?Fundamentals are still shaky in the financial market, and will be for some time, says Dan Pickering, co-president of Tudor, Pickering, Holt & Co. Securities. He spoke at a Societe Generale Americas Securities LLC program in Houston.

“Since Sept. 15, when Lehman Brothers went under, the average swing in the market, on a daily basis, is 8.8%,” he said in early November. “Five years ago, the average swing was 1.6%. What has happened in the market has been big and has been fast.”

The public markets are rationing capital in a big way. “So, much to the chagrin of anyone who makes money trying to help other companies use or raise money, you can’t do an IPO today. In fact, the stock market hasn’t received an IPO since August. And the secondary market is virtually closed for energy.”

In general, if an E&P does not have an A-rated credit standing, it will not be able to do a debt deal. “There is a ton of private equity out there, and they are ready to go to work, but probably not for four to six months. The market is coming their way—things are getting cheaper—but there is still a mismatch between buyer and seller expectations.”

Shale players, in particular, are going to have a tough time because these assets “cost money in the near-term; they don’t generate money in the near term,” Pickering said. “What we are seeing is that anyone who owns shale acreage loves it. I love it. Except it doesn’t generate any cash, so no one wants to buy more acreage.”

It’s a buyer’s market, but many are waiting for a cheaper deal. Property values are down, and capex cuts are going to accelerate.

“Pioneer Resources is going to cut its capex by 30% to 60% next year,” he said, as an example. “That is a meaningful cut.”

A cold winter won’t fix the gas-price problem, he added. Lower rigs rates will, but not in the first quarter of 2009. The gas market will be better after some 400 rigs are down by the second half of 2009 or early 2010.

Oil markets are generally strong because it is “tough to add supply,” but now demand is soft. Natural gas prices have fallen only because supply is high.

“It’s not an energy thing. It’s an economy thing. We just need to slog through it. We’ve been on a roller-coaster ride, but sooner or later, the fear and the craziness will stop.”

Recommended Reading

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.

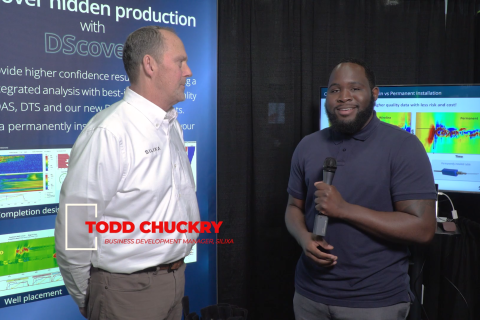

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Message in a Bottle: Tracing Production from Zone to Wellhead

2024-04-30 - New tracers by RESMAN Energy Technology enable measurement while a well is still producing.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.