Multi-basin E&P Coterra Energy sees potential for drilling and service costs to fall 5% next year based on current market pricing. (Source: Shutterstock.com)

Multi-basin E&P Coterra Energy sees potential for drilling and service costs to fall 5% next year based on current market pricing.

Houston-based Coterra Energy Inc. is starting to see relief in recent well costs on some big-ticket items, the company reported in second-quarter earnings after markets closed on Aug. 7.

Drilling rig costs have fallen by around 10%, Coterra said in an investor presentation; costs for frac crews and sand are down 10% and costs for steel tubular goods have also dropped by 15%.

However, Coterra has yet to see much movement on other sources of well cost inflation.

“Other cost categories, including labor and surface rentals, have been more sticky and flat to modestly up,” said Coterra CFO Shannon Young on the company’s Aug. 8 earnings call. Young joined Coterra as CFO this summer after previously working as CFO for offshore E&P Talos Energy Inc.

Several other E&Ps, including Diamondback Energy, Matador Resources and Range Resources, have also reported softening in costs for steel, fuel, sand and other drilling-related goods.

Coterra noted that since its contracts are staggered over the course of the year, the company may not realize the full 5% savings forecast.

But Coterra is also looking at other ways to decrease spending. In the company’s Marcellus footprint, capital spending could decline by at least $200 million per year while still holding production relatively flat if natural gas prices continue to remain low.

“We have the option to redirect the capital or to simply invest at a slower cadence,” said Coterra Chairman, President and CEO Thomas Jorden on the call. “We also retain the ability to restore activity if the gas macro were to significantly recover.”

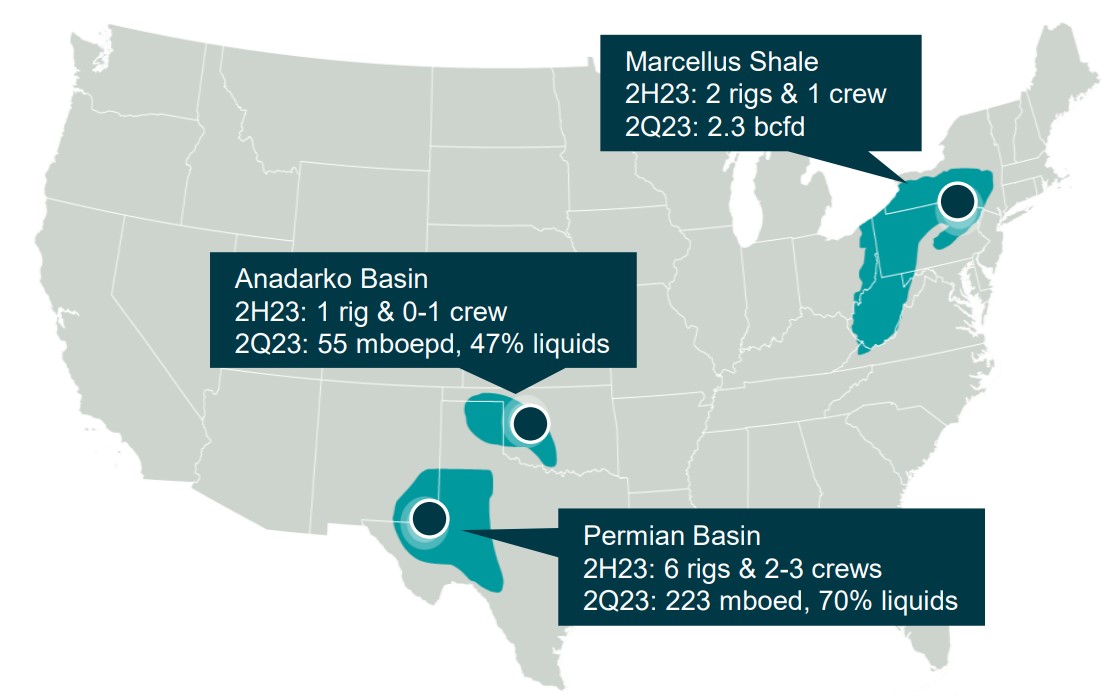

Coterra recently reduced its Marcellus rig activity to two rigs and one completion crew. The company is running six rigs and three completion crews in the Permian Basin and one rig and one crew in the Anadarko Basin.

Reducing spending in the Marcellus gives Coterra the potential to allocate more capital to its liquids-rich Permian acreage or toward the Anadarko Basin. However, the company has yet to make a final decision on any reallocation of capital, Jorden said.

RELATED: Coterra Energy Warns Stockholders to Reject 'Mini-tender' Offer

Earnings, dividends and buybacks

Coterra beat Siebert Williams Shank & Co.’s estimates on several key metrics in its second-quarter earnings, including crude oil production and total output volumes, free cash flow (FCF) and EBITDA, managing director Gabriele Sorbara wrote in an Aug. 8 report.

Strong well performance in the first half of the year led Coterra to raise its total 2023 production guidance by 2% and its oil production guidance by 2.8%.

But, the company’s strong operations in the second quarter don’t appear to be fully carried forward given a weaker oil production outlook in the back half of 2023, according to analysts at Tudor, Pickering, Holt & Co.

Oil production in the third quarter is expected to range between 88,000 bbl/d and 91,000 bbl/d—down over 6% at the midpoint from 95,800 bbl/d in the second quarter.

Total third-quarter output is expected to come in between 630,000 boe/d and 655,000 boe/d—down around 3% at the midpoint from 665,000 boe/d in the second quarter.

The decline is a function of timing of well turn-in-lines during the quarter as a spot frac crew rolls off, according to analysts at TD Cowen.

Coterra also returned $208 million to shareholders during the second quarter, including $151 million in declared dividends and $57 million in share buybacks.

The company’s board declared a quarterly base dividend of $0.20 per share—in line with last quarter’s dividend. The current dividend is payable on Aug. 31 to Coterra holders of record on Aug. 17.

Coterra repurchased 2.4 million of its outstanding shares at an average price of $23.55 per share during the quarter. The company has $1.7 billion remaining on a $2 billion share buyback authorization.

In total, Coterra returned 184% of its quarterly FCF to shareholders during the second quarter, versus its commitment to return 50% of FCF.

“The company's large cash balance afforded us the luxury to return capital in excess of our quarterly FCF and continue to buy our shares countercyclically at attractive prices,” Young said on the call.

Based on the pace of its share buybacks and expected declared dividends for the year, Coterra expects to return at least 75% of its FCF to investors this year. Coterra has returned $628 million to shareholders so far this year—representing 94% of its total FCF.

RELATED: Energy Bests All Sectors in Q1 Dividend, Buyback Yields

Recommended Reading

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

E&P Highlights: April 29, 2024

2024-04-29 - Here’s a roundup of the latest E&P headlines, including a new contract award and drilling technology.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.