In comparison, Midland County’s output was 1.5 Bbbl since 2009; Martin’s, 1.2 Bbbl. Each are the No. 1 and No. 2 Texas producer, with the Eagle Ford’s Karnes County third with 1 Bbbl. (Source: Shutterstock)

Northern Midland Basin new-drill horizontals in southern Dawson County are making some whoppers, according to state data.

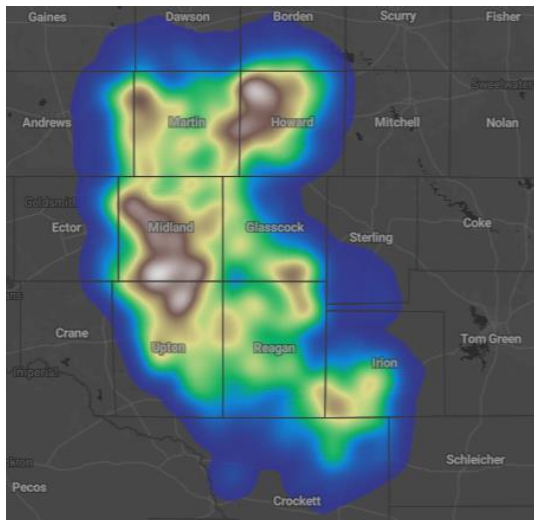

Just north of Martin and Midland counties—the hottest spots not just in the Permian Basin but in all of Texas—Dawson County appears as a cool (under-performing) spot in early-gen Midland Basin heat maps.

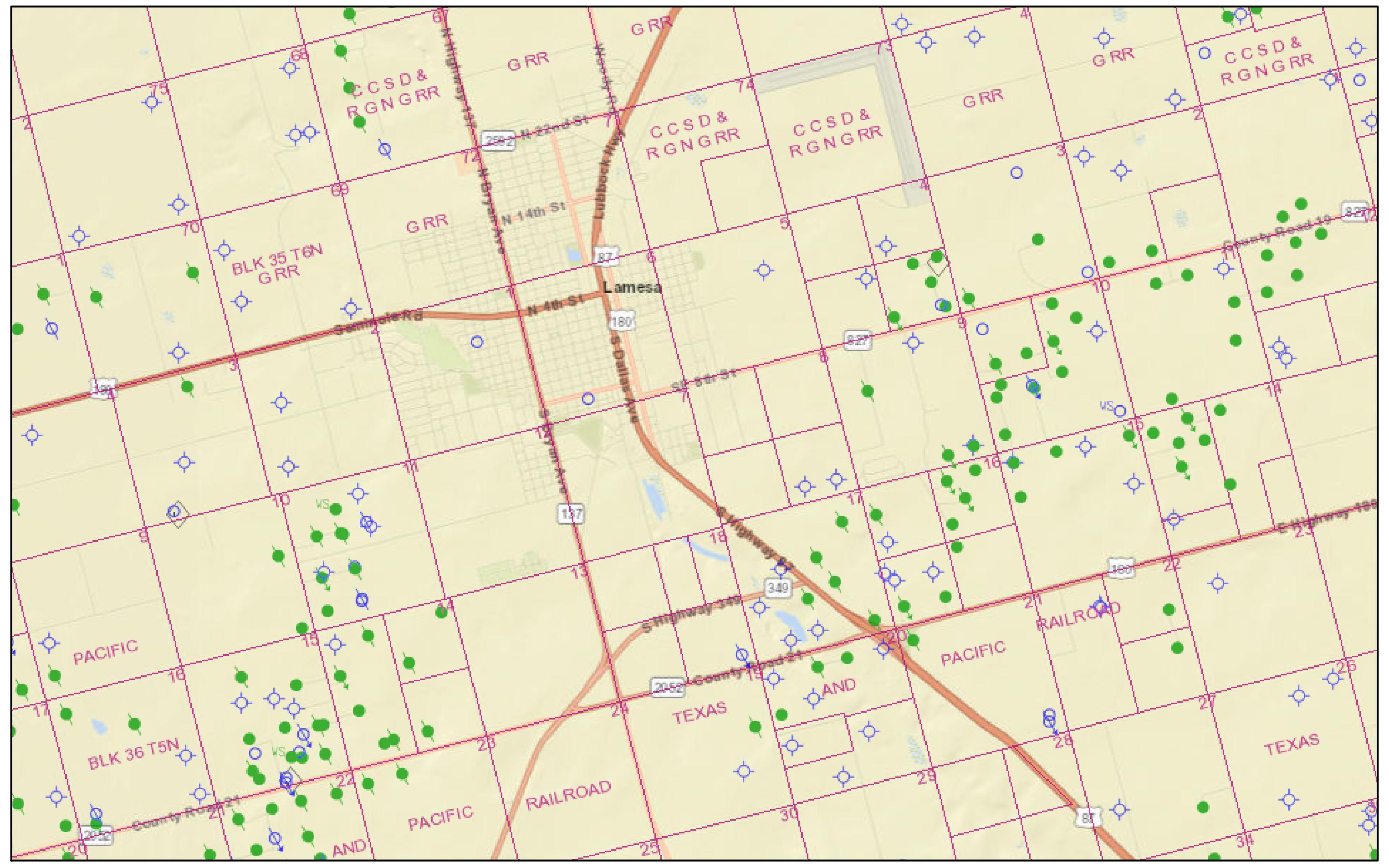

Dawson County’s center, near Lamesa, Texas, is about 50 miles north of Midland. In the new play, operators are primarily landing laterals above the Wolfcamp.

Deposited in the upper sequence of the Lower Permian system (post-Pennsylvanian), the sandstones Clearfork, Spraberry and Dean are at some 7,000 ft to 9,000 ft overlying Wolfcamp.

“Historically, we have seen minimal drilling activity in Dawson and [its western neighbor] Gaines counties, as average well performance there significantly lags other Midland Basin counties,” Mark Lear, an analyst at Piper Sandler, wrote in 2021 when EOG Resources was suspected of building a Dawson play using the pseudonym CGS Operating.

CGS transferred its Dawson property to EOG at year-end 2022, according to Texas Railroad Commission (RRC) data.

While Dawson’s historical output pales to that of its southern neighbors, there is oil. It’s made 53 MMbbl since 2009, along with 28.5 Bcf of solution gas, according to the RRC. November output was 242,906 bbl.

In comparison, Midland County’s output was 1.5 Bbbl since 2009; Martin’s, 1.2 Bbbl. Each are the No. 1 and No. 2 Texas producer, with the Eagle Ford’s Karnes County third with 1 Bbbl.

Midland County’s November production was 17.3 MMbbl; Martin’s was 18 MMbbl.

In Dawson, only 253 permits for horizontals have been requested from the RRC historically, including a 1996 application by Parker & Parsley, predecessor of Pioneer Natural Resources.

But activity is heating up: 60 permits—nearly a quarter of the total 253 permits—were issued in 2023 alone.

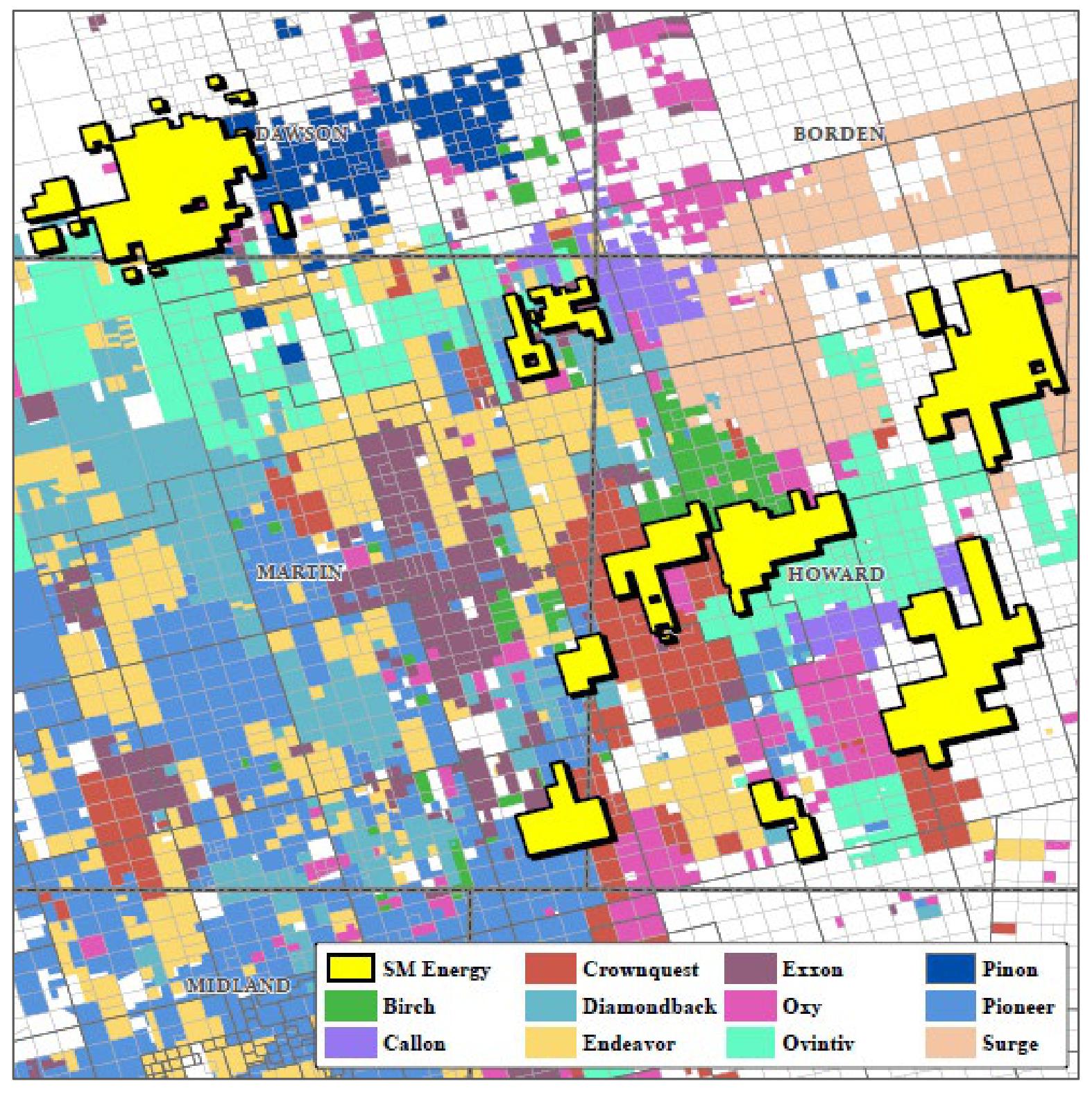

The Top 5 producers in 2023 were Callon Petroleum, first with 665,443 bbl; Birch Operations, second with 458,561 bbl; EOG, third, 407,435 bbl; Reliance Energy, fourth, 360,415 bbl through June before selling to SM Energy; and Occidental Petroleum, fifth, 293,114 bbl.

EOG’s Dawson, southwest

EOG began wildcatting in Dawson in the spring of 2020 as CGS, focused in the county’s southwestern corner.

Its Stonecreek and Sundance wells are “a mixed bag,” Arun Jayaram, an analyst for J.P. Morgan Securities, reported last month.

Stonecreek B #M4H tested 1,372 boe/d, 87% oil, from a 9,459-ft lateral landed in Spraberry on a 64/64 choke, according to RRC and J.P. Morgan reports. Stonecreek A #M3H tested 1,149 boe/d, 92% oil, from a 9,703-ft lateral in the Clearfork.

But two other wells had lower initial rates and more gas. Stonecreek C #M6H tested 742 boe/d, 76% oil, (10,676-ft lateral, Spraberry) and Stonecreek B #M5H came on with 589 boe/d, 71% oil (12,246-ft lateral, Spraberry).

In another unit, Sundance, the two wells under-performed. Sundance #1H came in with 207 boe in a 24-hour test, 87% oil, (9354-ft lateral, Spraberry) and Sundance A #M2H gave up 162 boe, 84% oil, (9,355-ft lateral, Spraberry) on a 64/64 choke.

Piper Sandler’s Lear wrote in 2021, though, that EOG’s first test, Santorini Unit #1H, produced 216,000 bbl in its first 12 months, “outperforming EOG’s ‘Double Premium’ type curve by 4%.”

Santorini #1H came on in May 2020 with 3,000 bbl/month from the Middle Spraberry at about 8,200 ft from an 11,000-ft lateral. Lear added that it was completed with 1,500 lb of proppant per lateral foot.

The 12-month rate was more than double the Dawson average of 80,000 bbl per 12 months, Lear reported. Through this past December, the #1H made 444,805 bbl. In December, it made 2,834 bbl.

EOG’s Bluebonnet A Unit #M1H came on in September 2021 with 9,000 bbl/month. Through this past December, it made 176,918 bbl. December output was 1,649 bbl.

Trinity B Unit #2H, made in June 2022, produced 260,621 bbl its first 19 months. The Trinity A Unit #M1H made 160,482 bbl.

The two wells had tested a combined average of 791 boe/d, 91% oil, according to J.P. Morgan’s Jayaram. The average was 61 boe per 1,000 lateral ft.

Combined production through December was 421,103 bbl.

EOG’s Overton unit, completed in 2021, tested 669 boe/d, 92% oil. Production through December was 204,020 bbl. Its output in December was 2,829 bbl.

EOG’s total Dawson County production in December was 15,142 bbl.

SM Energy, southwest

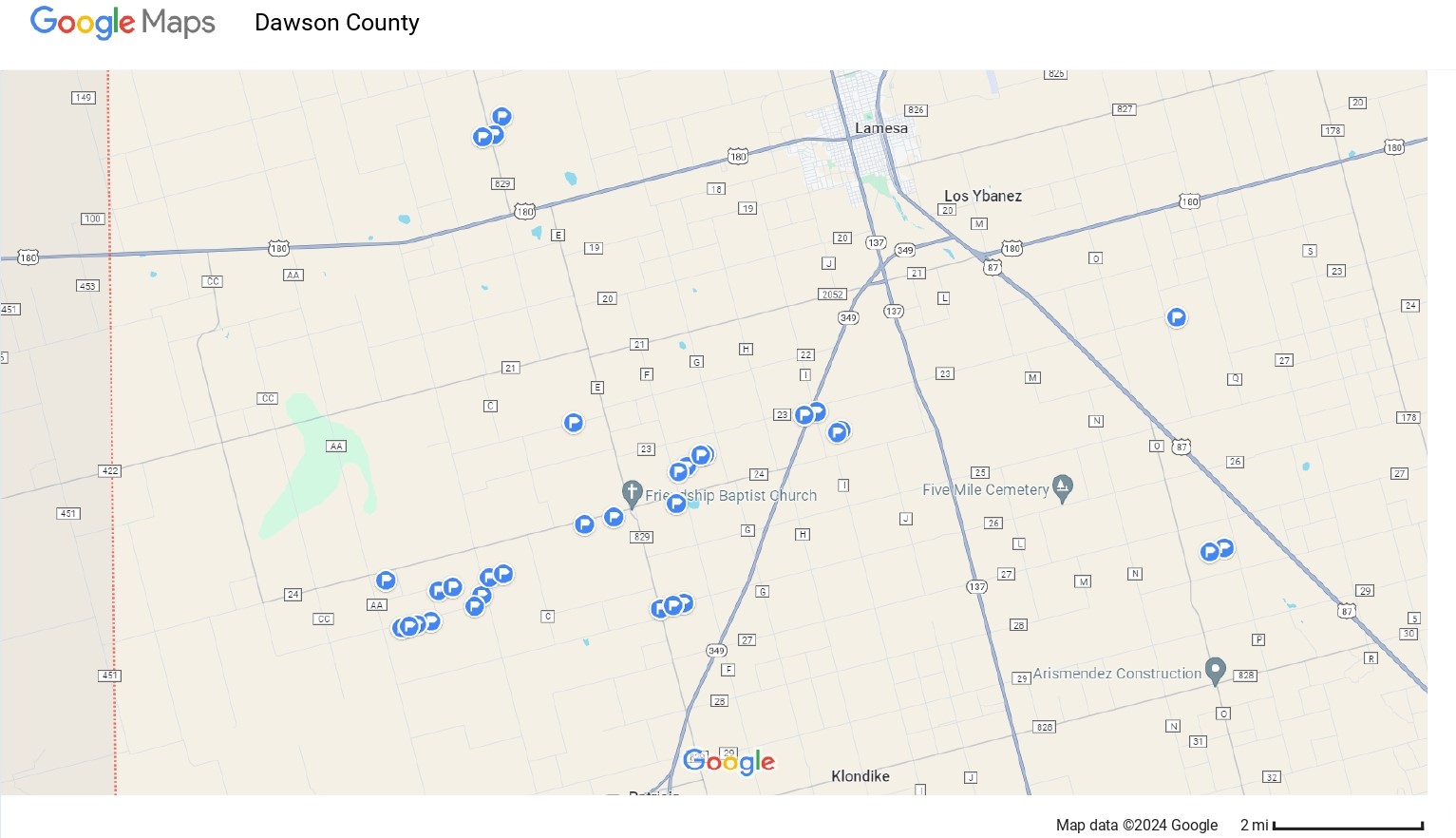

SM Energy entered Dawson County last summer, buying out privately held, Midland-based Reliance Energy, which had put the property for sale in April 2023 and was marketed by Detring Energy Advisors.

From it, SM produced 215,598 bbl through year-end 2023, primarily from the Arod 2-11-14 lease that Reliance brought online in July 2022 that made 506,831 bbl in its first 17 months.

Also, the Blue Beauty unit, made in August 2021, surfaced 505,362 bbl in its first 28 months.

The Reliance property, focused in southwestern Dawson, puts SM in EOG’s wildcat area. The package came with some 20,750 contiguous net acres, 90% average working interest, producing roughly 1,300 boe/d from eight horizontals (six, Dean; two, Middle Spraberry) and 30 legacy verticals, according to the sales flyer.

Potential was estimated for 66 Dean, Middle Spraberry and Upper Wolfcamp A locations, 62 operated.

SM paid $93.5 million for the package. It reported when announcing the deal that, “based on extensive geologic data and demonstrated economics from nearby wells,” it expected to target the Dean and Middle Spraberry.

The acreage add was initially assigned to its “RockStar” area in the Midland Basin, bringing the total holding there to 111,000 net acres.

It was given its own name, Klondike, this fall. SM put a rig at work in December, drilling one science well, it reported this month. It expects to drill three pads this year, totaling between eight and nine wells, with first results beginning in the third quarter.

Herb Vogel, CEO, said in a November earnings call that the Dean is interesting in the area and new drills will target that, while the “Middle Spraberry sand is a lesser portion of the value up there, but it's still a great value contributor.”

In an August call, Vogel said, “This is not your usual stacked-mudrock Permian play. In this area, we're really targeting much more conventional sands with a higher porosity and really oil-saturated rock.”

Jayaram reported after the acquisition news, “SM has highlighted that it studied geological factors that drove strong Dean performance on its current acreage position and looked for similar characteristics across the [Permian] Basin, which drove the transaction.”

He added that SM “boasts a sizeable geoscience staff—some 50 employees—and has had past success in organically adding inventory through its technical prowess, including pushing the boundaries of the Midland Basin farther east in Howard County and successfully developing the South Texas Austin Chalk.”

Birch’s stunners, southeast

Privately held, Houston-based Birch Operations entered Dawson in July 2022, focusing on the county’s southeastern corner.

Its new-drill horizontal Gold Lion 39-46 A #2DN came on in June with 2,590 bbl/d and 755 Mcf of solution gas in its 24-hour test 18 miles southeast of Lamesa, from a 10,305-ft lateral.

The choke size wasn’t reported. Wells’ oil/gas ratio is generally more than 95% oil in southeastern Dawson County.

Gold Lion made 254,280 bbl its first five months online. Birch has not filed a production report with the Texas RRC for the well since October.

The adjacent Gold Lion 39-46 B #6DN came on with 2,769 bbl/d from a similar-length lateral.

Nearby, Birch brought on Longclaw 34-27 A #2DN in June with 1,888 bbl/d from a 10,349-ft lateral. And the adjacent Longclaw 34-27 B #6DN tested 2,043 bbl/d from a same-length lateral.

Its Ironborn 34-27 A #2DN, made in July 2022, surfaced 34,412 bbl its first full month of production after testing 1,307 bbl/d. Total output through year-end 2023 from the 2-mile lateral was 265,552 bbl, according to the RRC.

A companion well, Ironborn 34-27 C #6DN, came on with 1,281 bbl and made 189,550 bbl through year-end 2023.

The Ironborn wells were Birch’s first in Dawson. In 18 months to date in the county, Birch has produced 728,015 bbl. Its 2023 production alone, 458,561 bbl, ranked it as Dawson’s No. 2 producer.

The output includes wells it picked up in March 2023 from Compass Energy Operating.

Two newer Birch completions, Butterbumps 39-46 A #2DN and Butterbumps 39-46 B #6DN, came on in September with 2,066 bbl/d and 2,219 bbl/d, respectively, each from 2-mile laterals.

Also in the area, Balerion the Dread 36-24 C #7DN and Balerion the Dread 36-24 A #4DN tested 2,192 bbl/d and 2,450 bbl/d, respectively, in November from 15,628-ft and 15,734-ft laterals.

Callon’s whoppers, southeast

Also in Dawson’s southeastern corner, Callon Petroleum, which is being acquired by Apache Corp. parent APA Corp., brought on the three-well Chaparral Unit A5 in June 2022. The unit saw 85,969 bbl in its first full month of production (July 2022), about six miles southeast of the Birch wells.

In its first 18 months online through year-end 2023 (it was offline all of February 2023), the unit made 612,617 bbl.

Parent well #5AH tested 1,719 bbl/d, while #13SH tested 729 bbl/d and #19H tested 869 bbl/d, each from a 2-mile lateral.

Newer Callon completions include the nearby two-well Copper Creek A6 unit that tested the #11SH for 660 bbl/d and the #18H for 1,070 bbl/d this past spring.

Meanwhile, three other 2-mile Copper Creek wells (units A7, A8 and A9) in April tested the #4AH for 1,257 bbl/d, the #44H for 689 bbl/d and the #12SH for 731 bbl/d, each from a 2-mile lateral.

Production through year-end from the five wells totaled 455,553 bbl, according to RRC data.

Callon was No. 1 in Dawson in 2023 with 665,443 bbl. Production in December was 39,873 bbl.

Callon entered Dawson in 2016, picking up wells from privately held, Midland-based Element Petro Operating II and Big Star Oil & Gas.

Recommended Reading

Marketed: Paloma Natural Gas Eagle Ford Shale Opportunity in Frio County, Texas

2024-02-16 - Paloma Natural Gas has retained EnergyNet for the sale of a Eagle Ford/ Buda opportunity in Frio County, Texas.

Marketed: Williston, Powder River Basins 247 Well Package

2024-03-11 - A private seller has retained EnergyNet for the sale of a Williston and Powder River basins 247 well package in Sheridan, Montana, Burke and McKenzie counties, North Dakota and Campbell County, Wyoming.

Marketed: Onyx Resources 23 Well Package in Texas

2024-03-25 - Onyx Resources has retained EnergyNet for the sale of a 23 well package plus 1,082.81 net leasehold acres in Archer, Clay, Fisher, Jones, Kent, Stephens, Taylor and Young counties, Texas.

Marketed: Bendel Ventures 73 Well Package in Texas

2024-03-05 - Bendel Ventures LP has retained EnergyNet for the sale of a 73 well package in Iron and Reagan counties, Texas.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.