On Oct. 7, Viper bolstered its third-quarter deal-making with the announcement that it had closed an additional 25 acquisitions for about $193.6 million. (Source: Shutterstock.com)

Diamondback Energy Inc.’s acquisition machine in the mineral space seems to be running at a breathtaking pace so far this year.

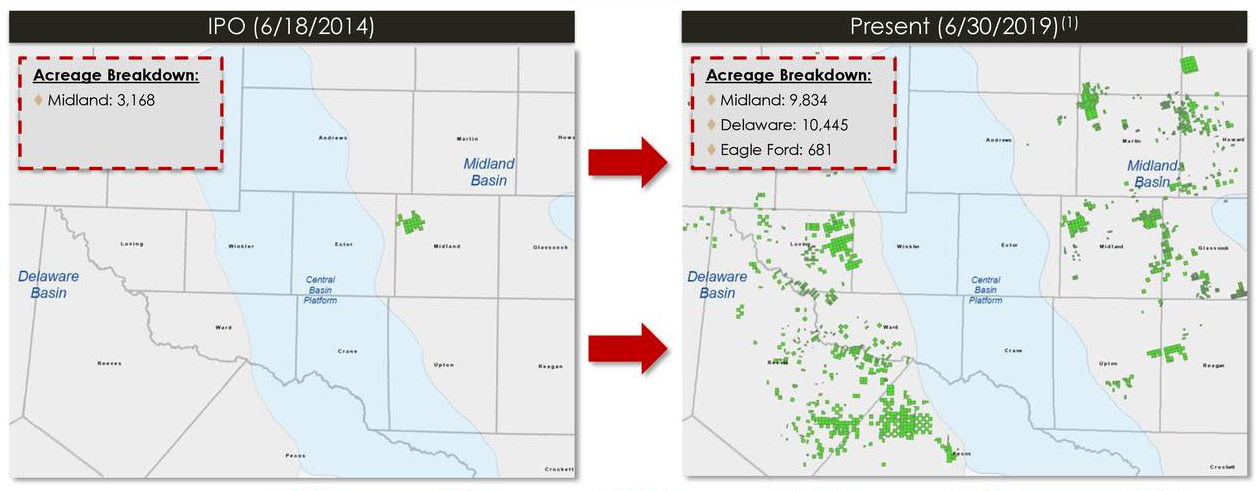

In the third quarter alone, deal-making by Viper Energy Partners LP, subsidiary of Diamondback, totaled over $1 billion of closed or committed acquisitions. Pro forma for all recent transactions, Viper’s acreage position now represents 23,990 net royalty acres, up from 15,870 net royalty acres as of June 30. About half of the acreage is operated by Diamondback.

“To date in 2019, our acquisition machine has now acquired over 9,000 net royalty acres for approximately $1.2 billion across more than 100 transactions, and importantly, we have more than doubled our exposure to Diamondback-operated properties,” Diamondback CEO Travis Stice said in a statement on Oct. 7.

Viper kicked off the third quarter with a roughly $700 million dropdown acquisition of about 5,000 net royalty acres from Diamondback in July. In September, the company followed that up with a $150 million all-equity transaction to acquire 1,358 net royalty acres from private-equity backed Santa Elena Minerals LP.

Then, on Oct. 7, Viper bolstered its deal-making for the quarter with the announcement that it had closed an additional 25 acquisitions for an aggregate purchase price of about $193.6 million in third-quarter 2019. In total, the company added about 1,272 net royalty acres.

According to Viper, the two notable acquisitions of these was a $100 million deal for 682 net royalty acres across the Midland Basin and a $68 million deal for 363 net royalty acres concentrated in southeast Lea County, N.M.

“The acquisitions closed during the third quarter, along with the previously announced drop down and the pending acquisition of assets from Santa Elena, highlight Viper’s unique ability to leverage our scale to aggressively consolidate the fragmented private minerals market in the Permian Basin,” Stice said in his statement.

1) Pro forma to include dropdown; all other acreage data as of June 30, 2019

(Source: Viper Energy Partners LP July 2019 Investor Presentation)

The dropdown closed on Oct. 1 and the acquisition from Santa Elena is expected to close later during the fourth quarter. Viper intends to finance the cash portion of the recent acquisitions with cash on hand and borrowings under its revolving credit facility, according to the company press release.

On Oct. 7, Viper also launched a $400 million senior notes offering intended to refinance outstanding borrowings on its credit facility. Moody’s and Fitch Ratings assigned B1 and BB-, respectively, to the Viper notes with a rating outlook of stable, according to a research note by Capital One Securities Inc.

The Capital One analysts also noted that Viper’s production in the third quarter of about 21,300 barrels of oil equivalent per day (boe/d) was generally in line with expectations, though the 64% oil mix was lower than expected. However, assuming all closed and committed acquisitions were owned for the entire quarter, Viper estimated that its third-quarter production would have reached roughly 27,900 boe/d (65% oil).

Recommended Reading

E&P Highlights: May 13, 2024

2024-05-13 - Here’s a roundup of the latest E&P headlines, with a couple fields coming online, as well as new contract awards.

New Permian Math: Vital Energy and 42 Horseshoe Wells

2024-05-10 - Vital Energy anticipates making 42 double-long, horseshoe-shaped wells where straight lines would have made 84 wells. The estimated savings: $140 million.

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-09 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”

Vår Selling Norne Assets to DNO

2024-05-08 - In exchange for Vår’s producing assets in the Norwegian Sea, DNO is paying $51 million and transferring to Vår its 22.6% interest in the Ringhorne East unit in the North Sea.

Crescent Energy: Bigger Uinta Frac Now Making 60% More Boe

2024-05-10 - Crescent Energy also reported companywide growth in D&C speeds, while well costs have declined 10%.