(Source: Shutterstock)

Enterprise Products Partners announced April 3 it has expanded its gas processing capabilities in the Permian Basin and plans to add more capacity over the next two years.

Enterprise has begun service on two plants: the Leonidas in the Midland Basin and the Mentone 3 in the Delaware Basin.

Each plant has a capacity to process 300 MMcf/d of natural gas and 40,000 bbl/d of NGLs. Three more plants are scheduled to come online by the second quarter of 2026.

“The Permian Basin is expected to account for more than 90% of domestic NGL production by the end of the decade as producers and oilfield service companies continue to push the envelope and develop new and more efficient techniques in one of the world’s most prolific energy basins,” A.J. “Jim” Teague, co-CEO of Enterprise’s general partner, said in a press release.

The U.S. NGL market has been driven primarily through growth production in the Permian region, the U.S. Energy Information Administration reported April 3. U.S. ethane production rose 9% from 2022 to new record highs in 2023.

“The Texas Inland and New Mexico refining districts, which span the Permian Basin, accounted for 61% of all U.S. ethane production in 2023,” according to an EIA press release. Since 2014, the U.S. annual daily average of production has grown from about 1.1 MMbbl/d to 2.6 MMbbl/d.

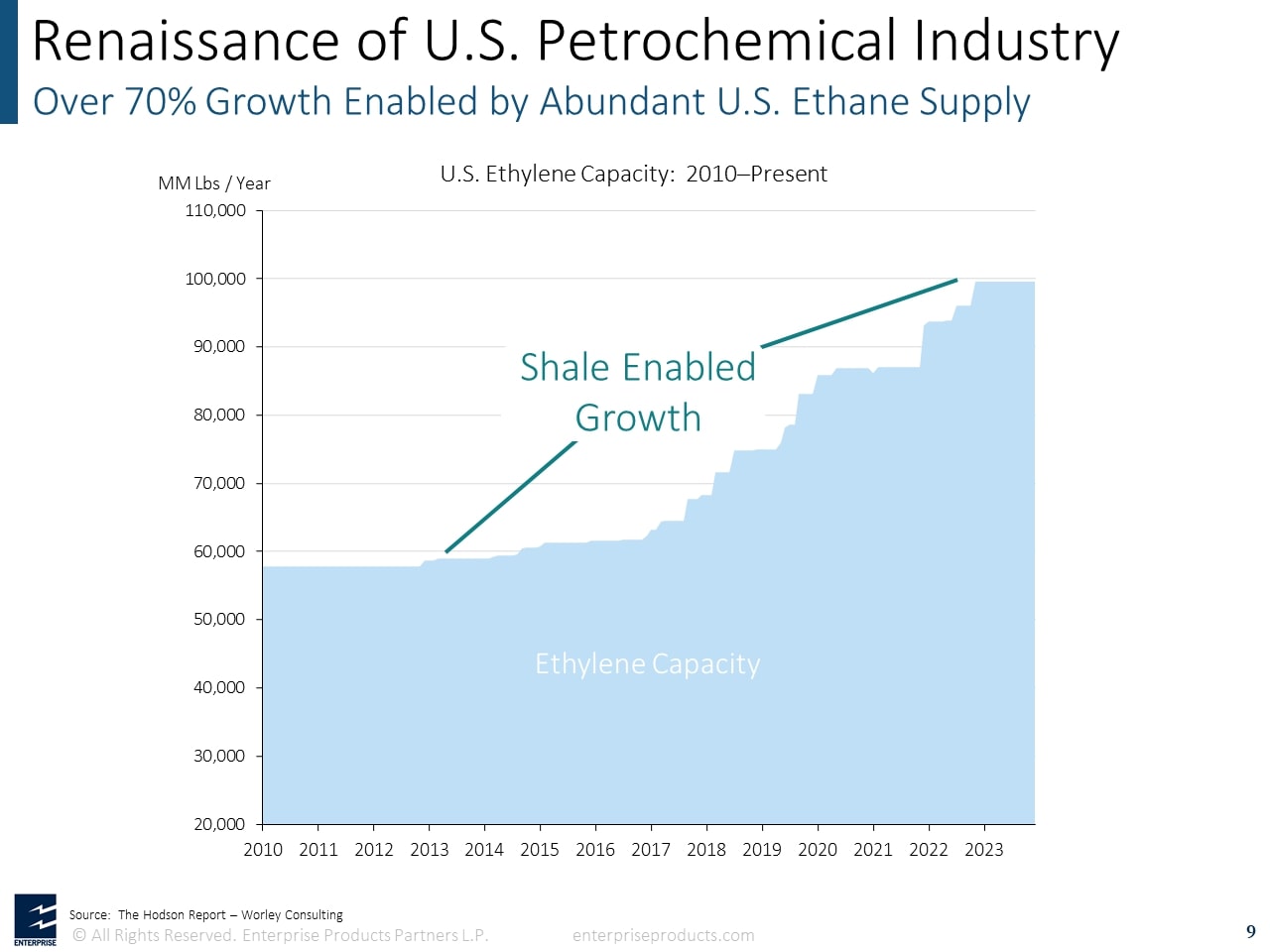

At the company’s investor day on April 3, Teague showed the audience a chart that tracked U.S. ethane production from 2010 to 2023, when production almost doubled to just under 100 billion pounds a year (US$126 billion).

“You can see what’s happened as a result of shale on ethylene production,” Teague said. “It has been like a tsunami.”

Recommended Reading

Kosmos Energy’s RBL Increased, Maturity Date Extended

2024-04-29 - Kosmos Energy’s reserve-based lending facility’s size has been increased by about 8% to $1.35 billion from $1.25 billion, with current commitments of approximately $1.2 billion.

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

2024-04-29 - Marathon Oil, Occidental, Continental Resources and others are reaching under the Permian’s popular benches for new drilling locations. Analysts think there are areas of the basin where the Permian’s deeper zones can compete for capital.

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-28 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-28 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.