The combined company—to be managed by the Desert Peak team headquartered in Denver—will remain focused on consolidating high-quality mineral and royalty positions in the Permian Basin, a company release said. (Source: Hart Energy)

Falcon Minerals Corp. agreed on Jan. 12 to an all-stock merger with Desert Peak Minerals, the largest independent Permian Basin pure-play mineral and royalty company, set to create a mineral and royalty company with a significant Permian and Eagle Ford footprint and an enterprise value of $1.9 billion.

The transaction will mark the next chapter for Falcon, which formed in 2018 through an $800 million combination involving its predecessor—a blank-check company—and Blackstone’s royalty business. It also follows a thorough evaluation over the last several months of a number of alternatives to maximize shareholder value, according to Claire Harvey, chair of the Falcon board and the transaction committee.

“Following our comprehensive review, we believe that a combination with Desert Peak represents the best opportunity to maximize value for Falcon’s shareholders,” Harvey commented in a company release.

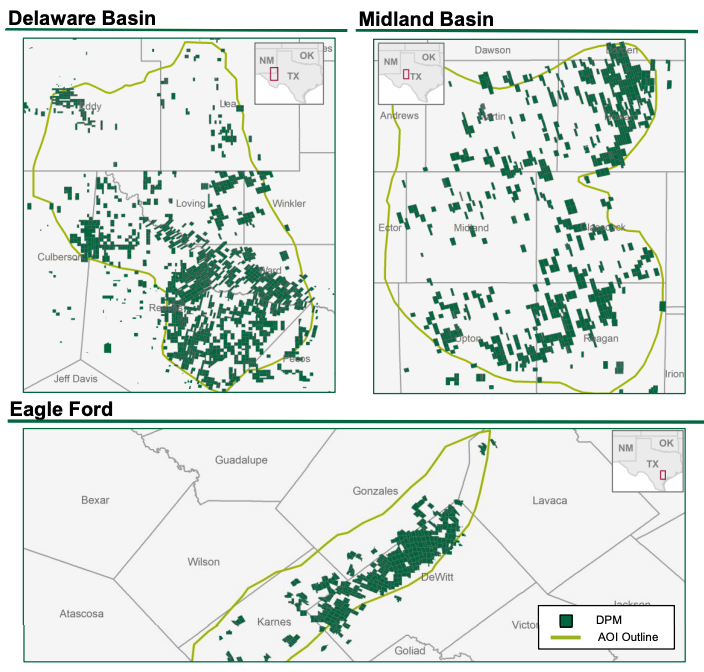

Combined, the company will own over 139,000 net royalty acres, normalized to a 1/8th royalty equivalent, over 105,000 of which are located in the Permian Basin. The company is projected to produce approximately 13,500-14,500 boe/d in first-half 2022 on a combined basis.

The combined company—to be managed by the Desert Peak team headquartered in Denver—will remain focused on consolidating high-quality mineral and royalty positions in the Permian Basin while optimizing its existing asset base, a company release said.

“We believe the ownership of Permian minerals and royalties is trending toward larger-scale, more efficient institutional ownership,” Desert Peak CEO Chris Conoscenti commented adding that the new company strategy is to be the “leading consolidator” of these assets.

Desert Peak was founded by Kimmeridge, a private investment firm focused on energy solutions, to acquire, own and manage high-quality Permian Basin mineral and royalty interests. The company has accumulated its 105,000 net-royalty-acre position in the Permian through the consummation of over 175 acquisitions to date, according to the release.

Meanwhile, Falcon owns mineral, royalty, and over-riding royalty interests covering over 21,000 net royalty acres in the Eagle Ford Shale and Austin Chalk in South Texas. The company also owns over 12,000 net royalty acres in the Marcellus Shale across Pennsylvania, Ohio and West Virginia.

Combined, the company will have approximately 20 net wells normalized to a 5,000 ft basis that have either been spud or permitted. The inventory of line of sight wells provides visibility into attractive organic production over the next 12 months, the company release said.

“As we have previously communicated to our shareholders, we believe scale matters in the minerals business, as it enhances the ability to drive greater consolidation, improves access to capital, and reduces volatility caused by asset concentration,” added Bryan Gunderson, president and CEO of Falcon, in the release.

At closing expected during the second quarter, Desert Peak will become a subsidiary of Falcon’s operating partnership and the combined company will retain Falcon’s “Up-C” structure.

Under the terms of the definitive agreement, Falcon will issue 235 million shares of Class C common stock to Desert Peak’s equityholders. Falcon’s existing shareholders will own approximately 27% of the combined company, and Desert Peak’s equityholders will own roughly 73%.

Following closing, the combined company will have a new board of directors consisting of eight members. According to the release, member of the new board are currently expected to be: Noam Lockshin, Christopher Conoscenti, Erik Belz, Allen Li, Claire Harvey, Steven Jones, Morris Clark and Alice Gould. Lockshin, a partner at Kimmeridge, Desert Peak’s and the combined company’s largest equityholder, will serve as chairman of the new board of directors.

Barclays is serving as lead financial adviser to Falcon’s transaction committee, and Houlihan Lokey also served as a financial adviser to the transaction committee. Latham & Watkins LLP is Falcon’s legal counsel, and White & Case LLP is serving as legal counsel to the transaction committee. Vinson & Elkins LLP is serving as legal counsel to Desert Peak and Kimmeridge.

Recommended Reading

Solaris Stock Jumps 40% On $200MM Acquisition of Distributed Power Provider

2024-07-11 - With the acquisition of distributed power provider Mobile Energy Rentals, oilfield services player Solaris sees opportunity to grow in industries outside of the oil patch—data centers, in particular.

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

2024-07-18 - Service company Liberty Energy Inc. upped its EBITDA 12% quarter over quarter but sees signs of slowing drilling activity and completions in the second half of the year.

Offshore, Middle East Buoys SLB’s 2Q as US Land Revenue Falls

2024-07-19 - Driven by a strong offshore market and bolstered by strategic acquisitions and digital innovation, SLB saw a robust second quarter offset by lower drilling revenue in the U.S.

Halliburton Sees NAM Activity Rebound in ‘25 After M&A Dust Settles

2024-07-19 - Halliburton said a softer North American market was affected by E&Ps integrating assets from recent M&A as the company continues to see international markets boosting the company’s bottom line.

NextDecade Appoints Former Exxon Mobil Executive Tarik Skeik as COO

2024-07-25 - Tarik Skeik will take up NextDecade's COO reins roughly two months after the company disclosed it had doubts about remaining a “going concern.”