In this 3D illustration, pipelines leading to an LNG terminal can be seen. Cheniere Energy’s expansion at the Corpus Christi Liquefaction (CCL) export facility is expected to be complete ahead of schedule, and the company generated second quarter revenues of approximately $4.1 billion and net income of approximately $1.4 billion, the company said in its second quarter earnings conference call on Aug. 3. (Source: Shutterstock.com)

Cheniere Energy’s expansion at the Corpus Christi Liquefaction (CCL) export facility is expected to be complete ahead of schedule, and the company generated second quarter revenues of approximately $4.1 billion and net income of approximately $1.4 billion, the company said in its second quarter earnings conference call on Aug. 3.

“Corpus Christi Stage Three is well ahead of schedule, increasing my optimism for that project being completed ahead of the guaranteed date,” Cheniere President and CEO Jack Fusco said.

Cheniere announced final investment decision (FID) on the seven-train project in June 2022, and the project is 38% complete. The midscale trains are expected to add 10+ million tonnes per annum (mtpa) production capacity to the export facility in Corpus Christi, Texas.

Cheniere said expected substantial completion of stage 3 is expected from the second half of 2025 to the first half of 2027. As of the end of June, engineering was 63.5% complete, procurement 56.3% complete, subcontract work 47.1% complete and construction 4.9% complete.

So far, more than 10,000 pilings have been installed and concrete for train one is more than 50% complete, Fusco said.

“Progress is way ahead of schedule,” he said. “I know that we have some very critical components for train one that have been shipped. They just haven't been received.”

Also at CCL, Cheniere is progressing its CCL Midscale Trains 8 & 9 Project, which would add about 3 mtpa capacity to the facility. In March 2023, the company filed for authorization from the Federal Energy Regulatory Commission (FERC) to site, construct and operate the project and in April 2023, filed for authorization from the Department of Energy (DOE) to export LNG.

Cheniere Partners is also expanding the Sabine Pass LNG (SPL) terminal in Cameron Parish, Louisiana. The facility currently has production capacity of 30 mtpa, and the three-train expansion is expected to add 20 mtpa. In April, Bechtel was contracted to handle the front-end engineering and design (FEED) for the expansion, and in May, the project entered a pre-filing review process with FERC.

Fusco is “guardedly optimistic” about the direction of the FERC and DOE.

“I think under Chairman Phillips, FERC is trying to act a little more in a bipartisan way. They've approved some major natural gas projects and specifically some LNG projects to move forward,” he said. “Similarly, I'd say at the DOE, Secretary Granholm was very clear when she discussed the critical role of U.S. LNG to support our allies in testimony that she recently gave to the House of Representatives. Those, to me, are really positive developments on the regulatory front for our expansion opportunity.”

During the second quarter, Cheniere also signed long-term contracts for up to 76 MMmt of LNG for delivery between 2026 and 2049. In June, Cheniere entered a long-term LNG purchase and sale agreement (PSA) with ENN LNG (Singapore) Pte. Ltd. for about 1.8 mtpa, starting in 2026. Also in June, Cheniere entered a long-term LNG SPA with Equinor for about 1.75 mtpa with delivery starting in 2027. In May, Cheniere signed an LNG SPA with Korea Southern Power Co. Ltd for about 0.4 mtpa starting in 2024.

“With the global LNG market expected to nearly double by 2040, hundreds of millions of tons of new LNG capacity will need to be developed to meet this demand,” Fusco said.

Updated guidance

For the second quarter of 2023, Cheniere logged revenues of $4.1 billion, net income of $1.4 billion and consolidated adjusted EBITDA of $1.9 billion, compared to the second quarter of 2022 revenues of $8 billion, net income of $741 million and consolidated adjusted EBITDA of $2.5 billion.

“Our second quarter results reflect the higher proportion of our LNG being sold under long-term contracts, less volumes being sold into short-term markets, continued moderation of international gas prices, as well as the operating cost and production impact from the major turnaround at SPL during the quarter,” executive vice president and CFO Zach Davis said.

Fusco said the forecast for the balance of 2023 has improved slightly.

“We're raising our full year guidance ranges by $100 million to $8.3 [billion] to $8.8 billion of consolidated adjusted EBITDA and $5.8 [billion] to $6.3 billion” of distributed cash flow, he said.

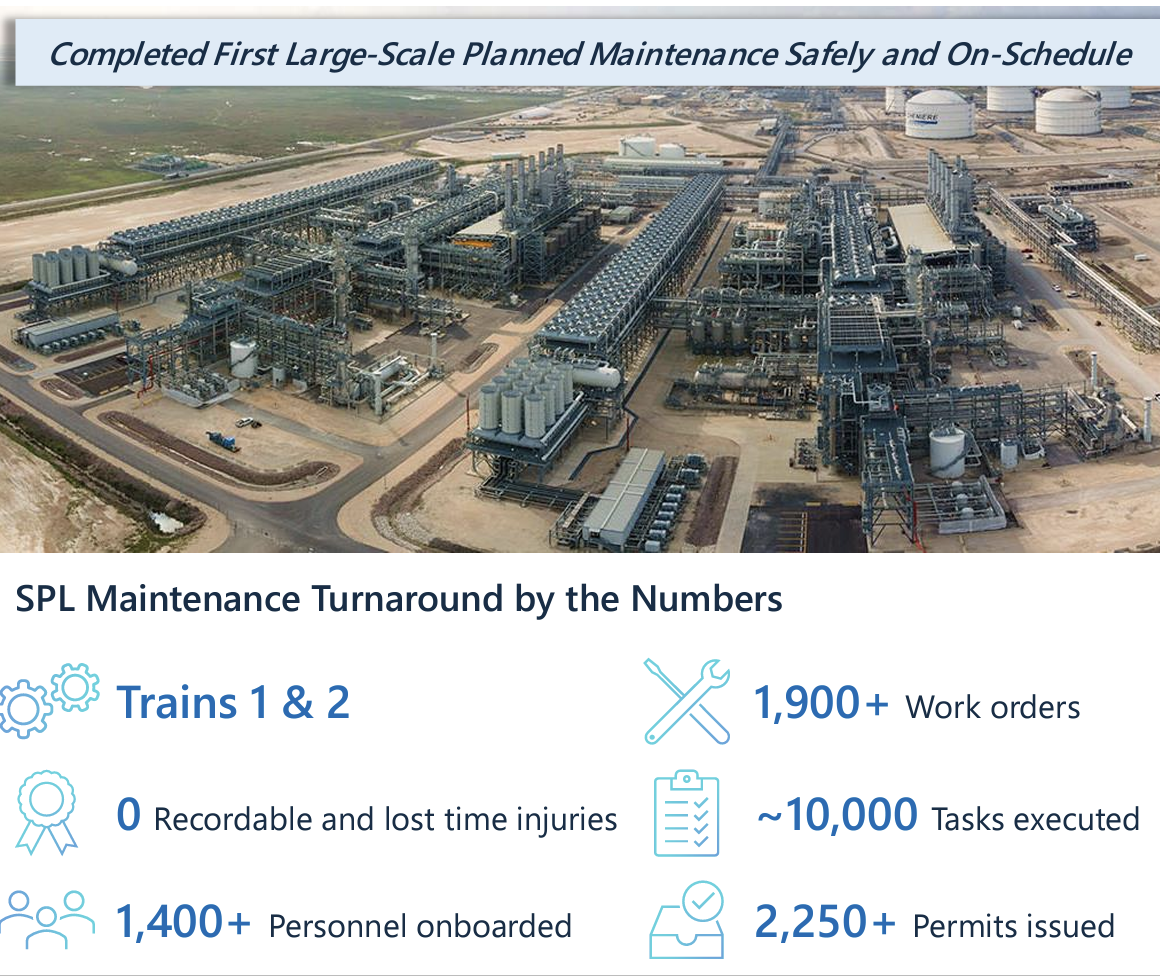

In the second quarter of 2023, Cheniere had 149 cargoes compared to 156 in the same quarter of 2022. The lower number relates to the planned maintenance turnaround at the SPL earlier this year, when Trains 1 and 2 were offline for about 25 days.

“This was the largest maintenance turnaround we've completed yet,” Fusco said, noting it was completed successfully on schedule and with zero recordable or lost time injuries. The turnaround required “approximately 10,000 total tasks across 2,000 work orders. With all of that work requiring over 2,250 permits to be issued, to have an effort like that completed in under four weeks speaks to the enormous amount of planning and preparation ahead of time.”

For the second quarter of 2023, Davis said, Cheniere saw income from 561 TBtu of LNG, of which 547 TBtu came from Cheniere projects and 14 TBtu was sourced from third parties. He said about 85% of the volumes were sold under long-term agreements.

“2024 may end up being our most contracted year ever on a percentage basis ahead of stage three coming online in 2025 and 2026, which is expected to grow our operating LNG portfolio to over 55 million tons per annum. Despite some near-term challenges in the market like cost inflation, higher borrowing costs and competition, the global market is clearly calling for new LNG supplies,” Davis said.

Credit upgrade

In late July, Fitch upgraded Cheniere to BBB from BBB-, Davis said.

“Now that we have achieved investment grade ratings across our corporate structure going forward, we are targeting a one-to-one ratio of de-leveraging and share buybacks on an aggregate basis,” he said.

During the second quarter, Cheniere repurchased 2.3 million shares of common stock for $337 million, he said, adding it is likely there will be “a catch-up trade over the next year or two in order to achieve that one-to-one ratio where our opportunistic repurchase plan will outpace debt repayment.”

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.