A natural gas fracking pad near Moundsville, West Virginia. (Source: Shutterstock)

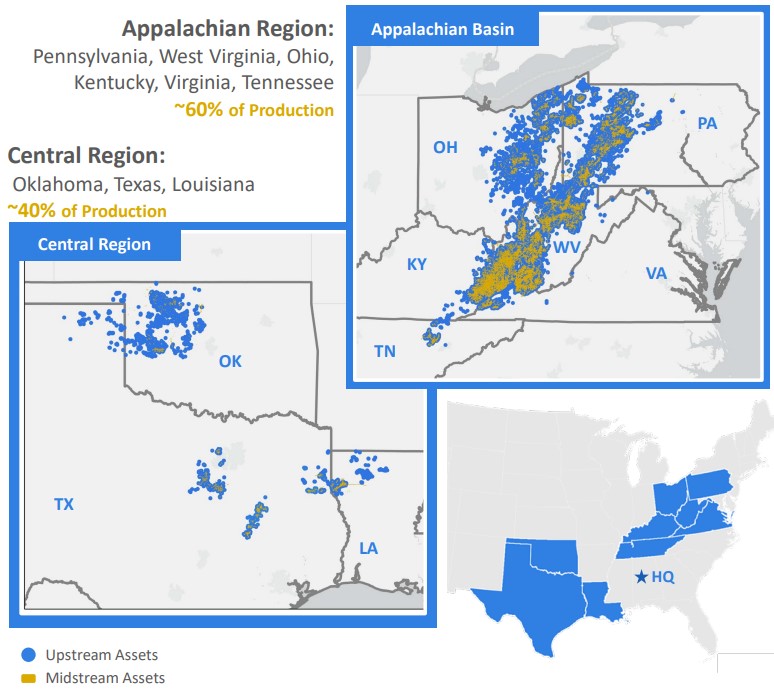

Diversified Energy sold assets from its Appalachia portfolio as the natural gas E&P works to reduce debt.

Diversified Energy Co. Plc sold producing assets in Appalachia to a special purpose vehicle (SPV) for proceeds of approximately $200 million, the Alabama-based company announced Jan. 2.

The transaction was comprised of an asset backed securitization placed at the SPV and the sale of an 80% interest in the SPV for approximately $30 million.

Diversified Energy said it retained a 20% minority interest and operatorship of the assets.

The implied valuation of the deal represents a 5.7x multiple of the expected hedged 2024 EBITDA of about $35 million.

The Appalachia assets were previously used as collateral on Diversified’s sustainability-linked loan. The sale resulted in the company’s revolving credit facility being redetermined at $305 million.

The PV-10 of the divested assets was approximately $230 million, based on forward-looking commodity prices; gross production averaged around 50 MMcfe/d.

“This latest transaction further demonstrates the attractiveness of Diversified's asset base that provides reliable production and consistency of cash flows,” Diversified CEO Rusty Hutson Jr. said in a news release. “At an attractive multiple, this transaction has provided a path for the company to unlock additional value from our assets, reduce our outstanding debt and enhance our liquidity.”

Proceeds from the asset sale were used to repay outstanding borrowings from Diversified’s revolving credit facility, which reduced net debt by approximately 12%.

Diversified ended the third quarter with a leverage ratio of 2.4x, the company disclosed in its most recent earnings report.

Diversified’s shares began trading on the New York Stock Exchange under the ticker symbol “DEC” on Dec. 18, 2023. The company also continues to list and trade shares on the main market of the London Stock Exchange.

RELATED

Diversified Energy’s Gameplan: Avoid Operational, Financial Risk

Federal scrutiny

Also on Dec. 18, Diversified told investors it had received a request for information from four Democratic members of the U.S. House Committee on Energy and Commerce.

In a letter addressed to Huston, the Democratic committee leaders “demanded answers for [Diversified Energy’s] extensive and growing long-term environmental liabilities.”

Diversified Energy’s business model involves buying existing, producing assets and operating them until they are plugged at their end of life. Many of the assets are legacy, low-producing wells.

In 2022, Diversified Energy acquired three plugging and abandonment (P&A) companies to plug its depleted wells and provide plugging services to outside parties. The company said it works with several Appalachian states to retire state-owned orphan wells.

The Democratic committee members expressed concerns about Diversified’s accounting projections for future plugging, abandonment and cleanup costs, claiming “it is highly unlikely that Diversified Energy will have adequate funds to clean up all of its marginal wells when they should be retired.”

Diversified Energy responded that it would review the letter and planned to engage in a positive and open manner with the information request.

However, the company countered that the request cited a 2021 media report “that broadly speculated and inaccurately described numerous items” about Diversified’s P&A operations.

The company’s stock price closed at $14.02 per share on Dec. 21, down 14% from $16.33 per share on Dec. 19. Diversified stock was trading at $15.30 per share near midday on Jan. 2.

RELATED

Recommended Reading

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.

Mitsubishi Makes Investment in MidOcean Energy LNG

2024-04-02 - MidOcean said Mitsubishi’s investment will help push a competitive long-term LNG growth platform for the company.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.