Chesapeake Energy and Southwestern Energy's merger will create dominant positions in Appalachia and the Haynesville Shale, which the companies say would compete on the global stage. (Source: Shutterstock.com)

Editor's note: This is a breaking news article. This article has been updated to add additional commentary, a pro forma production chart and acreage maps.

Chesapeake Energy and Southwestern Energy have entered into an all-stock merger agreement valued at $7.4 billion, or $6.69 per share, based on Chesapeake's closing price on Jan. 10, 2024, the companies said on Jan. 11.

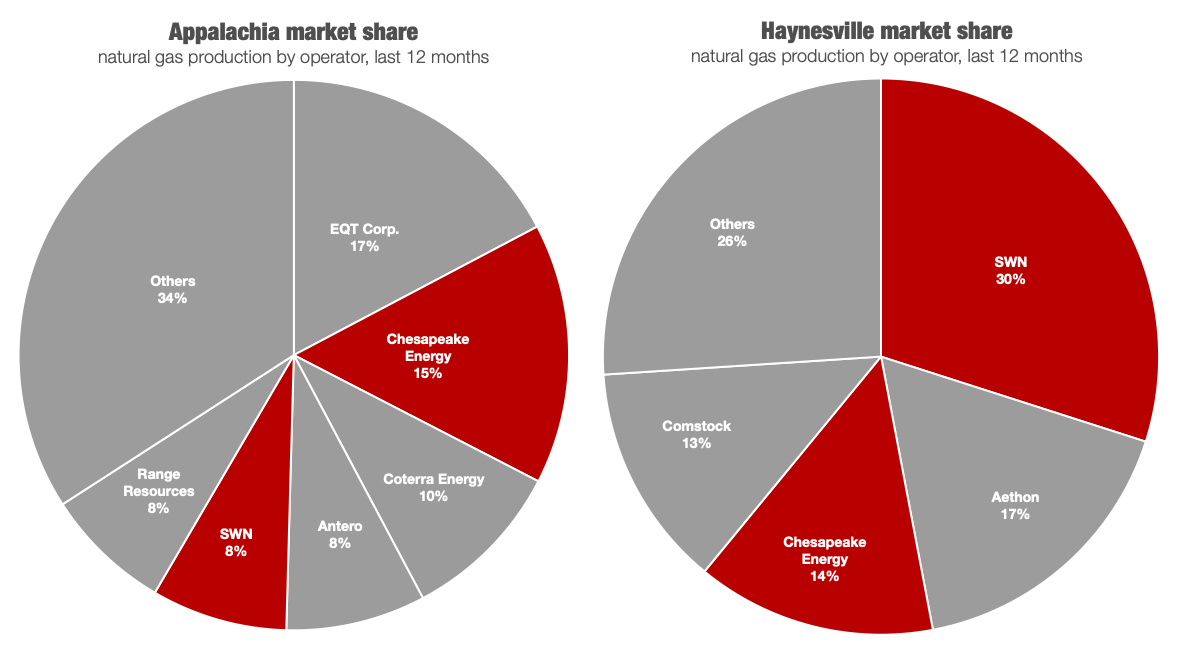

The deal would create the U.S.’ largest natural gas producer, but it is almost certain to face intense scrutiny as a wave of consolidations, largely oil-focused, has already raised the hackles of some Congressional Democrats.

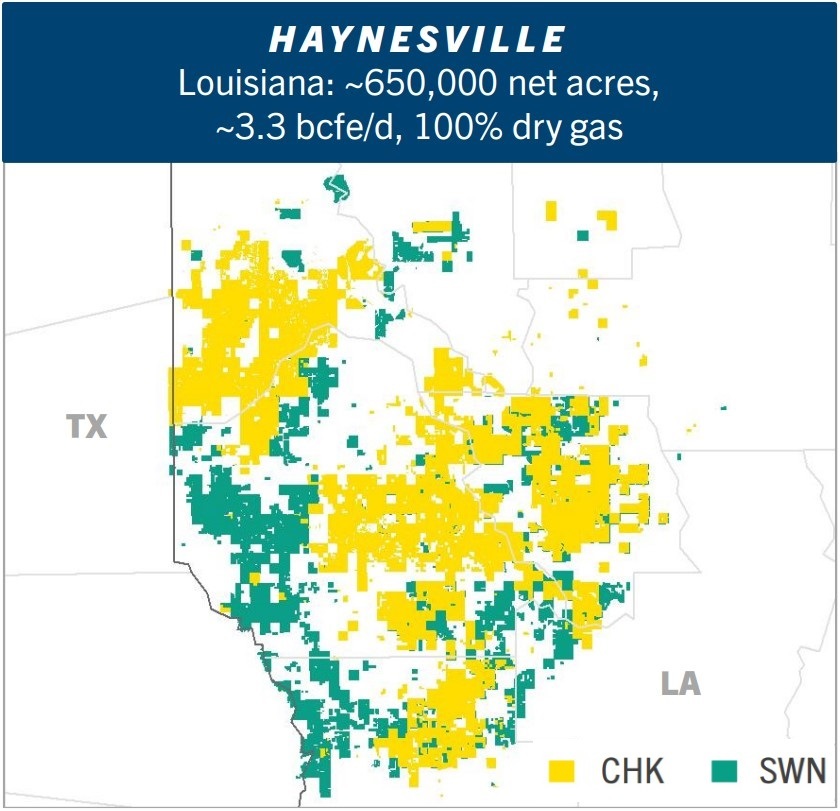

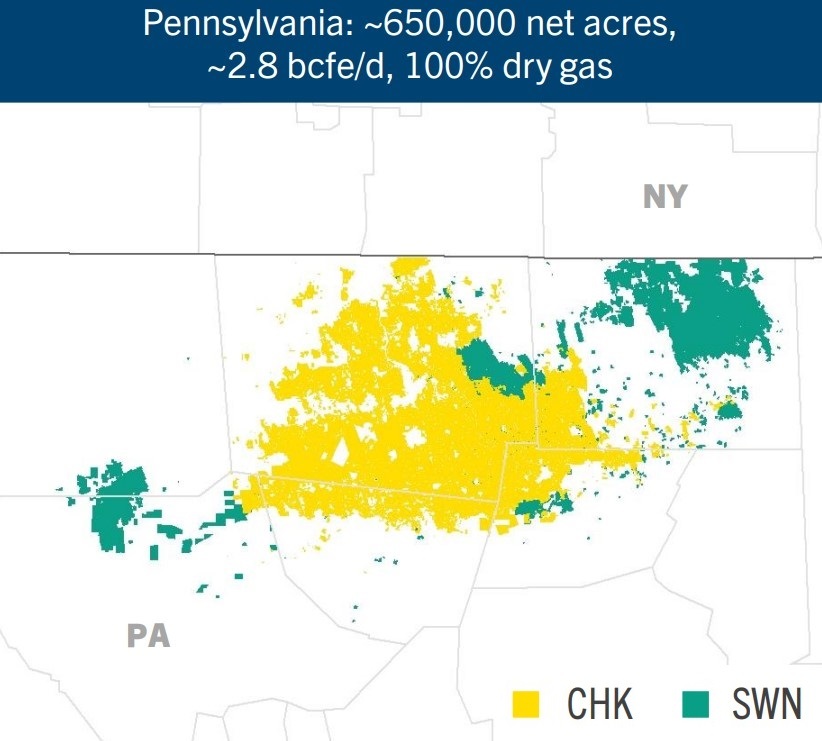

The deal unites Chesapeake and Southwestern’s Appalachia and Haynesville portfolios into a pro forma company with average net production of approximately 7.9 Bcfe/d. The company would have more than 5,000 gross locations and 15 years of inventory.

The companies have also identified $400 million in synergies through improved capital efficiencies and operating margins — driven by longer laterals, lower drilling and completion costs, G&A reductions and the utilization of shared operational infrastructure.

Chesapeake and Southwestern said the deal would be immediately accretive to operating cash flow, free cash flow, cash dividends, net asset value and return on capital employed.

Chesapeake, which emerged from bankruptcy nearly three years ago, and Southwestern envision creating a global platform to expand their marketing and trading business to reach more markets and mitigate price volatility.

The combination “redefines the natural gas producer, forming the first U.S. based independent that can truly compete on an international scale,” said Nick Dell'Osso, Chesapeake's president and CEO.

“The world is short energy and demand for our products is growing, both in the U.S. and overseas,” Dell’Osso said. “We will be positioned to deliver more natural gas at a lower cost, accelerating America's energy reach and fueling a more affordable, reliable, and lower carbon future. I look forward to leading the talented workforce of the combined organization to accelerate the long-term value opportunity for our shareholders, employees, and all stakeholders."

Southwestern President and CEO Bill Way said the transformational combination “can drive improved margins and returns from our highly complementary portfolios through enhanced scale, capital allocation flexibility, and access to premium markets to supply growing global natural gas demand.”

“Most importantly, both sets of shareholders are able to participate in the substantial value creation and future growth opportunities of the combined company, with one of the top shareholder return frameworks in the sector,” Way said.

Under the terms of the agreement, Southwestern shareholders will receive 0.0867 shares of Chesapeake common stock for each share of Southwestern common stock outstanding at closing. At this exchange ratio and the respective share prices on January 10, 2024, the combined company would have an enterprise value of approximately $24 billion.

Pro forma for the transaction, Chesapeake shareholders will own approximately 60% and Southwestern shareholders will own approximately 40% of the combined company, on a fully diluted basis.

Mark Viviano, a managing partner and lead portfolio manger of Kimmeridge’s public investment team, said the firm is highly supportive of the merger.

“It aligns with our long-standing framework for successful consolidation and is one of the few transactions in the sector where one plus one should turn out to be much greater than two,” Viviano said.

“We believe it will be one of the few must-own stocks in the sector, especially as investors recognize the significance of a leading Haynesville position into a historic buildout of LNG export capacity along the Gulf Coast.”

The resulting valuation re-rating opportunity associated with the deal and a market cap of close to $20 billion should ultimately see the company included in the S&P 500 and upgraded to investment grade, he said.

Following the merger, the board of directors of the combined company will increase to 11 members and will initially be comprised of seven representatives from Chesapeake and four representatives from Southwestern. Dell'Osso will serve as president and CEO of the combined company and Mike Wichterich as non-executive chairman.

The combined company will be headquartered in Oklahoma City while maintaining a material presence in Houston. The combined company will assume a new name at closing and will be “uniquely positioned to deliver affordable, lower carbon energy to meet growing domestic and international demand with significant, sustainable cash returns to shareholders through cycles,” according to a press release.

Evercore is serving as lead financial adviser, J.P. Morgan Securities LLC as financial adviser, Latham & Watkins LLP and Wachtell, Lipton, Rosen & Katz as legal advisers, and DrivePath Advisors as communications adviser to Chesapeake. Morgan Stanley also advised Chesapeake.

Goldman Sachs & Co. LLC. is serving as lead financial adviser and RBC Capital Markets LLC along with BofA Securities and Wells Fargo Securities LLC as financial advisers. Kirkland & Ellis LLP is serving as legal adviser, and Joele Frank as communications adviser to Southwestern Energy.

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.