(Source: Shutterstock.com)

Family offices have considerable interest in investing in energy when putting money into the public market, according to a new family office survey by CitiBank.

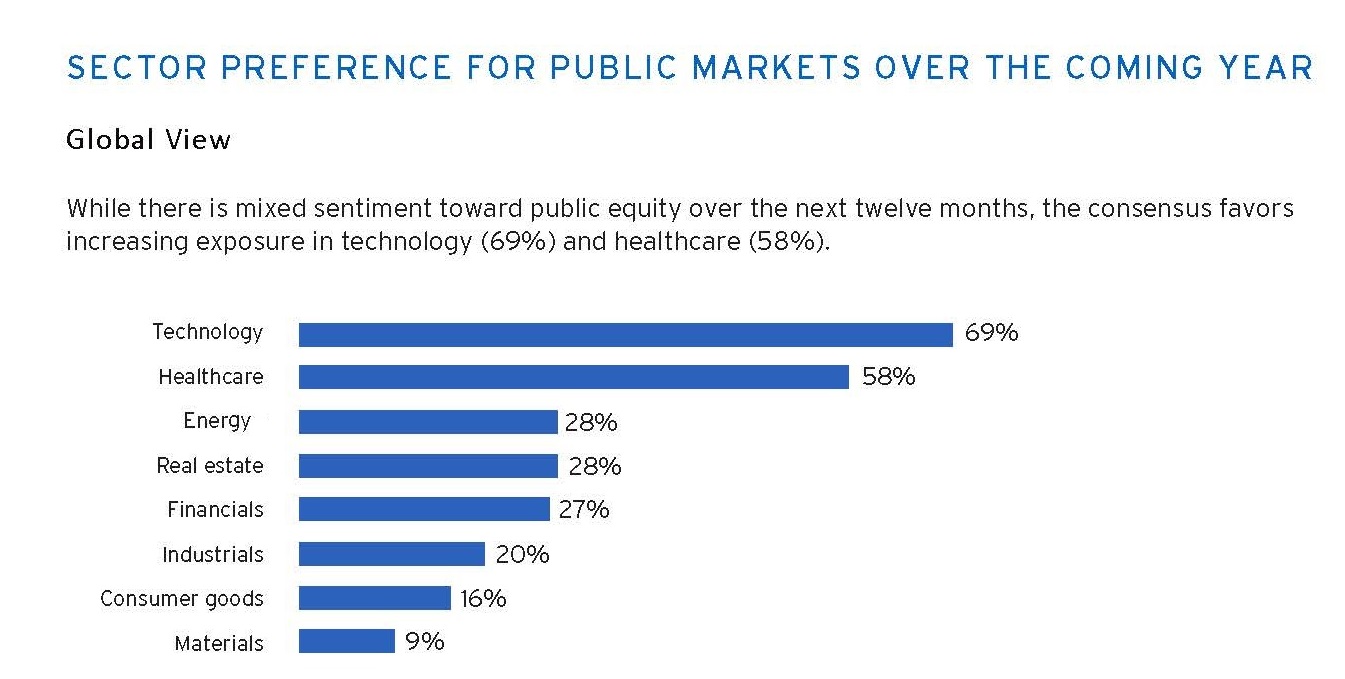

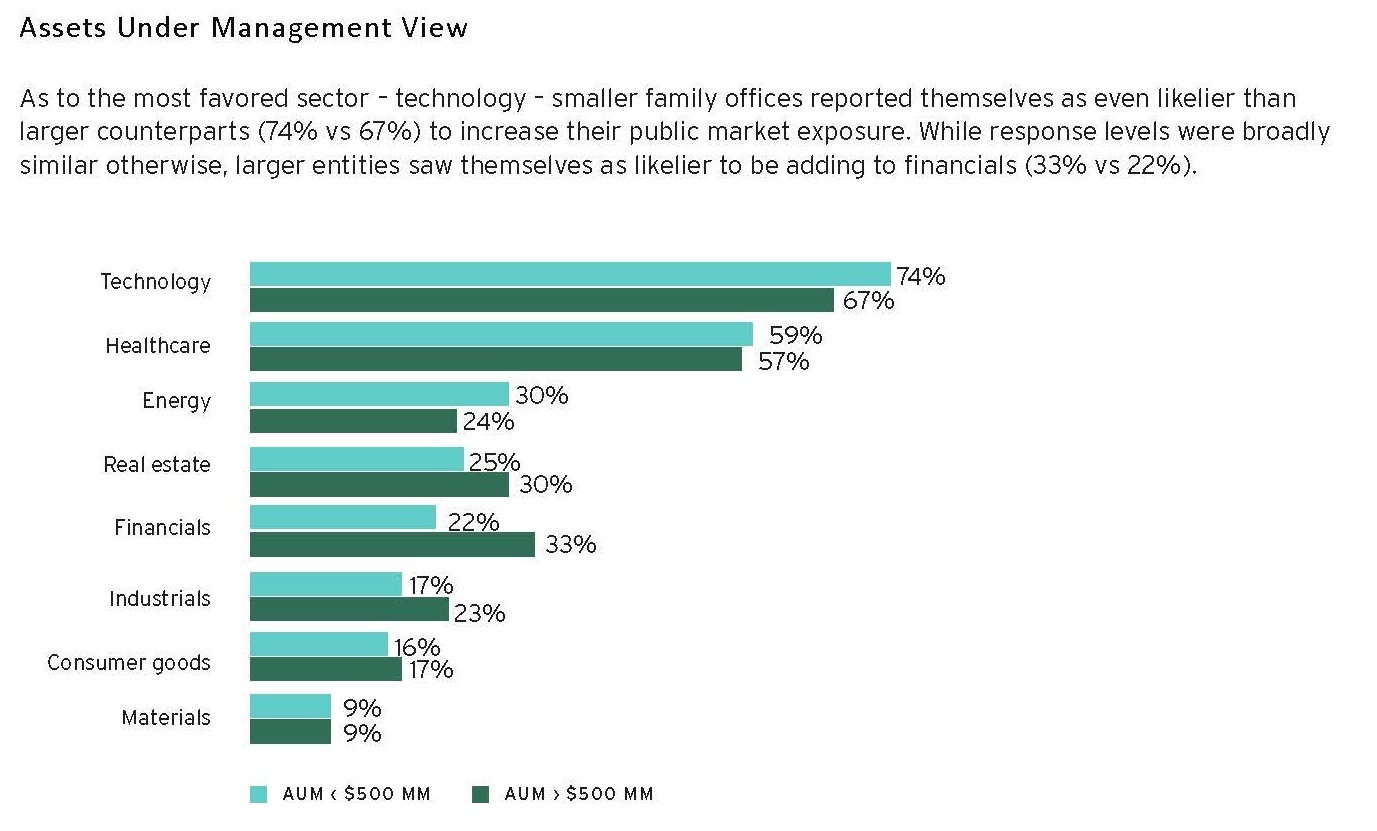

Respondents preferred to invest in technology and healthcare sectors in the coming year, with energy in third place — narrowly beating out real estate and financials, according to the study, “Global Family Office Survey Insights 2023.”

Thirty percent of family offices with assets under $500 million expressed interest in energy investments, according to the survey. The oil and gas industry has seen family offices replace some investors who have left the sector due to a variety of reasons, including qualms over fossil fuels and the cyclical nature of commodity prices.

Family offices preferred private equity and private equity funds over other investment options such as venture capital and real estate, according to the survey.

Family offices sometimes make up some of the new partners in new private equity energy funds, and have been involved in consortiums for energy investing. Family offices were part of a consortium that acquired Wyoming natural gas producer PureWest Energy for $1.84 billion cash in May.

For sustainable investing, the survey found that family offices were mostly interested in climate transition solutions, with agricultural and food security solutions a very close second.

Recommended Reading

Mitsubishi, Chevron Overcome Hydrogen, Storage Project Woes

2024-03-21 - ACES Delta developers say the project remains on track for 2025 startup, despite previous supply chain obstacles.

Exclusive: What’s Needed to ‘Get Things Moving’ with CCS

2024-03-05 - CCS momentum is brewing, says Katja Akentieva, vice president of New Energy Solutions for the Western Hemisphere at TGS. Now it's time to capitalize on that momentum in this Hart Energy LIVE Exclusive with Jordan Blum.

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Svante CEO on Reducing ‘Friction’ in the Carbon Capture Marketplace

2024-04-10 - Svante President and CEO Claude Letourneau discusses the challenges — and progress made — with capturing carbon emissions with Jordan Blum, Hart Energy’s editorial director.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.