Tengasco Inc. (Amex: TGC), Knoxville, Tenn., and its Tengasco Pipeline Corp. subsidiary lined up $5.6 million of financing with a special-purpose lender to construct the second phase of the Swan Creek pipeline system. The facility has a five-year term at 10.75% interest and requires payment of interest only for the first six months. The agreement carries no prepayment penalty. The lender will receive a throughput fee of 10 cents per million Btu while the loan is outstanding. It was formed to provide special-purpose financing by certain Tengasco directors, who committed the necessary capital. Tengasco also announced that it has executed a term sheet with Bank One in Houston for a $20-million senior note secured by substantially all of the integrated natural gas company's producing properties. Duke Energy Field Services LLC, Denver, registered with the SEC to offer up to $2 billion of debt. The midstream natural gas company holds the combined gas gathering, storage, marketing and natural gas liquids businesses of Phillips Petroleum Co. (NYSE: P) and Duke Energy Corp. (NYSE: DUK). Net proceeds of any offering under this shelf registration would be used for repayment of other debt, capital expenditures, future acquisitions, advances to subsidiaries, additions to working capital and other general corporate purposes. DEFS would issue new debt under this shelf under its indenture with Chase Manhattan Bank. Fossil Bay Resources Ltd. (Canadian Venture: FBR), Houston, plans to complete a short-term financing by issuing $5 million of secured notes. The Houston independent producer will use proceeds to finance its recent takeover of Blue Sky Resources Ltd. The debt will bear interest at prime plus 2%, and lenders will receive an up-front fee of 8% of principal. Both the fees and the interest will be payable in Fossil Bay stock priced a C40 cents per common share. The debt will be repayable in a year and will be secured by Blue Sky shares that Fossil Bay owns.

Recommended Reading

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.

Fracturing’s Geometry Test

2024-02-12 - During SPE’s Hydraulic Fracturing Technical Conference, industry experts looked for answers to their biggest test – fracture geometry.

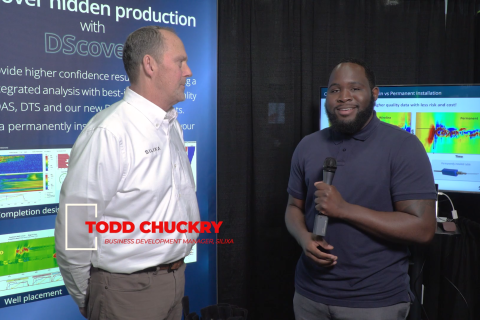

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.