(Source: G.B. Hart/Shutterstock.com)

Permian Basin player Concho Resources lowered its well costs by 20%, and third-quarter production gains proved a shift to wider spacing to correct past missteps is paying off.

The Midland, Texas-based company also reported this week production grew by 15% to 330,000 barrels of oil equivalent per day (boe/d) compared to a year ago, and it generated $665 million of cash flow from operating activities.

The improvements contributed to Concho’s reported net income of $558 million for third-quarter 2019, compared to a loss of $199 million a year earlier, bolstering the company’s confidence in its ability to meet expectations.

Concho CEO Tim Leach said Oct. 30 that second-quarter results, which included unfavorable news on its 23-well Dominator project that used seven rigs and five frac spreads in a one-mile section, “undermined” its track record and raised concerns about its execution ability.

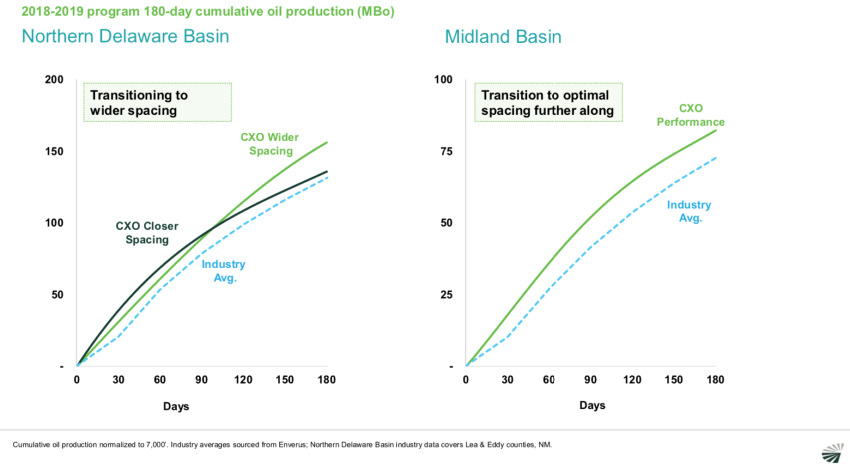

But the company has made changes, showing improved 180-day cumulative oil production rates in the Northern Delaware Basin and Midland Basin.

“I’m confident that Concho hasn’t lost our ability to execute and that our performance is sustainable over the long term,” Leach added.

The company expects fourth-quarter production to average between 318,000 boe/d and 325,000 boe/d, down from 334,000 boe/d to 341,000 boe/d given its divestment of New Mexico Shelf assets.

RELATED

· Permian Well Spacing: Finding The Right Balance

· Spur Energy Strikes Again With $925 Million Concho Deal

Wider Spacing, Lower Costs

“On production, our spacing tests are cycling through and our guidance incorporates our expectations for those tests,” Jack Harper, president of Concho, said on the call. “In other words, we believe that we adequately risk the volume guidance to account for the remaining tests that are coming online. And importantly, as we plan for 2020 and beyond, we will develop fewer wells per project at wider spacing.”

The development strategy to prioritize returns includes “multiple decades of inventory” with six to eight wells per section spacing.

“We are assembling a 2020 development program that incorporates everything we’ve learned this year from well spacing and density to lateral placement and completion techniques,” Harper said. “We will continue to learn and adapt but not at the expense of returns…with a sharp focus on capital efficiency and managing levers we control.”

Concho saw its DC&E costs fall by 28% in the Delaware Basin and 13% in the Midland Basin in the third quarter, compared to first-half 2019, although executives acknowledged the starting point was high.

“The key initiatives include continuing to optimize drilling and completion designs,” Harper said. “Water is also an important part of the supply chain and in the second quarter we entered into a joint venture with Solaris that leverages the scale of this system to provide cost-effective water management to our operations in Eddy County.”

Concho also plans to drawn down its drilled but uncompleted (DUC) well count in the fourth quarter and maintain its frac crew count, mainly due to efficiency gains and cost savings.

“That’s going to allow us to keep running [the] two frac crews that we were planning on dropping in the fourth quarter,” said Will Giraud, the company’s executive vice president and COO. “The result is a [smoother] transition from the fourth quarter of ’19 into the first quarter of ’20 and a reduction in the year-end 19 DUC count to roughly 70. But importantly, our 2019 capital budget guidance is unchanged.”

Coping With Uncertainites

Financially speaking, Harper said Concho is focused on what it can control.

However, flexibility will be key to coping with other challenges. The unknown involves politics.

“Today sentiment toward the sector is low and amplified by campaign promises to severely limit or regulate away oil and gas operations,” Leach said. “Since we don’t know how the politics will resolve, I’ll clarify that our exposure to federal acreage is about 20% of our total gross and net acreage position, and our capital allocation for that acreage is roughly the same. We have a great deal of flexibility if we need to reallocate that capital.”

Concho’s has assets on federal lands in in New Mexico with “quite a bit of activity on them right now,” Leach said. However, “the beauty of having assets in both the Delaware and the Midland” in New Mexico and Texas is the ability to move rigs across state lines.

Meanwhile, oil and gas price volatility continue to chomp at profit-making potential. Concho said its average realized price for oil in the third quarter was $54.01/bbl and $1.34 per Mcf for natural gas, down from $56.38/bbl and $4.18/Mcf, respectively.

The company’s adjusted net income fell to $122 million, down from $269 million a year earlier. This included the impact of a $101 million impairment related to the sale of its New Mexico Shelf assets and lower commodity prices, despite nearly 60 new wells being put on production during the quarter.

“Looking ahead to 2020, planning around a conservative commodity price, we can deliver oil growth, free cash flow and shareholder returns,” Leach said. “At lower oil prices, our financial strength provides flexibility and we’ll manage the business within cash flow. Higher prices will generate more free cash flow, which will fund more shareholder returns.”

The company hopes to generate an estimated $350 million in free cash at $50/bbl West Texas Intermediate and $750 million at $60/bbl oil next year.

“Importantly, if oil prices increase, we won’t chase the incremental barrel,” Harper added. “We have a strong commitment to capital discipline because we believe it’s key to maintaining a strong balance sheet and growing long term value.”

Although the results missed analysts’ expectations, according to a Reuters report, many analysts remain confident in Concho’s ability to weather continued commodity price instability. Several congratulated Concho on the results, saying “well done” and “great quarter.”

Moody’s Investors Service expects Concho to “maintain strong credit metrics and operational performance through 2021” despite the weak near-term outlook for oil and gas prices, the firm said in a report Oct. 29.

Recommended Reading

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.