Oil States International is perhaps best known for its manufactured products and services that support oil and gas drilling, completions, subsea installations and production, but the traditional energy service and equipment company is also carving out niches for itself in the renewables space.

The Houston-based company has diversified into deep-sea minerals gathering and offshore wind technologies while eyeing where it can help accelerate growth in other areas like CCUS and geothermal energy. This focus on diversification follows industrywide lessons learned from challenging post-COVID years and Russia’s invasion of Ukraine.

Balancing energy security, sustainability and affordability is essential; however, the unexpected can upend everything.

The COVID-19 pandemic brought profound challenges to companies throughout the industry supply chain: demand for oil and gas dramatically declined, inflation soared and market disruptions linger. Prices plummeted. On April 20, 2020, WTI sold at negative prices—the first time WTI futures contracts traded at less than $0 since entering the market in 1983.

“It was a gut-wrenching moment for any company, certainly ours,” said Oil States CEO Cindy Taylor, who is also on the board of directors for the Federal Reserve Bank of Dallas. “PPP loans supported small, privately owned businesses. The Main Street Lending Program focused on investment grade entities, so companies like ours were unable to participate. We had no choice but to cut costs and cut costs fast and deep, which included reducing our global workforce by about 30% in 2020.”

But Oil States has largely recovered. Backlog growth reported this summer in its offshore manufactured products segment reached its highest levels since the end of 2015, which supports further growth through 2024.

“There is now growing acceptance that conventional oil and gas development is critical, and will be needed for decades in the future,” she said.

Taylor grew up in Goldthwaite, a small town in the center of Texas, but she has traveled the world during her career in the energy business and witnessed the impacts that the business and its leadership can have on global economies. She’s seen livelihoods destroyed during times of dictatorship as oil production fell in Venezuela and citizens adjusted from enjoying a progressive economy to standing in breadlines. She’s also seen oil workers elsewhere demoralized, despite their efforts to provide affordable and reliable energy to the world.

“It gave me a great perspective about a lot of things we’re talking about,” she said.

Velda Addison, senior energy transition editor, Hart Energy: A common theme seen nowadays is reducing emissions. How is Oil States using its core expertise to pave a path toward a global energy mix that’s both lower carbon and multi-sourced?

Cindy Taylor, CEO, Oil States International: What we’re trying to do is take our core technologies, our core expertise that we’ve developed over decades and apply them in newer applications. What I tend to ask is, “What are we really good at? Where do we have differentiated market share and can that be adapted into new applications?” If you think about electrification, or battery storage, if you think grid infrastructure development, you’re going to need the critical metals and minerals that build out the infrastructure. We don’t mine to a large degree in the United States. I think probably 90% of these critical metals come from China or Chinese-controlled mines right now.

If we’re going to progress, decarbonize and electrify, we will need the metals. Where are they and where is the least intrusive environmental footprint to source them? Open pit mining is a common source today but it can take years of overburden removal to reach the critical metals.

Put that into contrast to what Gerard Barron, CEO of The Metals Company, Allseas and Oil States is working on. There are polymetallic nodules located in the Clarion-Clipperton Zone of the Pacific Ocean, as well as in other deepwater regions around the world. Think deepwater offshore, middle of nowhere, but the metals are very accessible using deepwater oil and gas technology. Possibly complicating the development is defining who owns that resource. There’s an International Seabed Authority under the auspices of the United Nations that is looking at potential environmental impacts from retrieving the metals off the seabed. We’ve already developed the systems to move the nodules up to the floating surface vessel. What we have done is take core expertise around our oil and gas riser systems—our industry produces oil and gas offshore in deepwater and has for decades—with a vertical conduit, basically from the seabed to the floating facility for oil and gas. We can do the same—with modifications—to source these metals off the seabed. So, that’s one avenue of using core technologies in new applications.

VA: What other product development or technology initiatives are underway at Oil States?

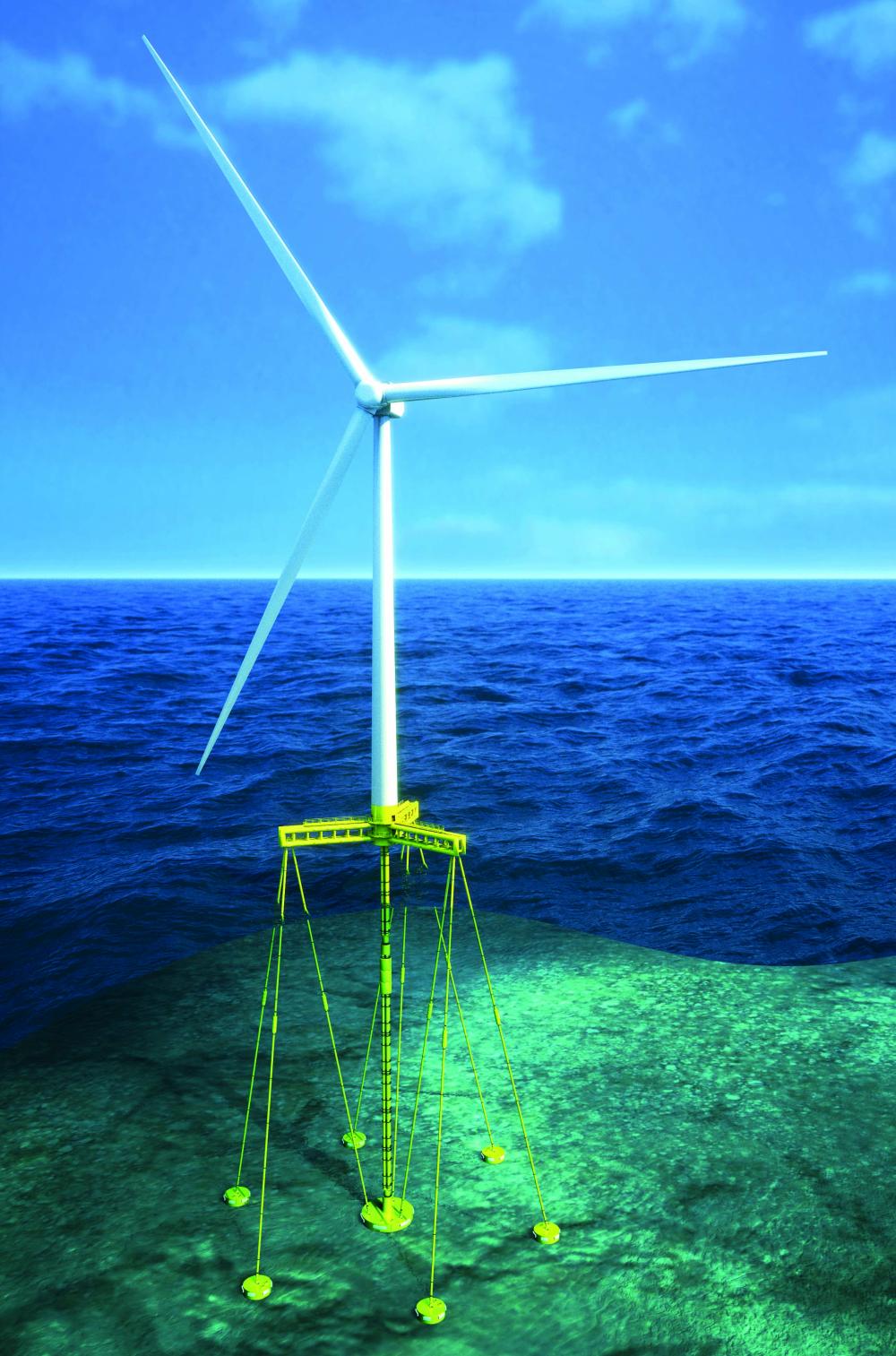

CT: Another area of investment for us is floating production facilities offshore for use in wind applications. Over the last five to seven decades in the traditional oil and gas space, we’ve moved from fixed platforms near the shore to ultradeep platforms in floating harsh environmental conditions. We believe that offshore wind developments will take the same trajectory. We’ve developed a great application around a fixed tension leg platform (FTLP) that is designed for wind applications. The goal is to decarbonize the manufacturing process, the installation process and drive the cost down to be economic to the consumer. That’s the real rub with most of the energy transition investments. These platforms are very, very expensive. So, we’re trying to condense the size of the platform and yet make it secure because the wind turbines need stability. Think about the movement and the vibrations, the wear and tear which can reduce the life of a wind platform if you don’t have needed stability. Both stability in the seabed and wave dynamics are in play.

We’ve tested our wind FTLP in a simulated environment. One is not yet installed; it’s a prototype. But through academic research and engineering data analysis, we’ve simulated testing in up to 150 meters of water depth and 20 meters of wave height. The next step is to actually build a real FTLP system, put it on a lease and allow it to work. Reducing the carbon footprint and scaling the equipment to make the investments economic are challenges that we all face. Our expectation is that the FTLP system for offshore wind comes to market in 2026 at the earliest.

We also have the potential for geothermal applications, using our Merlin riser system technology, which is commonly used in oil and gas. These environments require a very intense connection system that can withstand high temperatures. Geothermal power is created by accessing heat, but you’ve got to be able to transport that heat from fractures deep in the earth back up to the surface. This process requires incredibly robust equipment that is capable of handling the high temperatures. You inject cool water, but then you heat it up subsurface and bring it back up. We have the equipment and the technology, but success is going to be very location specific just by the nature of geothermal applications. These are examples of things that we’re focusing on, but we’re not trying to be all things to all people. There are certain capabilities we have that can be adapted to new applications drawing upon our own abilities, manufacturing capacity, global facilities, as well as our cash flow to enable these technologies.

VA: Let’s go back to the critical metals or minerals. Companies such as Exxon Mobil and Chevron have announced they are getting into the critical minerals market. Can some of your equipment be adapted for use onshore?

CT: Yes, it can, but … if it’s mining, not so much. I personally think there is going to be very limited open pit mining allowed in this country. Time will tell. Just from the history we have in oil and gas permitting, coupled with the environmental issues associated with mining, I just don’t see the United States permitting mining on a large scale. If you go offshore, into the deep water—there are going to be environmental issues there that also have to be addressed—but I think the world has to accept that all of these technologies have tradeoffs. Which one is the least intrusive? First of all, there is no truly carbon-free energy other than nuclear. We can all debate whether you will ever achieve net-zero carbon emissions or not. The point is, this industry is not resistant to expanding our capabilities and investing in newer technologies. There are certain things that I think we do well that provide avenues for us to grow newer technologies. I would first rank the minerals riser gathering systems for us in the metals recovery, again, assuming we’re allowed to gather the minerals long term.

Wind is also a good solution for us but will develop over time. Westwood [Global Energy Group] projected that there needs to be 26,500 offshore wind turbines installed over the next seven years. That’s a huge number! I don’t think anybody appreciates the supply chain impacts of even trying to engineer and manufacture this number of wind platforms. Right now, we’re looking at water depths up to 150 meters for our FTLP wind system. To my knowledge, there are no vessels yet built to install them. So, just think about the scope and scale of what we’re talking about. That’s the reality check that people are beginning to appreciate. I was at a conference on the West Coast and we literally went through almost every transitional technology from geothermal, CCUS, direct air capture, electrification via wind, solar, etc. The realization is they’re all going to take longer; they’re all going to cost more and they’re difficult to scale. That’s going to be the major challenge that we face. There’s no silver bullet out there.

VA: So, the Inflation Reduction Act (IRA) attempted to solve some of these issues or at least help solve some of these issues. Are you seeing any benefits from the IRA for Oil States?

CT: I’m going to say not yet and let me give you one reason. When we talk about our mineral riser gathering system, we’ve invested in research and development and spent capital equipment dollars already. The same is true for the FTLP system, but much of that is being developed in the United Kingdom and Europe right now because they’re so far ahead of the United States from a permitting perspective. The benefit of that technology will absolutely come to the United States, but we don’t get credit for that under the IRA because monies were invested outside of the United States. That’s one of the areas that I wish we could change. If you’re not manufacturing in the United States, spending the money in the United States, you cannot access the IRA. But I can tell you we, as a country, will benefit from the technologies that we’ve invested in elsewhere.

We do have credits that we’re getting from the United Kingdom because of the initiatives that we’re taking but they are less lucrative. Areas like Scotland are probably a decade ahead of the United States as it relates to offshore wind permitting. We want all these clean decarbonized energy sources, but heaven forbid, we don’t want to look at a windmill out our window. Right? I think it’ll shock people that Texas is the No. 1 producer of wind energy and the No. 2 producer of solar energy in the United States. Everybody thinks, “oh, those people in Texas, all they care about is oil and gas.” Not true. If you go up to the East Coast and start building out the windmill systems that we have in Texas, you’re going to get massive resistance. So, offshore is a solution because the infrastructure is not in line of sight.

VA: What is Oil States’ role in the energy transition?

CT: We want to take a leadership role in being a vocal advocate for our industry and a conduit for decarbonization long term. I think that statement probably sums it up pretty well. We’re small though. We have to do what we can do economically, feasibly, for technology investments that we believe have long-term benefit to our company and to our shareholders. We have existing technology that can be adapted to benefit these future applications. Part of our corporate strategy is to progress from largely supporting the oil and gas industry to supporting a multi-sourced energy mix, which we believe the world will need over the long term.

VA: You’ve mentioned permitting, which has been an issue in the United States. Do you have any suggestions or ways to improve the situation here?

CT: First of all, governments control access and regulations in the various regions that we operate in. I’m the most optimistic person you will ever meet, but I get really down when I see dysfunction in our own government with so many issues becoming politicized. Permitting in the oil and gas world has become very politicized and those barriers have to break down. I fear that it will take a crisis for that to reverse. Europe averted a bit of a crisis last year. You can advocate for ESG, strive to be net-zero all you want, make investments in wind, but you’d better be thinking where your energy source comes from and ensure that they are both reliable and affordable. With United States permitting—it can be for oil and gas, it can be for mining, it can be for wind or nuclear—I don’t think the American people fully understand the complexities of this transition, nor do they understand the cost.

We, on average, in Texas anyway, probably pay $0.13 a kilowatt hour, which is about 25% lower than the national average. If you were to say to the consumer, this energy transition is going to cost you $0.20 [ per kilowatt hour] to $0.50 a kilowatt hour, do you think that attitude would change? It would, but that’s what we have to address. Fifty percent of our population in the most advanced economy in the world has virtually nothing saved for retirement, according to the Wall Street Journal. How do you know that and say your gasoline is going to cost more and your power is going to cost more? Over half of the United States population lives paycheck to paycheck. There are real economic consequences that demand leadership from our government. Our debt to GDP is the highest it’s ever been, and we really haven’t rolled over to paying the higher interest rates on our government debt that have been raised to control inflation, which was largely triggered by the COVID pandemic-induced lockdowns.

All these things are interrelated. We rely on governments to lead and to fund infrastructure, and our government right now is deeply divided. I fear it takes a crisis, much like what Europe suffered, for this to trigger a greater sense of realism. We need to focus on permitting and planning infrastructure investments. Environmental groups should answer to a higher body as well. They have banged on the door of the Woodside CEO’s home in Australia, and they have boarded ships in transit to the Arctic. These things have to be stopped. They’re dangerous to the population and to the people doing it. It’s one thing to be aspirational around net zero and alternative energy solutions. But if you believe that a crisis could ensue, let’s drop all the rhetoric and start working together.

VA: Do you think we need to become more realistic about these net-zero goals globally? The IRA has all these incentives for renewables but you’ve mentioned the permitting problem, and then there are transmission challenges in getting connected to the grid.

CT: We are blessed in this country. Yet, somehow, we convince ourselves that we’re not. There are millions of people who have no access to energy at all. One of the very small members of OPEC last year—calm, collected, not offensive—just simply said, my small country’s economy is very dependent on the revenue we generate from oil and gas production. My citizens consume the equivalent energy of one refrigerator. Why are you asking us to reduce my country’s revenue to support the consuming nations in Europe and the United States by lowering the price of oil? It’s a great question.

We consume, on average, 20 times more energy than a lot of people in the world. So, there also has to be the recognition that we need the rest of the world to come up to adequate living standards similar to what we’ve enjoyed. You have to accept that there are other views outside of these held in the United States and other developed economies. That doesn’t mean we shouldn’t invest in new technologies, but they have to be secure, reliable and affordable. We have to consider other parts of the world and their need to grow and develop, which demands energy. Let’s just be honest with each other; recognize that we’re going to rely on conventional oil and gas for a long time, but that the industry can fuel investments in longer-term, lower carbon technologies. The more technology we create in developed countries, will allow us to deploy those technologies, in theory, at a lower cost to lesser developed economies. This can be a winning proposition if we can work together to solve problems and achieve these goals.

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Keeping it Simple: Antero Stays on Profitable Course in 1Q

2024-04-26 - Bucking trend, Antero Resources posted a slight increase in natural gas production as other companies curtailed production.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.