper Midwest and Michigan on ANR and Trunkline as well as markets served via the Texas Gas mainline system.

In addition, backhaul deliveries to the Perryville Hub and any desired upstream markets or storage points are available on each of the three systems. An enroute FEP connection to Kinder Morgan-affiliate Natural Gas Pipeline Co. of America (NGPL) provides optional access to markets and storage in the Chicago area if those markets are desired.

With its interstate facilities located on the west side of the Mississippi River, Spectra Energy's Ozark Gas Transmission pipeline was positioned early-on to begin providing transportation support to area players in the initial portions of the Fayetteville shale development cycle.

With 500 MMcf per day of immediately available capacity eastward on its system, Ozark has and continues to provide delivery capability to lower Midwest markets via interconnections to Texas Eastern Transmission, Natural Gas Pipeline of America (NGPL) and Mississippi River Transmission (MRT).

Although Ozark's level of firm contracting and associated throughput may have decreased somewhat with the introduction of the newly constructed area exit pipelines and access to new markets, the short-term commitments to Ozark were effective and essential as shippers awaited the arrival of the long-term infrastructure.

Other regional interstate pipelines also participating in transporting upstream portions of the Fayetteville shale volumes in the early development stage were Centerpoint Energy Gas Transmission (CEGT), and Natural Gas Pipeline of America (NGPL) and each remains a transporter of Arkoma area supply volumes as well. Though possibly no longer transporting as much Fayetteville shale gas as previously, these pipelines do continue to serve as alternate area transporters and can provide access to other markets when desired.

Reviewing actual flow data for 2009, 2010, and 2011 to date, it appears that Fayetteville shale volumes have indeed ramped up into the developed midstream infrastructure. Daily volumes have grown over time and are most recently between 2 and 2.5 Bcf per day. Thus, with area operators focused on the continuing process of "manufacturing/annuity" activity, it appears that the more than 3 Bcf per day of pipeline capacity built to move the Fayetteville shale volumes to market is quite adequate and will meet current and future regional needs.

Recommended Reading

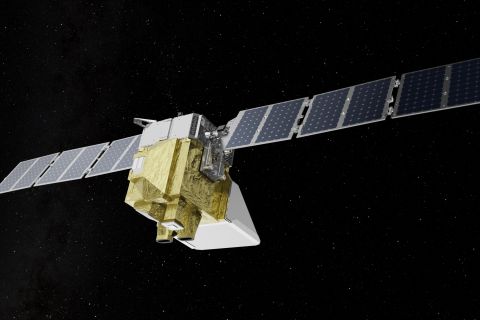

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

The Problem with the Pause: US LNG Trade Gets Political

2024-02-13 - Industry leaders worry that the DOE’s suspension of approvals for LNG projects will persuade global customers to seek other suppliers, wreaking havoc on energy security.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

Vietnam Seeks Delicate Balance Among US, China, Russia

2024-02-08 - Ongoing U.S. tensions with China and Russia offer Vietnam an opportunity to boost economic ties with the former if American investors can steer past geopolitical smokescreens and destine funds for infrastructure, power and LNG projects all somewhat tied to Vietnam’s manufacturing sector.