Comstock is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston. (Source: Shutterstock)

Comstock Resources’ eighth new far western Haynesville wildcat came on at 31 MMcf/d—while still cleaning up—and three more wells are expected to come online in the coming weeks.

The 1.5-Bcf/d pureplay natgas producer is also dropping two of its seven rigs—both in its legacy, core Haynesville acreage in East Texas and Northwestern Louisiana.

And Comstock has suspended its $0.125 quarterly dividend as natural gas tanked to less than $1.65 per Mcf. Its fourth-quarter production cost was $0.81/Mcf.

Two rigs will continue to drill in the western Haynesville stepout north of Houston, the company reported. Comstock is also dropping one frac spread, averaging 1.7 crews at work during 2024.

Jay Allison, Comstock chairman and CEO, assured investors on an earnings call Feb. 14 “that our majority stockholder, the [Dallas Cowboys owner] Jerry Jones family, is in 100% approval” of the measures “to protect our balance sheet … and they're well involved with what we do.”

Analysts on the call expressed concern about whether Comstock would exceed the debt-leverage ratio in its covenants this year.

Roland Burns, Comstock president and CFO, said, “We don't see that. We don't think that we come that close to that.”

New wildcats

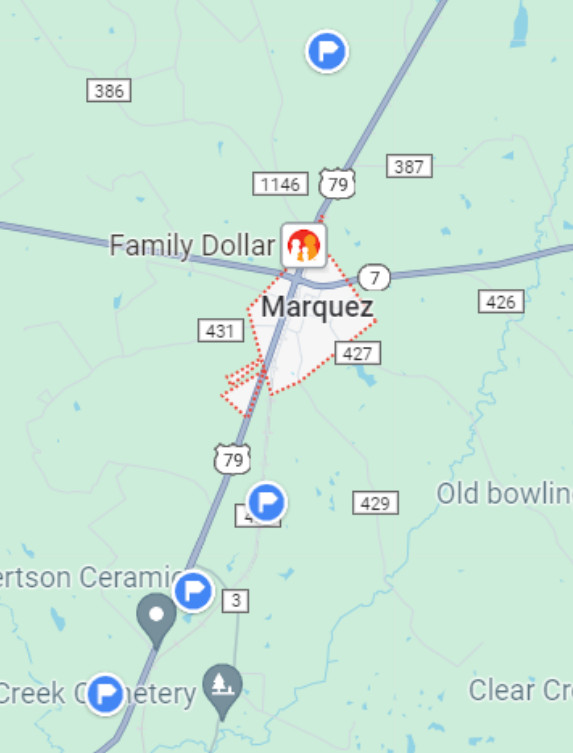

Comstock’s newest wildcat, Neyland MMM #1H in Leon County, is 2.8 miles north of Marquez, Texas. The 10,438-ft lateral is at a total vertical depth of 16,752 ft and landed in the Haynesville formation, Comstock reported.

Just turned online, the well “has not reached its maximum initial production rate,” it added.

Three newer wildcats, also in Leon County, will be brought online by March 31. According to Texas Railroad Commission (Texas RRC) files, Harrison WA #1H is 2 miles south of Marquez; Glass RT #1H is 4.3 miles south; and Farley GD #1H is 3.1 miles south.

Comstock added another 23,000 net acres to its western Haynesville holding for $21.9 million in the fourth quarter to total more than 250,000 net acres—bringing its leases in the step-out area to roughly equivalent its position in the core.

Competition for more land hasn’t manifested, Burns told investors. Comstock has leased its 250,000 net acres for an average of $550 per acre.

“The process definitely has not become more competitive with the weak gas price environment,” Burns said. The land left to be captured is “rounding up” where there are some blank spaces. “It's just finishing up.”

Allison added, “I can promise you there's no competition out there at $1.61 (natgas) at all.”

Dropping spreads, rigs

In dropping one of its three frac spreads, management expects to have one or two at work through year-end, said Dan Harrison, Comstock COO. “One running full time and one with some gaps in between.”

Allison said a proactive measure would be to drop one spread, and “we’ve already done that.” None of the spreads is on a long-term contract, he added. “It's well by well.”

As for dropping rigs, Allison said, “It takes two, three or four months … We were proactive back in December to give notice.”

As for DUC’ing some new-drill wells, that’s an option, Allison said. Also, “If we need to lay down another rig, we'll have the optionality to do that.”

If another rig is dropped, it would be in Comstock’s core acreage and not in the western step-out, he added.

(Source: Hart Energy via Google Maps)

Going to two-well pads

In the stepout, Comstock is switching to two-well pads, while it had been drilling singles as it was delineating its leasehold. Allison expects the E&P will be able to add a third rig in the play in 2025, which is what it had planned to do last year for 2024.

The eight wells it’s brought online to date have de-risked a swath some 25 miles wide, Allison said.

Harrison added that, since it takes longer to drill and complete the super-deep (up to 19,000 ft vertical depth), super-pressure, super-temperature western Hayneville wells, those that Comstock will drill next likely won’t come online before year-end.

“One rig just started the two-well pad a couple of weeks ago and our other rig is getting ready to move to a two-well pad,” Harrison said. With two-well pads, “they'll be drilling all through the spring and summer and fall.”

The number of days to reach total depth—vertical plus lateral—has fallen by 20 so far in the new play, Harrison said, “and we still see that kind of potential going forward.”

Increasing EUR

As for EUR, its first wildcat, Circle M #1H, was initially estimated at 3.5 Bcf per 1,000 lateral feet. Hart Energy found earlier this month that the well had already produced 50% of that EUR in its first 19 months online.

Burns said Feb. 14 that the initial 3.5 Bcf per 1,000 lateral ft continues to stand with its newer wells, but the Circle M’s EUR has been raised. The new EUR was not disclosed.

“The rest of the wells don't have near the number of months under production,” Burns said, “so we’ve left them where they are. But the reserves are trending nicely in the play for the first wells that we've drilled.”

Consistent completions

A bonus in the stepout acreage is that, so far, the wells “frac very consistently,” Harrison said. “The pressures don't just go up and down and go all over the place.

“That would obviously make it a lot more difficult. They frac very consistently, which makes it easier to frac them at [these] high pressures.”

Also, Comstock is drilling the laterals with “snubbing units using stick pipe,” he said. “You can basically handle higher-pressured wells with that than with coil tubing.

“We've had great success in that regard that's also helped us out with these wells.”

Debt ratio

In 2022, at a higher gas price, Comstock made $1.7 billion in operating cash flow; in 2023, it generated $774 million.

Production grew in the fourth quarter to 1.5 Bcf from 1.4 Bcf in fourth-quarter 2002, despite dropping some of its rigs in 2023.

Proved reserves took a hit at year-end, using the 12-month average Henry Hub price that is the Securities and Exchange Commission rule, falling from 6.7 Tcfe to 4.9 Tcfe. If using the SPE rule, which is based on the Dec. 31 Henry Hub price, Comstock’s proved reserves were only 1% fewer than year-end 2022, the company reported.

Its earliest bond maturity is $1.2 billion in 2029. Its bank debt is $480 million on a $2 billion facility that matures in 2027. Total debt is $2.7 billion.

Gabriele Sorbara, an analyst with Siebert Williams Shank & Co., reported prior to the earnings call that he modeled Comstock would trip its 3.5x net debt/EBITDA covenant at the current natgas price.

“However, we expect it to be able to negotiate covenant relief with its banks and/or receive an investment from its largest investor, Jerry Jones,” Sorbara wrote.

Recommended Reading

Shell Taps Bloom Energy’s SOEC Technology for Clean Hydrogen Projects

2024-03-07 - Shell and Bloom Energy’s partnership will investigate decarbonization solutions with the goal of developing large-scale, solid oxide electrolyzer systems for use at Shell’s assets.

Energy Transition in Motion (Week of March 1, 2024)

2024-03-01 - Here is a look at some of this week’s renewable energy news, including Chevron’s plans for a solar-to-hydrogen facility in California.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

No Silver Bullet: Chevron, Shell on Lower-carbon Risks, Collaboration

2024-04-26 - Helping to scale lower-carbon technologies, while meeting today’s energy needs and bringing profits, comes with risks. Policy and collaboration can help, Chevron and Shell executives say.

One Man's Trash? Treasure of RNG Prospects Available for Waste Facilities

2024-02-21 - About 4.4% of current U.S. fossil gas demand could be displaced by RNG from waste, a new Deloitte report shows.