On the surface, this statement may not differentiate the partnership from other companies in the oil and gas industry. However, unlike other companies, American Midstream’s transformation has been positive.

With support from private equity firm ArcLight Capital Partners LLC, which controls the general partner (GP), the partnership has evolved from a small, Gulf Coast-based midstream operator, to a diversified midstream operator located in the major U.S. resource plays.

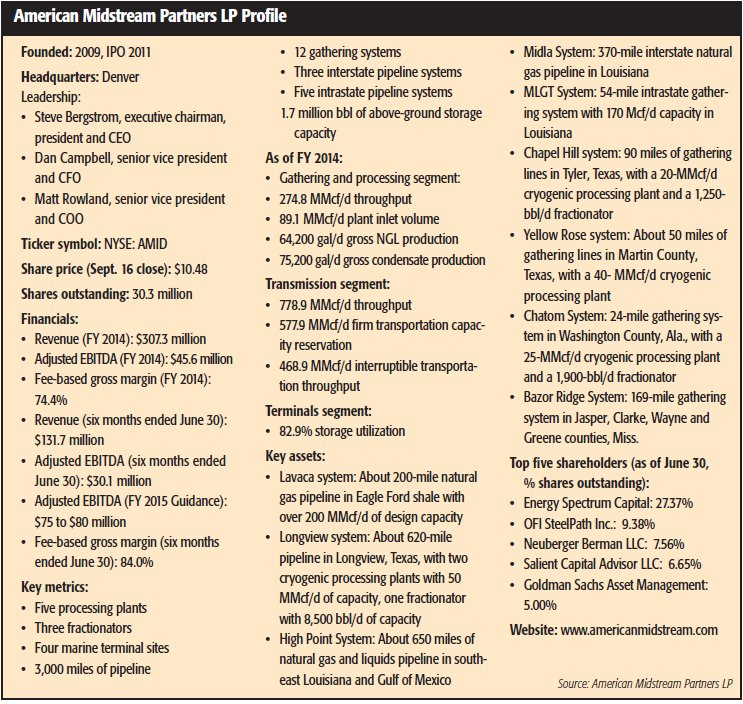

Consider that in 2012, about 40% of American Midstream’s gross margin was commodity-price sensitive because a large portion was derived from percentage of proceeds (POP) contracts. Today, about 15% of the partnership’s gross margin is directly exposed to commodity prices, which is expected to decrease to less than 10% in 2016. This transformation began in April 2013 when ArcLight acquired a controlling interest in the general partner and Steve Bergstrom was named executive chairman, president and CEO of American Midstream.

“At the top of my to-do list was to complete a ‘bottoms-up’ analysis of every asset the company owned. What we learned was roughly half of the assets were small and not contributing much cash flow,” Bergstrom told Midstream Business.

Over the next six to eight months, non-core assets were divested and the partnership pursued acquisitions to diversify operations into major resource plays and reduce commodity exposure. This included the acquisition of a terminals business, Blackwater Midstream, in December 2013, from ArcLight and expansion into the prolific Eagle Ford Shale in early 2014 with the purchase of the Lavaca natural gas gathering system. “Today, the partnership doesn’t look anything like it did in 2013,” he said regarding the changes that were made.

Indeed, the company’s commodity sensitivity is set to do a complete 180-degree turn next year, thanks to the diversification efforts, including the recent acquisition of a 25% interest of ArcLight’s 51.7% controlling interest in the Delta House semisubmersible floating production system and associated oil and natural gas export pipelines located offshore in the deepwater Gulf of Mexico.

“That’s a phenomenal turnaround in such a short time,” Bergstrom said. “We haven’t modified or terminated the POP contracts; we’ve just grown out of the commodity sensitivity by acquiring and developing assets with fee-based gross margin.”

Acquisitions in a difficult environment

The $162 million dropdown of Delta House complements American Midstream’s strategic focus on the eastern Gulf of Mexico, where the partnership is pursuing additional, related opportunities.

Equity costs are higher in the current environment, which makes accretive deals harder to find. Delta House delivers immediate, fee-based cash flow to American Midstream and is accretive to its current distribution. Cash flows for Delta House are currently supported by a 100%, volumetric-tiered, fee-based tariff structure with ship-or-pay components and life-of-lease dedications.

“Most deals and acquisitions are back-end loaded, but the way that ArcLight structured the deal with LLOG Exploration Co. LLC [which owns a portion of and operates the facility and is also developing the fields associated with the project], there is a tremendous incentive for LLOG to flow significant volumes on the front end,” Bergstrom said.

The dropdown may seem like a reaction to the current down cycle but it was years in the making. American Midstream executives worked with ArcLight to source and execute the Delta House project several years ago when the deal was consummated and the construction began.

“The timing of the dropdown may look like we pulled it out of our pocket at a time when the industry is struggling, but that is not the case. We’ve been following the project for several years and waiting for it to come online,” Bergstrom said.

At the time of the dropdown, Dan Revers, ArcLight’s managing partner, said ArcLight has “long viewed the Delta House project as complementary to American Midstream” and believes the “dropdown transaction is a testament to our strong and continuing support” of the partnership.

Delta House operations commenced in April 2015 and currently seven wells are online with at least eight wells scheduled to be online by the end of 2015.

“Large projects like Delta House typically don’t come online on time, but ArcLight and LLOG brought it online on time and under budget,” Bergstrom said.

Significant growth potential

Deepwater offshore drilling in the Gulf of Mexico flattened out following the Macondo oil spill in 2010, but deepwater drilling has steadily increased as the regulatory environment in the region took shape. Today, that situation remains steady despite the commodity price downturn with the U.S. Energy Information Administration stating that the downturn will have little impact on production levels due to the long lead times associated with deep-water Gulf of Mexico projects.

“The deepwater region where Delta House is located has quite a bit of growth. These are enormous oil plays and producers don’t stop investing because oil prices are down. They invest through cycles because it is so costly and takes so long to develop that they can’t stop and start like they can onshore,” Bergstrom said.

Thirteen production fields are expected to come online in the Gulf of Mexico in 2015 and 2016, half of which are expected to be tied back to existing platforms like Delta House. Gulf of Mexico production is expected to reach an average of 1.5 million barrels per day (bbl/d) in 2015 and 1.6 million bbl/d in 2016, accounting for about 15% of the nation’s total crude oil production.

In addition to its existing offshore assets, including the High Point system and its interest in Delta House, American Midstream is pursuing offshore interests through the acquisition of complementary assets, particularly those in which it can lower costs through more effective management. “The name of the game is cost cutting because of how expensive it is to operate offshore,” he said.

Changing trajectory

American Midstream has diversified its midstream operating platform in less than 24 months amid a downcycle. In the past 12 months, domestic crude oil and natural gas prices have fallen about 50% and 30%, respectively. However, the downturn has not resulted in the partnership making drastic changes to the growth strategy that was already in place.

“The growth is still there in the shale plays, but the growth trajectory has changed. The beauty behind MLPs like ours is that we already have the infrastructure in place so when things turn around and the drill bit goes back to work, most of our capital has already been invested because most of the drill pads have been connected,” he said.

Bergstrom did note that a meaningful change to the company’s growth project not impacted by commodity prices is Blackwater Midstream, the partnership’s terminal segment. Blackwater consists of 1.7 million bbl of above-ground storage capacity across three marine terminal sites in Louisiana and Georgia. The facilities are equipped to store a range of chemical, agricultural and petroleum products under fee-based contracts.

In the past 12 months, Blackwater has commissioned a new storage facility, the Harvey site, with capacity of about 535,000 bbl, of which 100% are leased under multiyear, firm storage contracts. Construction of an additional 150,000 bbl of storage capacity is underway with expected completion by the end of 2015. In addition, a deepwater ship dock was completed in July 2015 and can now accommodate ocean-bound vessels. When fully developed, Harvey has the potential for more than 2 million bbl of capacity, which would double the partnership’s existing capacity.

Another recent example of this type of project includes the construction of the High Point Lateral, a 15-mile extension of its High Point system located offshore Louisiana that is being built for an existing refinery customer. The $20 million project is backed by multiple, 10- to 15-year fee-based agreements.

More infrastructure needed

The need for more infrastructure, even as producers have pulled back on the rig count, is something that isn’t fully appreciated, Bergstrom said.

“There is more to midstream than just the producer drillbit,” he said.

“Major oil and gas producers have recently reported declining volumes and foreshadowed the likelihood for these trends to persist. As a result, the market paints all MLPs with the same brush and assumes the worst-case scenario going forward.”

“We were surprised because volumes are not down. Volumes are not necessarily increasing in every basin, but they are staying pretty flat. It’s not like everyone turned off the spigot at once. If a downturn is prolonged for two or more years, then you will see significant volume declines, but the overall market reaction was not consistent with reality,” he continued. This negative market commentary drove an industry-wide stock price downturn in early August, according to Bergstrom, with MLPs underperforming the S&P 500 by nearly 100 basis points.

Though it is very frustrating to see your unit price take a hit in these circumstances, Bergstrom said it was important to keep delivering cash flow with solid distribution and distribution coverage, and the market will eventually catch up. Year-to-date, American Midstream’s unit price is down about 40%, underperforming the benchmark. However, the partnership has sustained its distribution of $1.89 per unit at about 1X distribution coverage and expects to recommend to its board of directors an annualized distribution growth rate of 5% with the close of the Delta House acquisition.

“Markets will frequently overshoot in both directions. They go both higher and lower than they should on both the commodity and public markets. You can’t get hung up on market volatility, you just have to keep delivering,” he said.

Public-private partnership

American Midstream is strongly supported by ArcLight, which allows assets to be developed and become cash flow positive within the general partner before being dropped down. This allows the MLP to avoid significant capital outlays and receive cash flow once assets are developed and cash is flowing. It also allows the two companies to invest alongside each other, which further de-risks projects for American Midstream.

To allow for flexibility, American Midstream and ArcLight have not publicly set a dropdown schedule. “We haven’t provided public timing for dropdowns. We had two dropdowns in 2013, none in 2014 and then one this year. The timing is subject to market conditions and other factors,” Bergstrom said.

In addition to dropdown opportunities, American Midstream also sources third-party acquisitions to diversify its portfolio. One such opportunity was last year’s $470 million acquisition of Costar Midstream from Energy Spectrum Partners. This acquisition served as an entry into East Texas, the Bakken and the Permian Basin. Costar consists of gathering, processing, fractionation and off-spec condensate treating and stabilization assets in these regions.

“It was a strategic move that provided entry into attractive resource plays and added tremendous diversification. The Permian seems to have the best drilling economics in the country, and our Bakken assets are in the core of McKenzie County, [N.D.], one of the most productive areas in the Bakken,” he said.

The acquisition was financed with 50:50 debt and equity, which directly links the deal with American Midstream’s unit price. “In the current environment, you need diversified cash flow that delivers even in the current environment of $40 oil and $2.50 gas. Having different assets with different economics in different areas is how you find organic growth,” Bergstrom said.

Diverse asset bases also allow American Midstream to make quicker pivots and changes to keep growing in an ever changing industry.

Midla: a new century

American Midstream Partners’ review of its assets following ArcLight’s 2013 acquisition of its GP presented an interesting fact: the Midla Pipeline was still in operation. “I looked at acquiring Midla a number of times in my career and was surprised to find when I took over American Midstream that it was still in operation,” Bergstrom said. Midla, constructed in the 1920s, is one of the oldest pipelines still in use in the U.S.

“Most of these types of pipelines were replaced in the 1980s and 1990s, but the previous owner of Midla never addressed it. Midla should have been retired many years ago. It’s probably 30 years past its useful life,” he said.

The 370-mile interstate natural gas system links the Monroe natural gas field in northern Louisiana with the Transco Pipeline system and Gulf South Pipeline system to customers near Baton Rouge, La.

The pipeline was generating solid revenue, but persistent maintenance issues required two, full-time welding crews attached to the system to ensure safe operations. “We had to make a decision to either shut it down or create a new opportunity,” he said.

The partnership filed to decommission the system in April 2014, but because the pipeline is the lone supplier of natural gas along its route to Natchez, Miss., it was critical to arrange for alternative energy sources for the communities served by the pipeline. “We couldn’t just retire the pipeline; our preference was to rebuild it in the same right of way,” he said.

In December 2014, all parties agreed to the retirement of the existing Midla Pipeline and construction of the 52-mile Midla-Natchez Pipeline, extending from Winnsboro, La., to Natchez, Miss., along existing Midla rights of way. The Midla-Natchez Pipeline is anchored by multiple 10- to 15-year agreements, resulting in the partnership’s return on investment.

“It’s a classic example of taking an asset that had neutral to negative cash flow and turning it into a 20-year positive cash flow asset,” Bergstrom said. The partnership also anticipates industrial growth along the route, which will further support the decision to rebuild.

American Midstream has moved as quickly as possible through the regulatory process to ensure the safety of the people and communities in which they operate. Recently, the partnership filed for authorization to begin construction on the Midla-Natchez Pipeline. Total project cost is $50 million and construction is expected to commence in early 2016 once approvals are received.

Recommended Reading

Analyst: Exxon Mobil, Pioneer Deal Close Likely ‘Imminent’

2024-05-01 - With approval from the Federal Trade Commission, Exxon Mobil could close its $59.5 million acquisition of Pioneer Natural Resources after more than six months of review.

Oil, Gas Production Fee Set to Hit Colorado Producers

2024-05-01 - The deal reached this week will eliminate several proposed ballot measures targeting the fossil fuel industry ahead of this year's election, including one that would have halted drilling in summer months.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

2024-04-25 - Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

US Interior Department Releases Offshore Wind Lease Schedule

2024-04-24 - The U.S. Interior Department’s schedule includes up to a dozen lease sales through 2028 for offshore wind, compared to three for oil and gas lease sales through 2029.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.