The more things change, the more they really, really change.

In November 1980, the first IBM personal computer was about a year away from launch, almost all telephones were connected to a wall and the average price of crude oil was $35.09/bbl—$122.93/bbl if adjusted for inflation.

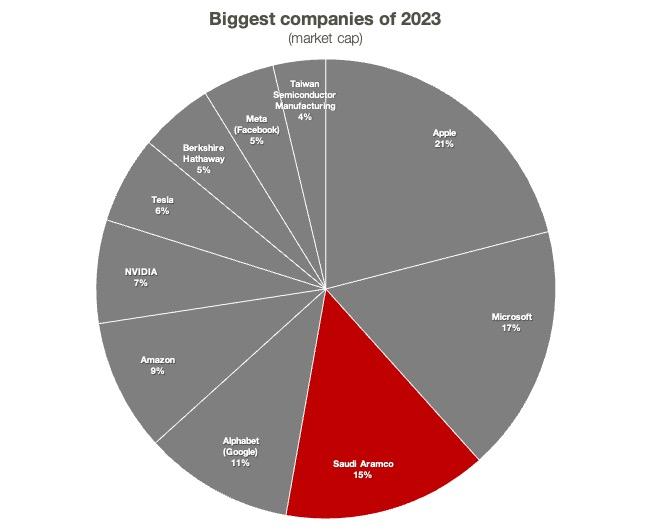

Technology was big back then, but so was oil. The No. 1 company by market capitalization was IBM, valued at $34.6 billion ($128.12 billion in 2023), according to City Index. Telecommunications giant AT&T was No. 2 at $33.4 billion ($123.68 billion).

Six of the eight companies that followed to round out the top 10 of 1980 were oil companies, and they accounted for 55% of the largest companies’ market cap. The other two were General Motors, maker of vehicles that ran on refined oil products, and DuPont, maker of chemicals derived from oil products.

Investing in public companies was facilitated by brokers, almost all men, who wore vests, wide ties and suspenders to hold up pleated slacks. If you wanted to make money in the market and were willing to take more risk than IBM or Ma Bell could offer, you would contact a broker and tell him you wanted to be … drumroll … an oil and gas investor.

Those investments made sense because the global economy back then ran on energy that was overwhelmingly supplied by fossil fuels. Just like now. Just like it’s been for the last 100 years or so.

Just like it was in 2000, when only Exxon Mobil and Shell represented energy in the top 10, accounting for 16% of the largest companies’ market cap. (In 1980, Exxon, Mobil and Shell combined accounted for 31%.)

Tech companies like Microsoft (PC software), Cisco (networks), Intel (chips), NTT Docomo and Nokia (phones) ruled. Exxon had purchased Mobil in 1999 and the combined value of the energy behemoths was dwarfed by Microsoft, a company missing from the 1980 list because it wasn’t traded until 1986.

Bill Gates’ baby was worth over $1 trillion in 2000 (in 2023 dollars), more than all top 10 companies’ combined value on the 1980 list. Now its value is around $2.5 trillion, and yet that comes well short of Apple’s $3.03 trillion.

Don’t give up

The list reflects profound changes in the world since 1980. The combined market cap for Exxon and Mobil then was an inflation-adjusted $193 billion. In 2000, Exxon Mobil’s market cap totaled $460.2 billion. In early October 2023, the company’s market cap was virtually the same at $464 billion and only one oil and gas company—state-owned Saudi Aramco—now ranks among the 10 largest companies in the world.

This is not exactly breaking news. Publicly traded oil and gas companies have struggled in the market for quite a while now. And if you want to note that Warren Buffet’s Berkshire Hathaway invested billions in Chevron and Occidental Petroleum, also note that 46% of the Oracle’s portfolio is in Apple.

An automaker still ranks among the largest companies, but it is Tesla, manufacturer of electric vehicles. The market cap of Tesla is roughly equal to the market cap of carmakers ranked No. 2 through No. 10, according to CompaniesMarketCap.com. Not General Motors, though; GM is only No. 12 on the automaker list, with a market cap of about $43 billion, or about 5.5% of Tesla’s.

It’s how the market perceives profitability in the energy transition. GM, after all, is doing well. It is No. 4 in revenue and No. 7 in earnings, just $1 billion behind Tesla in the four quarters ending June 30. But investors question whether it can compete in the new EV era, just as they question whether fossil fuel companies can compete as the energy transition continues to ramp up.

Portfolio manager David McAlvany believes fossil fuel companies can compete, at least in the natural gas space.

“The reality is, we’re looking at the most critical transition fuel in terms of the green energy transition,” he told BNN Bloomberg, the Canadian business channel, in mid-September. “We can’t go anywhere without natural gas, love it or hate it. This is where we’re at.”

He is skeptical that offshore wind will gain enough traction and be financially viable. And coal? Please.

“Natural gas is the way forward,” he insists.

Companies he likes in the space include Devon Energy, Chesapeake Energy and midstream giant Williams.

But that’s foresight, and hindsight is so much more accurate. Only four of the largest companies by market cap in 1980 exist as entities today. One day, people may utter sentences like, “I remember when everybody used to have an iPhone.”

Don’t give up on fossil fuel investments just yet. Even suspenders have made a comeback.

Recommended Reading

Supply Disruptions Ahead as Canadian Rail Workers Vote for Strike

2024-05-01 - The union, representing more than 9,000 employees at Canadian National Railway and Canadian Pacific Kansas City, announced that 95% of its members approved of a strike, which could happen as early as May 22.

Vision RNG Expands Leadership Team

2024-05-01 - Vision RNG named Adam Beck as vice president of project execution, Doug Prechter as vice president of finance and Beckie Dille as HR manager.

OGInterview: Building EIV Capital’s Midstream Investment Strategy

2024-05-01 - Midstream-focused EIV Capital has added non-operated assets and transition projects to its portfolio as a sign of the times.

NOG Lenders Expand Revolving Credit Facility to $1.5B

2024-04-30 - Northern Oil and Gas’ semi-annual borrowing-base redetermination left its reserved-based lending unchanged at $1.8 billion.

Imperial Oil Names Exxon’s Gomez-Smith as Upstream Senior VP

2024-04-30 - Cheryl Gomez-Smith, currently director of safety and risk at Exxon Mobil’s global operations and sustainability business, will join Imperial Oil in May.