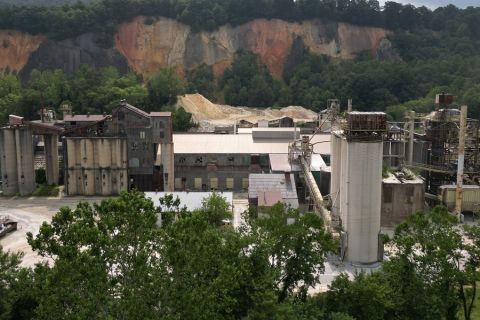

What began as a family business 20 years ago, Diversified Gas & Oil Plc has grown into a formidable aggregator of mature Appalachian assets led by its founder Rusty Hutson Jr.—with solid cash flows even while prices remain depressed. (PHOTOS COURTESY OF DIVERSIFIED GAS & OIL PLC)

[Editor's note: A version of this story appears in the August 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Rusty Hutson Jr.’s father and grandfather both worked for the same small West Virginia oil and gas company while he was growing up, so the business was in his blood. But it wasn’t what he aspired to do in his early career.

“My dad would put me to work in the summers. The majority of what I did was a lot of pipelining, which back then was a lot of manual labor for sure,” Hutson, the CEO of Diversified Gas & Oil Plc, said. “You didn’t have as much equipment, and I did a lot of hand digging and pipe fusing. When I graduated from college, the last thing on God’s earth that I wanted to do was work in the oil and gas industry.”

And he didn’t. With a degree in accounting from Fairmont State College in West Virginia, Hutson worked in banking for 13 years. But along the way he bought a package of producing wells in West Virginia from an individual that largely owner-financed the deal. He funded the cash portion from a home-equity loan. “My wife was none too happy taking out a home equity loan for what she stated was a piece of pipe sticking up out of the ground.” That deal led to others, which he financed with loans, until he finally left banking in 2005 to tend to his small but growing gas and oil portfolio.

In 2014, with total production of just 6.5 MMcfe/d at the time, Hutson recognized an opportunity. The larger Appalachian shale players were intensely focused on drilling and were neglecting their conventional portfolios. He just needed the capital to make offers.

Banks were tight following the 2014 oil price collapse, and he didn’t like the idea of giving up control to private equity, but an arranged meeting with a London attorney introduced him to the London market. Too small to list, Diversified raised $13 million for an unsecured bond on the ISDX exchange, which it used to buy conventional assets from Seneca Resources and Eclipse Resources. With the additional scale and size, Diversified was able to IPO on the London AIM for $50 million in 2017. In May this year, it moved to the main board of the London Stock Exchange.

DGO, commonly known by its acronym, based in Birmingham, Ala., most recently completed acquisitions with EQT Corp. and Carbon Energy Corp. in May for $125 million and $110 million, respectively. Just prior, in April, the company completed its second asset-backed securitization (ABS) debt financing for $200 million as a follow-on to its first ABS fundraising of $200 million in November. DGO is only the second E&P to use the financing structure.

Since going public, Diversified has acquired some $1.7 billion in deals involving 710 MMboe proved developed producing (PDP) reserves. Current total production is 112,000 barrels of oil equivalent per day (90% natural gas), with more than 600 million a day of gas. It now employs more than 1,000 individuals—with Hutson’s father being one.

Hutson spoke with Investor from his base in Birmingham.

Investor: Why does Diversified seem to be playing offense when so many other E&Ps are on the defense currently?

Hutson: Our model is different. It has been successful because we’re acquiring assets at compelling multiples from others needing or otherwise motivated to sell. We’ve also been focused on reducing our costs. The commodity price cycle has been extremely low—I mean, it’s been terrible, really, if you’re not a low-cost operator. If you are having to put your cash flow back into the ground, the returns are low right now because the flush production from the new wells is likely flowing back unhedged and at prices that really don’t work.

The industry is highly levered and has been out over its skis for too long. It would rather not be drilling, but for a variety of reasons it can’t seem to stop. The result is drilling what I would deem to be uneconomic or low rate-of-return wells, but ones needed to maintain production and cash flow to cover debt service.

We love low commodity price environments. That’s when we can buy assets at very attractive multiples. When companies are stressed or bankrupt and looking to sell assets to raise cash often to lower debt and repair the balance sheet, it’s a perfect opportunity to step in and be on the offense.

Our balance sheet is strong. We keep our leverage low, and we operate at a flat production profile. We’re at about a two times leverage ratio, net debt to EBITDA. That puts us in a strong position. And we have access to the equity markets, which few have at this point and for the last few years.

Investor: How would you describe DGO? What’s your business strategy?

Hutson: What makes us different is we’re not a drill-and-build company. We’re more acquire-and-optimize. We like to acquire producing properties, get more production out of them and operate more efficiently than the previous owners, which are generally more focused on managing costly development programs and deploying cash into the ground.

A lot of people get confused about how you can have an E&P company that’s not drilling. Our drilling is acquisition. Rather than acquiring undeveloped resource, we focus exclusively on buying producing assets, which changes our risk profile meaningfully versus others. I’ve evaluated it in every way, shape and form, and in all the times that I was drilling wells, the risk-adjusted internal rate of returns on new drilling were not as high as those from acquiring PDP properties. We’re buying the assets based on the current strip price and hedging them, so we’re getting good internal rate of returns on our acquisitions.

Our model is just different. What I really love about it is that it results in significant cash flows—cash flows that are not having to be returned to the drill bit, but that can be returned to equity and debt investors.

Investor: So do you have a drilling program at all?

Hutson: We do not. We have a substantial land bank—10 million acres in Appalachia of undrilled, largely held-by-production acreage. Most of it is conventional only, though we have some unconventional opportunities in the Marcellus and Utica. We could drill. We have a lot of prospects that we could drill, both gas and oil, but as long as opportunities exist on the acquisition side, we will not turn to the drill bit.

When you’re drilling wells, you’re focused on drilling, and that’s it, because drilling programs take a lot of time and attention and a lot of resources. You get distracted from your producing operations.

We buy existing production and put time and attention into it, to optimize the production to get as much efficiency from an operational standpoint as we can. We have a substantial ground game in Appalachia, and every time we acquire another asset there, we become more efficient.

Investor: What about infill or development drilling?

Hutson: It’s an option for us if gas prices should pop back up at some point in the future. And prices will move higher. The gas price that we have right now is not sustainable. If we see prices start to rebound, and sellers want more for their assets than we are willing to pay, we have the ability to switch to a drill bit growth strategy.

Another benefit of having low decline rate assets is that we can also afford to be patient through market cycles by waiting to buy until valuations are right. If we ever add organic growth to our mix, we would do so moderately. We would not jump into drilling like some in the industry have and, in my opinion, undermine shareholder value by drilling at any costs.

Investor: At what price would you do that?

Hutson: We have very compelling returns in the $3 range. We have a lot of acreage down in Southern Appalachia in some of the shallow shale plays. We have a lot of opportunities but, for us, it’s all about returns. It’s always about the highest rate of return that we can put our capital to.

Investor: Would you consider your model similar to a modern-day MLP?

Hutson: There are some similarities but there are major differences. At their core, MLPs made a lot of sense. However, a major difference relates to what we’re willing to pay for an asset. The MLPs did things that they shouldn’t have. They started paying high multiples for assets. I know because we used to compete against them quite a bit. We’d come out of a bidding war and ask, ‘How did they spend that much for that asset?’ We couldn’t come up with those kinds of valuations. Well, come to find out, they probably shouldn’t have either.

Also, they used more leverage than they should, and their distribution policies were too aggressive. Next, add that they started getting into some of these shale plays with higher decline rate assets. Those were recipes for disaster for companies that once were steady-as-you-go, cash-flow generative structures.

We share some similarities in terms of cash flow distributions to shareholders, but we stay away from high leverage. We keep our balance sheet in check, and we don’t overpay. I tell our institutional investors and our employees, ‘We will not risk the balance sheet for the sake of growth.’ We won’t do it. And we also stick with what works for us, which are long-life, mature, producing assets with manageable, shallow decline rates.

Investor: How do your economics work with natural gas below $2?

Hutson: We’ve got approximately 80% of our gas production hedged this year and next year at $2.65 to $2.70 per Mcf. So, if I’m talking to anybody about how current natural gas prices are affecting us, I’m not doing my job. We want to always be talking about natural gas two years out or further. We should be covering the commodity price risk well in advance. So, we’re constantly evaluating natural gas prices further out.

It’s all about visibility of cash flows. We’ve driven our total operating per unit, including G&A costs and operating more than 12,000 miles of midstream, to just under $1.20/Mcfe. We’ve built the business to not only survive but to do well even in low commodity price environments. We use hedging to provide line-of-sight to those stable returns.

Investor: The word on the street is that the deal market is dead, but you’ve completed several significant deals recently. Why is Diversified able to get deals done now when others aren’t?

Hutson: It’s a result of having capital availability. The markets have been dead because there are not a lot of people that have any capital. I think people would like to sell, and I think people would like to buy, but there’s some disconnect between expectations and reality.

We haven’t had that problem. Once you are known to have the ability to execute on a transaction, you typically can get deals done. In May, we raised $250 million between equity and debt, and when people know that you can do that, they’re more willing to take a reasonable price if they know they can get it executed. And we’re seeing a pretty heavy flow of deals, so I would expect that we’re going to be doing more as we move throughout the year.

Investor: So how are you getting the deals financed?

Hutson: We’ve done it multiple ways. We’ve done some through the RBL [reserve-based loan] with the support of a 17-bank syndicate led by KeyBank, and just last month we did a $160 million, 10-year term note with a fixed coupon and principal amortization with MunichRe. For some, the idea of principal amortization trips them up. Many don’t want to do a principal and interest note, but I’ve always thought it best to pay back your debt.

We’ve also completed two ABS structures, which have helped us create liquidity for deals and reduce our reliance on RBL financing that’s exposed to redetermination. We’ve all seen the challenges it creates to have your borrowing capacity pulled away from you when you need it most. The ABS structures are also on interest and principal amortization.

Investor: Aren’t you paying half equity, half debt for these deals?

Hutson: Yes, cumulatively. That’s how we’re able to keep our leverage profile in check with our self-imposed leverage limits.

Investor: But you mentioned that the equity markets aren’t open, though.

Hutson: While they’re not open to others, they’ve been open to us, which speaks to the appeal of our business model to equity investors. Since February 2017, which is when we did the IPO, we’ve raised over $800 million of equity in London via our LSE listing, including our most recent raise of $86 million that settled directly on the main market following our uplist to the premium board.

Investor: So is that an advantage to being in London versus the U.S. exchanges?

Hutson: There is some truth to that, for sure, but I think more than anything it’s just the business model. It is cash-flow generative, paying a dividend and low risk because we’re not putting it in the ground with a drill bit. Certain institutions see that as a very attractive investment.

When I founded the company in 2001, it was about cash flow for my family. Today, it’s about free cash flow for my equity and debt investors who are looking for yield in a yield-starved market. And we’ve been able to tap into that. We are one of the few E&P companies that actually have a significant amount of income funds in their investor base.

These investors may not know much about oil and gas, but they do know about dividends. They like the income stream and the fact that we’re able to generate a lot of free cash flow. In this industry, paying a dividend is difficult to find. Our dividend has been very generous from the perspective of the E&P sector. We’re trading at about 11% dividend yield right now.

Investor: What do you look for in an acquisition?

Hutson: It has to fit our profile: long life, low decline assets. We’re generally not interested in new wells that have just been drilled that have a significant decline rate associated with them. We target a two-to-four times cash-flow multiple. We’re looking at anywhere from a PV12 to PV18 for PDP and complementary midstream assets or around PV20 on PDP-only transactions. If it will fit in those molds, then we’ll do the deal.

We’re not going to overpay, and in this market—there’s no reason to do so. You don’t have to pay for undeveloped acreage. You don’t have to pay PV8 or PV10 for producing properties because nobody can or will, particularly when the financing is not there for people to do it. Further insulating us is that the equity markets haven’t been available to others. Our ability to raise some capital affords us the ability to determine valuations. And if sellers won’t come off of it, then we just don’t do the deal.

Investor: Do you pay for unproved upside?

Hutson: We do not. In this market, there’s no reason to. There are very few plays in the U.S. where somebody can sell their asset and value for undeveloped. Maybe the Permian, but that’s about it.

Investor: What about the asset opportunity? Are you finding there are more mature, producing assets on the market?

Hutson: What we’re seeing mostly is large companies looking to raise cash to both improve their debt profiles or to reposition their business around a more defined core asset base. Maybe it’s a nonstrategic asset for them. EQT, for example, sold us unconventional assets that were out of their core area where they’re going to be developing. And so I think a lot of the companies are going through those kinds of reviews, saying, ‘What cash is available to us now?’ for assets that are noncore to get their balance sheets back in check. We’re seeing a lot of those.

Investor: What inspired you to launch a securitized financing?

Hutson: Our assets are very conducive to that type of structure. An ABS needs visibility into production and cash flows, which our assets provide as they don’t have steep declines and are well suited for long-term hedging. We were able to carve out a working interest percentage off the whole portfolio so that there is no real concentration of assets in the security.

What was really attractive to us is that when we set that working interest into an SPV [special-purpose vehicle], we achieve an advance rate higher than it is on our RBL. That creates liquidity, which for us is particularly important in this market where we’re focused on transacting on other deals.

Investor: Is this a new structure?

Hutson: Obviously, it’s been well known in other industries like mortgages and other types of loans that banks do, but for the E&P sector, it is a new product.

Investor: What do you see as the advantages to the ABS structure versus more traditional capital vehicles?

Hutson: For us, it was the additional liquidity and alignment of our cash flows with the financing to avoid bullet maturities in markets that may not be open to refinancing. We’re not big on high-yield bonds. We see high yield as a kick-the-can-down-the-road type structure. They never seem to be repaid but refinanced over and over and over again.

And we’ve hit a period of time here where, guess what?—no refinancing opportunities. Now you’ve got all these high yield notes that are coming due and they have been difficult to refinance. That’s what’s gotten people in big trouble.

I liked the ABS structure because it puts us in a position to repay principal before maturity through excess cash flows. And, at maturity, the assets simply roll back to the balance sheet unencumbered. That’s a major benefit to having an ABS.

Investor: Does the ebb and flow of natural gas prices affect your ABS structure?

Hutson: We’ve got approximately 85% of the production hedged, which more than covers the principal and interest in the coverage ratios that are necessary to pay back the loan. They are 10-year hedges, so the only variable is the production. And because we’ve built our portfolio with long-lived, low-decline assets, we are very comfortable with the amortization structure of ABS. The pricing risk is off the table.

And because the structure has no recourse back to the parent company, even if we hit some volatility due to something unforeseen, the rest of our asset base would be unaffected.

Investor: Would you do any more of these ABS structures? Do you have the capacity?

Hutson: We could later. It’s not something we’re presently considering.

Investor: What is your outlook for natural gas?

Hutson: The natural gas market right now is suffering heavily from LNG exports being depressed. Nobody’s back to work except the U.S. for the most part, and so all the markets where this LNG goes has been pretty dismal. As we get closer to the fall and things start to recalibrate, we’ll see some improvement as the economies in the world start to recover and use natural gas again.

I’m a firm believer of $2.50 to $3.50 gas range bound. The United States has a lot of resource, and the industry can turn on-and-off very quickly. I do see natural gas with a long-term future as the cleaner fossil fuel. I think oil will continue to decline in use, and natural gas will continue to fill that void.

But I think there are going to be fewer and fewer natural gas producing companies. You’re going to continue to see some consolidation there, which will be good for the industry and for prices.

Investor: What about oil?

Hutson: The industry has long needed a disciplined approach. U.S. operators have been relying on repeated OPEC production cuts to essentially prop up prices to promote continued drilling and therefore putting capital in the ground that they probably shouldn’t have been. Now, OPEC appears to have had enough, and when coupled with the impacts of COVID, it demonstrates the need for a change in how the industry thinks about drilling and growth in the future.

It’s going to be interesting to see where the oil price goes from here. I have a sneaky suspicion that it may drop back off before it gets much better. But I do see the new dynamics in oil being supportive for higher, more stable natural gas prices.

Investor: Do you think yours is a new model for what oil and gas or gas companies should be?

Hutson: If you look at some of the announcements that were made within the industry in the last few months, some companies are articulating a move away from growth and toward maintenance mode over the next five years. We’ve also seen preferred, convertible type structures to pay down debt in the near term to lower the debt loads, which means—guess what?—free cash flow. So I think that some companies are trying to move to that model, which is a good thing.

It’s difficult if you’ve been running the drill bit for a long period of time to make the switch from developer to operator. You have to get your debt levels down because, if you don’t, your covenants may trigger as you slow down the drilling. So I do think that ours is a model that only the ones that are really capable and healthy will move to. The rest, in my opinion, will be a consolidation target.

Investor: Where do you expect DGO to be in the next five years or so?

Hutson: We have significant opportunity in front of us. We’ll continue to see these acquisitions materialize. I think there is going to be a lot more stress and distress that we’ll be able to take advantage of. I truly believe we can double the size of the company in the next 12 to 18 months without a doubt, production wise. Especially in Appalachia, we’re going to be able to work with the large shale guys to be their monetization outlet. That’s where we’re headed.

Recommended Reading

Apollo to Buy, Take Private U.S. Silica in $1.85B Deal

2024-04-26 - Apollo will purchase U.S. Silica Holdings at a time when service companies are responding to rampant E&P consolidation by conducting their own M&A.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.