The International Waterfront Complex and buildings housing Trinidad and Tobago’s Ministry of Energy and Energy Industries in downtown Port-of-Spain, Trinidad and Tobago. (Source: Shutterstock.com)

A recent deal between the U.S. and the Trinidad and Tobago federal governments opens the door for the country to tap into Venezuelan gas production from the offshore Dragon Field, part of the Mariscal Sucre project.

Potential production from the field is estimated at least 300 MMcf/d, based on historical data from Venezuela’s state-owned PDVSA.

Production from the project could give a much-needed boost to the Caribbean country’s declining gas production, which reached 2.8 Bcf/d in September 2022, compared to a peak of 4.52 Bcf/d in February 2010. Trinidad uses gas in its domestic market as well as to feed its LNG, ammonia and methanol export plants.

RELATED

Trinidad Launches Roadmap for Green Hydrogen Economy

“We applied to the Office of Foreign Assets Control (OFAC) in the middle of 2022 and have been working with our lawyers in DC as well as through other initiatives to be granted a waiver from sanctions to pursue the development of the Dragon gas field, which lies just about 17 kilometers across the border from our active Hibiscus platform,” Trinidad’s Prime Minister Keith Rowley confirmed Jan. 24 in an official remark from Trinidad’s capital Port of Spain.

Specific terms are still to be finalized, he said.

Trinidad’s Minister of Energy and Energy Industries, Stuart Young, didn’t immediately reply to questions from Hart Energy regarding the recent developments.

Trinidad is required to pay in kind, not in cash, said Bhoendradatt Tewarie, Member of Parliament at Caroni Central Constituency Office at Government of the Republic of Trinidad and Tobago, in an opinion piece published in the local press.

Dragon and Mariscal Sucre production potential

Dragon is just one of four fields to make up Mariscal Sucre, which is located offshore Venezuela in the northern Paria Peninsula.

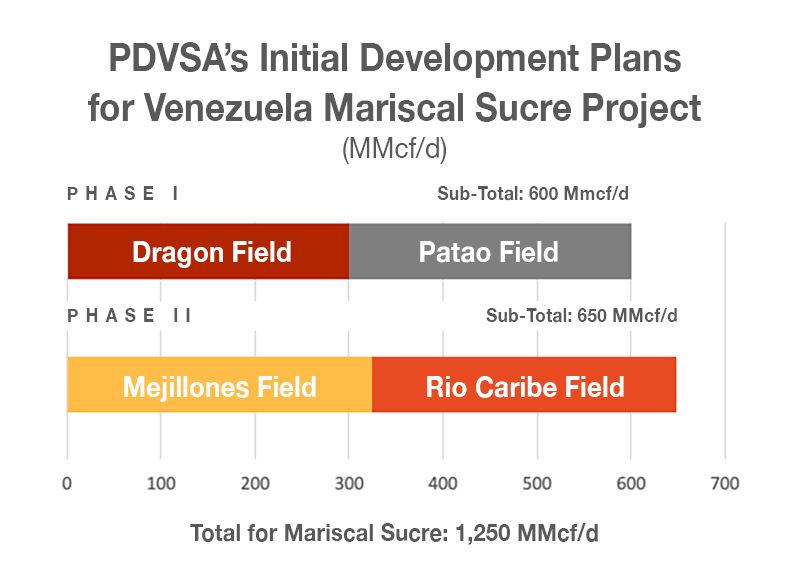

The four fields that comprise the Mariscal Sucre project include Dragon, Patao, Mejillones and Rio Caribe. Venezuela planned to develop the fields in two phases, according to the original development plan laid out in 2013 by former PDVSA president Rafael Ramirez.

In Phase I, Dragon and Patao were provide to 600 MMcf/d, while in Phase II, Mejillones and Rio Caribe were to provide 650 MMcf/d. The Rio Caribe Field was also to produce around 20,000 bbl/d of condensate. Primarily a lack of money tied to partner assistance has halted the project’s progression. Full production potential was envisioned for 2018, Ramirez back then.

PDVSA’s Initial Vision for Mariscal Sucre

Initial Dragon gas production was envisioned for Venezuela’s domestic market via a 36-inch diameter pipeline that was to span 99.8 km subsea plus 3.2 km onshore.

All the gas from Mariscal Sucre was initially destined for Venezuela’s domestic market and treatment at the PAGMI plant located within the CIGMA complex in Güiria, Venezuela. The gas was to feed thermoelectric plants, residential, commercial and industrial (especially petrochemical) sectors in Venezuela, according to PDVSA.

The government of then-President Hugo Chavez also envisioned construction of a 4.7 million ton per year liquefaction plant at CIGMA to export gas from Mariscal Sucre as well as from the Plataforma Deltana project, although none of the plans came to fruition.

Venezuela, besides possessing the world’s largest oil reserves, is also home to sizable natural gas reserves. However, a lack of partner commitments, infrastructure, gas production and more recently U.S. sanctions have prevented Venezuela from completely connecting the entire country to the gas grid and building an LNG export plant for excess volumes.

Recommended Reading

Gunvor Group Inks Purchase Agreement with Texas LNG Brownsville

2024-03-19 - The agreement with Texas LNG Brownsville calls for a 20-year free on-board sale and purchase agreement of 0.5 million tonnes per annum of LNG for a Gunvor Group subsidiary.

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

Asia Spot LNG at 3-month Peak on Steady Demand, Supply Disruption

2024-04-12 - Heating demand in Europe and production disruption at the Freeport LNG terminal in the U.S. pushed up prices, said Samuel Good, head of LNG pricing at commodity pricing agency Argus.

CERAWeek: JERA CEO Touts Importance of US LNG Supply

2024-03-22 - JERA Co. Global CEO Yukio Kani said during CERAWeek by S&P Global that it was important to have a portfolio of diversified LNG supply sources, especially from the U.S.