An oil extraction pump in Venezuela’s Zulia state. (Source: Shutterstock)

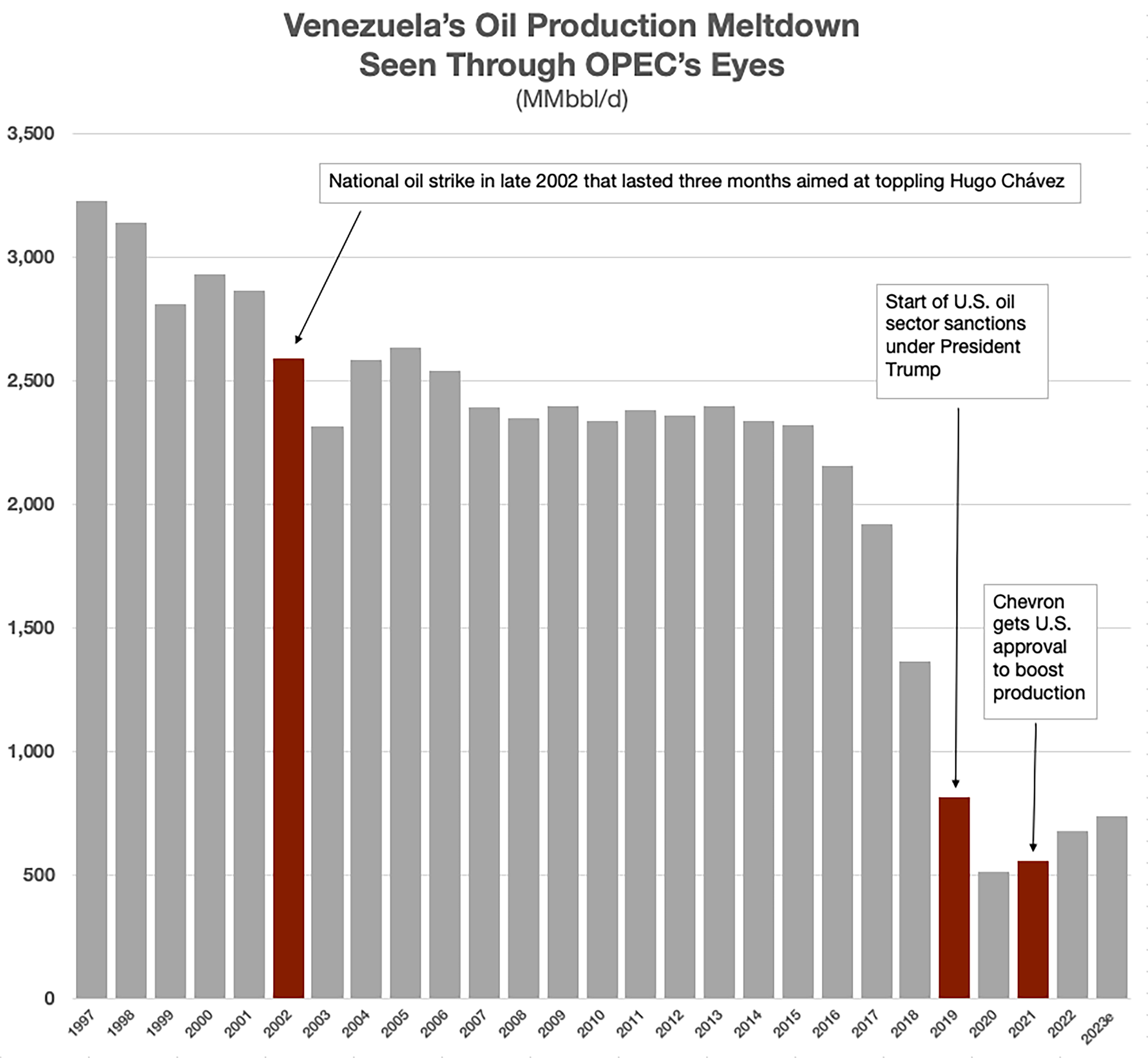

Venezuela’s oil production suffered under the watch of its so-called “socialist” leadership, and despite production growth of recent, the OPEC country is battling to break through a ceiling of what is seemingly 800,000 bbl/d.

Venezuela’s ability to break through the production ceiling will depend on a number of factors, including further easing of U.S. sanctions, which could spur additional investments. But, based on the direction of the current political spat between Washington and Caracas, Venezuela’s breakout moment may still be years away, if it happens.

Lost production between 1999 and the likely average this year of 734,000 bbl/d is on track to reach 2.07 MMbbl/d, according to data compiled by Hart Energy from OPEC monthly and annual reports.

In 1999, Venezuela’s late president Hugo Chávez inherited production of around 2.81 MMbbl/d. This compares to peak production of 3.23 MMbbl/d in 1997, two years prior to the leader taking office.

Venezuela’s production losses are a whopping 2.49 MMbbl/d over a quarter of a century, when taking into account the years beginning in 1997.

RELATED

LatAm Production to Grow 25% by 2028: IEA

Considering the oil prices spike during this time period, the lost revenue potential is nothing short of massive and probably even harder to swallow for leaders and citizens alike. The lost income coupled with political instability led to Venezuela’s great migration and the departure of over 7 million citizens in recent years.

U.S. oil sector sanctions imposed in 2019 by the Trump administration aren’t the only reasons why Venezuela’s production has sunk so low. Widespread oil sector corruption and a lack of investments are also part of a complicated equation.

Recommended Reading

Analysts: ‘Rare’ Summer NatGas Drawdown May Occur

2024-08-15 - A natural gas storage withdrawal for the Lower 48 may be in the cards this summer, the first to occur since 2016.

US Natgas Prices Ease to 2-week Low on Rising Output

2024-06-21 - The natural gas price decline came even on forecasts for hotter weather next week than previously expected.

Segrist: Gassed Up, Waiting to Go: Producers Aim to Remedy Gas Prices

2024-07-31 - The countdown clock for a surge in natural gas demand is ticking. Is the U.S. finally at the turning point?

EIA Forecasts Larger Decline in US Natural Gas Output for 2024

2024-08-06 - U.S. natural gas output will average around 103.3 Bcf/d this year, the U.S. Energy Information Administration said in its August edition of the short-term energy outlook report.

EIA NatGas Storage Report Comes in at 10 Bcf Above Forecast

2024-08-22 - Most of the additional gas in storage came from the Appalachian Basin. The Midwest added 19 Bcf and the East added 12 Bcf, according to the EIA.