The Tapstone acquisition will add almost 33% of anticipated production to Diversified Energy’s central region focus area, the company said. (Source: Hart Energy)

Diversified Energy Co. Plc recently announced a cash acquisition of Oklahoma City-based Tapstone Energy LLC, representing Diversified’s fourth deal in what the company has dubbed its new central regional focus area.

Founded in late 2013 by industry veteran Tom Ward, Tapstone Energy focuses in the Anadarko Basin of the Midcontinent region. The independent oil and gas producer recently completed a successful restructuring process whereby a new capital sponsor, Kennedy Lewis Investment Management, had selected Tapstone to be their key E&P platform.

According to a company release, Diversified agreed to acquire upstream assets, field infrastructure, equipment and facilities in Oklahoma from Tapstone and an affiliate of Kennedy Lewis Investment Management for $419 million in cash. Private equity group Oaktree Capital Management LP will pay $192 million for an initial 48.75% stake as part of the deal.

In the release, Diversified said its adjusted net share of the purchase price, at $174 million, represents a nearly 1.8x multiple on around $95 million of estimated adjusted EBITDA, not including potential synergies.

“With a net purchase price of less than two times net cash flow, this acquisition represents another highly accretive, fully balance sheet-financed acquisition that further demonstrates our status as a capable consolidator of producing assets within the central region,” Diversified Energy CEO Rusty Hutson Jr. commented in a company release on Oct. 7.

Headquartered in Birmingham, Ala., and listed on the London Stock Exchange, Diversified’s business model focuses exclusively on buying PDP natural gas assets, which, until its May acquisition of assets located primarily in Louisiana, had all been focused in the Appalachian Basin.

Since its initial acquisition in May, Diversified has added positions in its central region footprint, including in the Cotton Valley, Haynesville and Barnett shale plays. In total, Diversified has spent close to $470 million from its prior central region acquisitions, which comprised of Tanos Energy Holdings III LLC, Blackbeard Operating LLC and Indigo Minerals LLC.

“Replicating our success in Appalachia, we have quickly established ourselves as a significant operator in the central region, which positions us for additional growth,” Hutson said.

The Tapstone acquisition also represents the third co-investment since May with its financial partner Oaktree Capital Management, which will make a nonoperated working interest investment in the Tapstone acquisition, according to the company release.

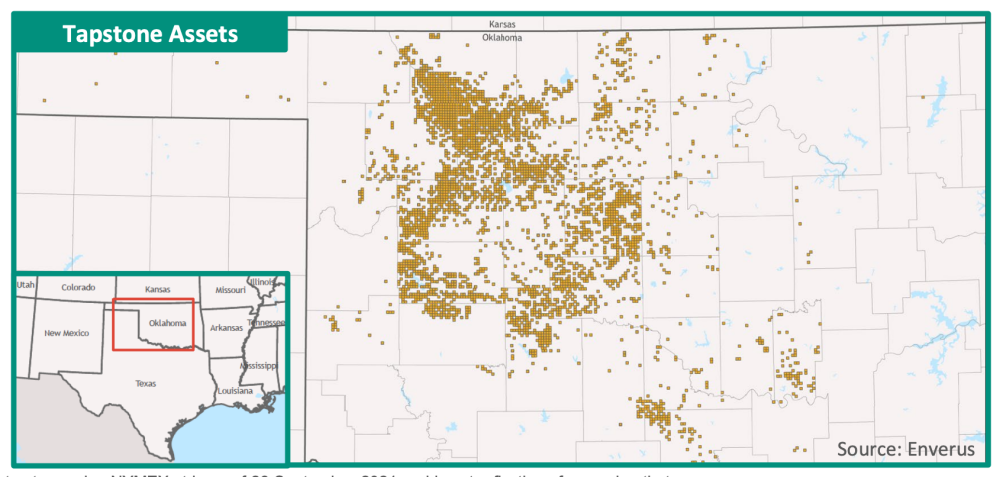

Net of Oaktree’s co-investment, Diversified said through the Tapstone acquisition it will acquire about 660 net operated wells located in Oklahoma within the broader Midcontinent producing area. Production in August was roughly 12,000 boe/d (over 80% natural gas and NGL).

The Tapstone acquisition will add almost 33% of anticipated production to Diversified’s central region focus area. The assets are also expected to increase adjusted EBITDA from the central region by 80% to $214 million.

“Our enlarged regional footprint strengthens our portfolio with additional high-quality assets and added scale to drive synergies,” Hutson added. “We are pleased to once again partner with Oaktree to acquire assets at a compelling multiple and with material upside potential available through asset optimization.”

Diversified intends to retain Tapstone personnel, which the company said is consistent with its growth strategy, to assist with Diversified’s smarter asset management program, which focuses on optimizing asset performance and reducing costs that will ultimately add value through realization of operational synergies.

The purchase price of Tapstone is expected to be adjusted down to about $366 million to account for production between the Aug. 1 effective date and an anticipated December closing, the release said.

Pro forma of the Tapstone acquisition, Oaktree will have deployed an aggregate of roughly $370 million of its $1 billion commitment for Diversified to pursue larger acquisition opportunities that the companies agreed to in 2020.

Evercore is exclusive financial adviser to Diversified in connection with the acquisition. Jeffries acted as sole financial adviser to the sellers.

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.