There might not be an industry that takes the adage “more than one way to skin a cat” more seriously than oil and gas, even when it comes to the proppants used to fracture reservoirs.

However, some ways are better—and cheaper—than others. Take the three proppants used in hydraulic fracturing: ceramics, resin-coated and natural sands.

“Ceramics are very good, but they cost 10 times greater than what we buy our natural sand for,” Zigurds Vitols, president and CEO of Select Sands, told Hart Energy. “And when you measure the performance against the cost, we think that we have a more economical product to offer.”

Select Sands is a Texas-based sand provider that mines northern white sand from the St. Peter formation, a sprawling sandstone formation that stretches north to south from Minnesota to Arkansas, and east to west from Illinois to Nebraska and South Dakota. This sand is the highest quality as defined by API and has the “highest crush strength you can get in natural sand,” Vitols said. The sand is hard and spherical with little turbidity, making it the right specification to maximize recovery in a well, he said.

Turbidity is a measure of suspended particles, so a lower-turbidity sand is cleaner and has less dirt and silt attached to each particle.

St. Peter formation sand is more conducive to fracking jobs in Colorado, Texas and Louisiana than the lesser strength and less spherical in-basin sands which have higher levels of turbidity and do not allow oil to move as easily. But there have been a number of advancements in chemicals and friction reducers that allow oil producers to still use in-basin sands, Vitols said.

Unfortunately, in-basin sands still deteriorate more quickly than white sands, which means engineers have to innovate.

“When [in-basin sands] aren’t as successful, the completion engineer will design a frac where some of the frac stages are with the white sand and some of the stages—where it’s less critical—use in-basin sand,” Vitols said. “So, we’re seeing some frac stages being done with our sand and some in-basin sand in the same well. We’re seeing some wells that exclusively use white sand, and some that don’t use any white sand.

“So, there is a mix, but if you want to get extraction of your petroleum out of the frac, you use white sand.”

‘Pinnacle of proppant’

The choice of a proppant can be one of the most important decisions producers make when fracking a well.

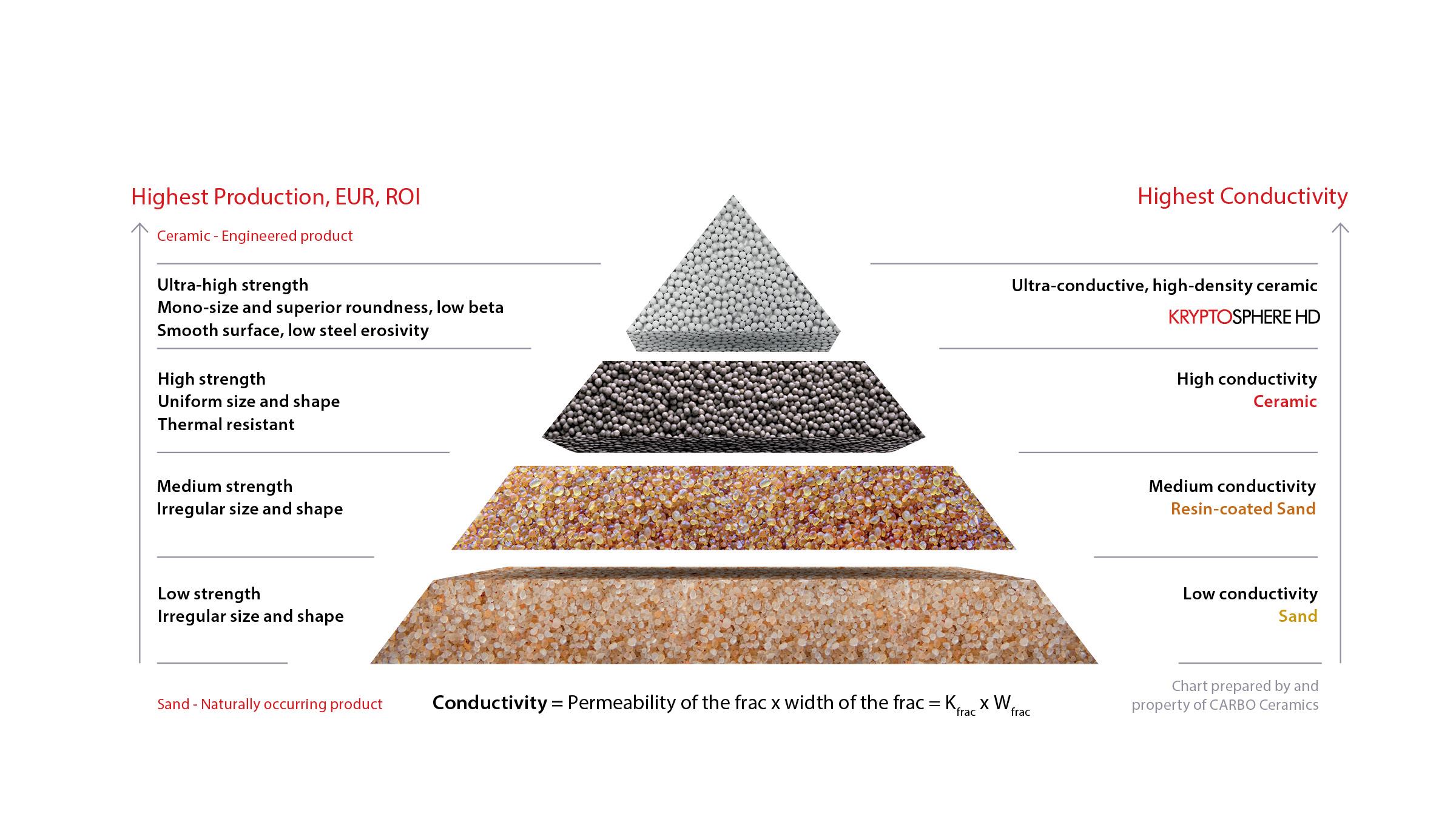

“Your choice in proppant is really what’s going to dictate the long-term performance of the well,” Josh Leasure, director of sales at CARBO, told Hart Energy. “If you’re going to create a long-term well, ceramic proppant is your answer.”

CARBO is a technology company that features a wide variety of high technology ceramic and resin-coated proppants. Among those products is the KRYPTOSPHERE, which Leasure calls “the pinnacle of proppant.”

“The manufacturing process is what dictates how good [our] products are,” he said. “We pride ourselves on the manufacturing process and how we’re able to get rid of the weak points within those proppant grains.”

Each proppant under CARBO’s KRYPTO umbrella (KRYPTOSPHERE, KRYPTOAIR and others) is ultra-conductive and suitable for high closure stress environments. Each grain is the same shape and size, maximizing the flow of production through the fracs. Offerings from CARBO can also be modified to fit specific needs for producers. Even the non-KRYPTO options have a higher thermal stability and conductivity than natural sands being used.

“We’re not only providing the strength and the particle distribution the industry usually wants from the proppants. We add value to each grain and that value can be tailored to the issues or problems [operators] have,” Max Nikolaev, senior vice president of sales at CARBO told Hart Energy. “So, if you are running the assets that have scale issues, we can address that. If you need tracers, we can address that. If you have issues with the flowback, we can address that and many, many, many other problems.”

Ceramic proppants, such as the products CARBO creates, are mainly used for offshore fracking due to their expensive, yet highly effective nature. Because the volume of proppants is limited by how much will fit on a ship, producers need to squeeze as much oil out of an offshore well as possible, said Brett Wilson, R&D manager at CARBO.

While natural frac sand is slightly less effective in its ability to maximize the flow of production from a fracked well, it is widely used onshore, as it is typically much easier to acquire than most ceramics. Natural sands are also cheaper than ceramics, allowing for more sand to be used when fracking a well.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.