The proposed acquisition is expected to more than double DGO’s daily production from legacy gas wells in the Appalachian Basin. (Source: Hart Energy and Shutterstock.com)

Diversified Gas & Oil Plc (DGO) said June 14 it entered a proposed acquisition of producing Appalachia assets that could more than double its daily production.

DGO signed a non-binding letter of intent to acquire the assets from an undisclosed seller for $575 million cash, which the company plans to cover using a new debt facility and a proposed share offering.

The acquisition comprises a network of about 11,350 producing wells in the Appalachian Basin and will include a significant extension to DGO’s existing pipelines and network of compression stations.

The assets’ current net total gas production is 32.1 Mboe/d, which DGO said represents an increase in the company’s net daily production of about 114% over its daily levels at the end of the first quarter.

DGO is a Birmingham, Ala.-based company traded on the London stock exchange that targets conventional legacy Appalachian wells to increase production and lower overhead, Rusty Hutson Jr., the company’s founder and CEO, told Hart Energy earlier this year.

“Our model is a contrarian model,” Hutson said. “We’re looking at assets no one else is looking at.”

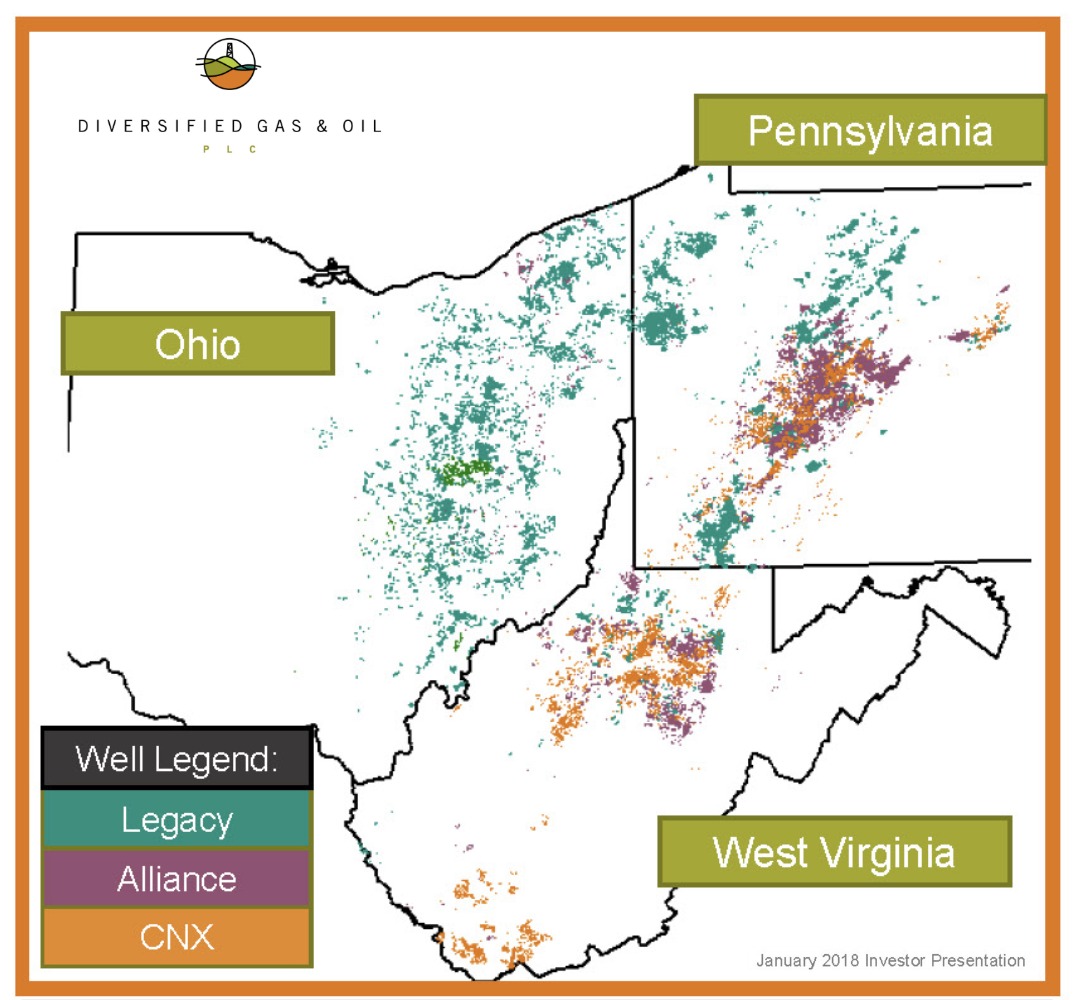

In March, DGO closed on two deals: the acquisition of Alliance Petroleum Corp. for $95 million and, at the end of the month, a second deal with CNX Resources Corp. (NYSE: CNX) for $85 million.

Between the two deals, the company added 107 million cubic feet of gas equivalent per day and 2.4 million undeveloped HBP acres.

In total, DGO holds a position of 4 million HBP acres in the Appalachian Basin with current proven developed producing reserves of 163 million boe.

Upon completion of its proposed acquisition, DGO expects its total net acreage under lease in the Appalachian Basin to increase to 6.5 million acres. The company’s proven developed producing reserves will also increase by 142% to 393 million boe.

If its proposed deal proceeds, DGO said the acquisition will constitute a reverse takeover.

The company plans to fund the acquisition using a $1 billion debt facility, of which DGO said it will draw roughly $376 million of the $600 million borrowing base for the proposed deal. In addition, DGO is proposing to raise up to $225 million from a placement of new ordinary shares.

DGO expects the acquisition to be immediately earnings accretive with a pro forma uplift in 2017 EBITDA of about 289%, according to the company press release.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.