Crescent Energy is boosting its stake in a western Eagle Ford asset the E&P spent $600 million acquiring earlier this year. (Source: Shutterstock.com)

Crescent Energy is upping the ante in South Texas with a deal to buy an additional stake in its Eagle Ford Shale assets.

Houston-based Crescent agreed to pay $250 million in cash for incremental working interest in its operated assets in the western Eagle Ford, the E&P announced after markets closed on Sept. 6.

The deal for additional working interest is expected to close this month, Crescent said.

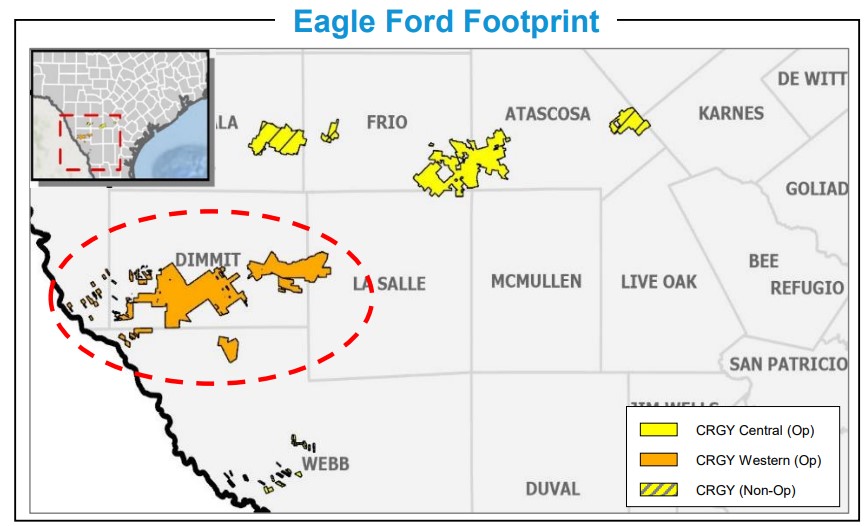

Earlier this summer, Crescent spent about $600 million to acquire operatorship of the asset in Dimmit and Webb counties, Texas, near the U.S.-Mexico border. The deal bolted on around 75,000 contiguous net acres from Mesquite Energy, formerly operating as Sanchez Energy.

In total, the collective $850 million in South Texas M&A is adding 95,000 net acres and approximately 32,000 boe/d of production to Crescent’s portfolio, according to investor materials.

Combined with acquiring operatorship of the asset in July, Crescent will boost its legacy 15% non-operated stake to a 63% working interest in the asset, the company said.

After closing the latest deal, Crescent will operate about 90% of its broader Eagle Ford position.

“We are pleased to further scale our high-quality western Eagle Ford position following the recent acquisition of operatorship of this asset earlier in the quarter,” said Crescent CEO David Rockecharlie in a news release.

“This transaction is consistent with our strategy to grow opportunistically through accretive acquisitions, adding low decline cash flow and high-quality inventory at attractive valuations while maintaining financial strength,” he said.

The current deal is expected to increase net production by an average 12,000 boe/d, the company said. Spending on capital investments is expected to increase by around $5 million in conjunction with the deal, the company said.

Crescent’s full-year 2023 production is expected to range between 146,000 boe/d and 151,000 boe/d—up from the company’s previous guidance of between 143,000 boe/d and 148,000 boe/d for the year.

Capex, excluding spending for acquisitions, is expected to come in between $580 million and $630 million for the year.

RELATED: Crescent Energy Closes Eagle Ford Acquisition

Recommended Reading

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Marathon Oil Declares 1Q Dividend

2024-04-26 - Marathon Oil’s first quarter 2024 dividend is payable on June 10.

Talos Energy Expands Leadership Team After $1.29B QuarterNorth Deal

2024-04-25 - Talos Energy President and CEO Tim Duncan said the company has expanded its leadership team as the company integrates its QuarterNorth Energy acquisition.