Citizen Energy’s projected next 12-month EBITDAX is now expected to range between $750 million and $800 million, the company said in a June 29 press release. (Source: Hart Energy)

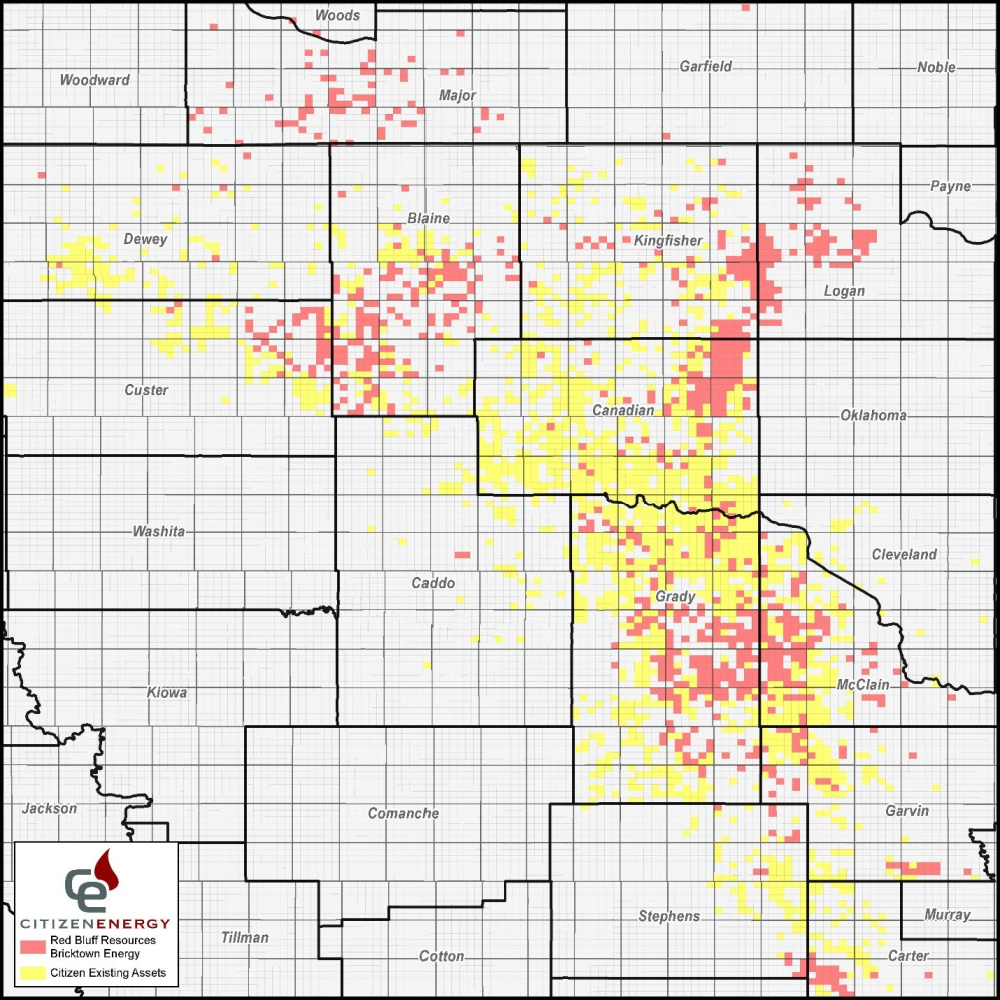

Citizen Energy closed its first acquisition of 2022, giving the Tulsa, Okla.-based company what it called a “dominant Midcontinent footprint” by acquiring substantially all assets owned by Red Bluff Resources and Bricktown Energy.

The deal raises Warburg Pincus-backed Citizen’s average daily production by 18% to average production of 86,000 boe/d from more than 720 operated wells across the Anadarko Basin. The company will also hold 326,000 net acres, 98% HBP. Citizen’s projected next 12-month EBITDAX is expected to range between $750 million and $800 million, the company said in a June 29 press release.

A private company, Citizen said in the release it expects the acquisition to be “highly accretive to shareholder returns” and that it sets it on a trajectory to becoming one of the top private producers in the U.S.

The company’s press release did not specify the purchase price of Red Bluff and Bricktown’s assets. Citizen didn’t immediately respond to a request for comment.

In the release, Citizen did report it had closed $250 million in senior secured second lien notes to fund the acquisition and pay down its revolving credit facility. The company secured the financing from private funds managed by EIG.

The deal, with an effective date of April 1, adds:

- 13,000 boe/d, 56% liquids;

- 200 operated wells;

- 739 nonoperated wells; and

- 80,000 net acres.

It was the company’s first deal since the Dec. 31 closing last year of a $153 million acquisition for 28,000 net acres in Oklahoma’s Blaine, Canadian and Kingfisher counties.

Citizen Energy describes itself as an integrated oil and natural gas company located in Oklahoma and primarily targeting the Meramec and Woodford shale formations. The company is the successor of Roan Resources, which Citizen took private in a $1 billion all-cash acquisition that closed in 2019.

Citizen also operates about 213 miles of natural gas gathering pipelines, 225 MMcf/d of gas processing capacity, and roughly 103 miles of water gathering pipelines.

Baker Botts served as legal counsel for the buyers for the June 30 transaction. Kirkland & Ellis served as legal counsel and JPMorgan served as the exclusive financial adviser for the sellers.

Recommended Reading

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.