EQT Corp.'s strategic bolt-on will add ~800 MMcfe/d in the core of southwest Appalachia. (Source: Steve Heap / Shutterstock.com)

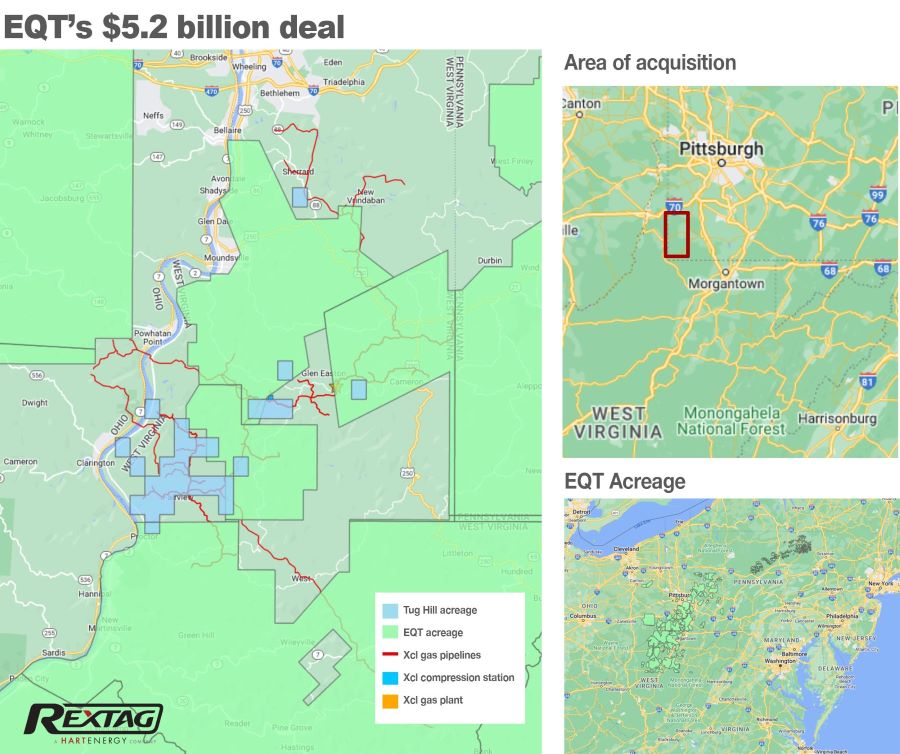

EQT Corp. entered into a purchase agreement to acquire THQ Appalachia I LLC (Tug Hill)'s upstream assets and THQ-XcL Holdings I LLC (XcL Midstream)'s gathering and processing assets, according to a company press release on Sept. 6.

Expected to close in fourth-quarter 2022, the total acquisition is valued at $5.2 billion comprised of about $2.6 billion in cash and about $2.6 billion in EQT common stock. Tug Hill and XcL Midstream are backed by equity commitments from Quantum Energy Partners-managed funds.

Quantum Energy Partners founder and CEO Wil VanLoh will join EQT's board of directors upon EQT's board approval process and the closing of the transaction.

"The acquisition of Tug Hill and XcL Midstream checks all the boxes of our guiding principles around M&A, including accretion on free cash flow per share, NAV per share, lowering our cost structure and reducing business risk, while maintaining an investment grade balance sheet," EQT CEO Toby Rice commented in the company release.

The Appalachian bolt-on will grant EQT an additional 800 MMcfe/d to its current operations. The company will gain approximately 90,000 core net acres offsetting its existing West Virginia core leasehold, with a 96% operated working interest and 83% net revenue interest.

According to the release, the assets are anticipated to generate free cash flow at average natural gas prices over the next five years above 1.35/MMBtu.

Pro forma free cash flow for 2023 is now expected to exceed $6 billion, the company said, with long-term annual free cash flow anticipated to average $5+ billion. Additionally, the deal caused shareholder returns to increase, doubling share repurchase authorization to $2 billion, as well as raising the year-end debt reduction target for 2023 to $4 billion.

"The valuation metrics are compelling and accretion from the deal should lower our NYMEX free cash flow breakeven price by approximately $0.15/MMBtu, which gives us greater free cash flow durability through the cycle," Rice continued.

"EQT is the face of the new energy paradigm," Tug Hill and XcL Midstream CEO Michael Radler added. "[Rice's] vision around U.S. LNG is something we believe in and because of our significant ownership position, are excited to be a part of that vision."

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

2024-02-29 - Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.