Exxon acquired drilling rights for more than 100,000 gross acres in southern Arkansas for lithium brine production. (Source: Shutterstock)

Exxon Mobil’s early foray into lithium brine production is “looking more and more promising,” CEO Darren Woods said in third-quarter earnings.

Spring, Texas-based Exxon Mobil Corp. looks to deploy $17 billion into low-carbon investments in the coming years, including carbon capture, hydrogen and biofuels.

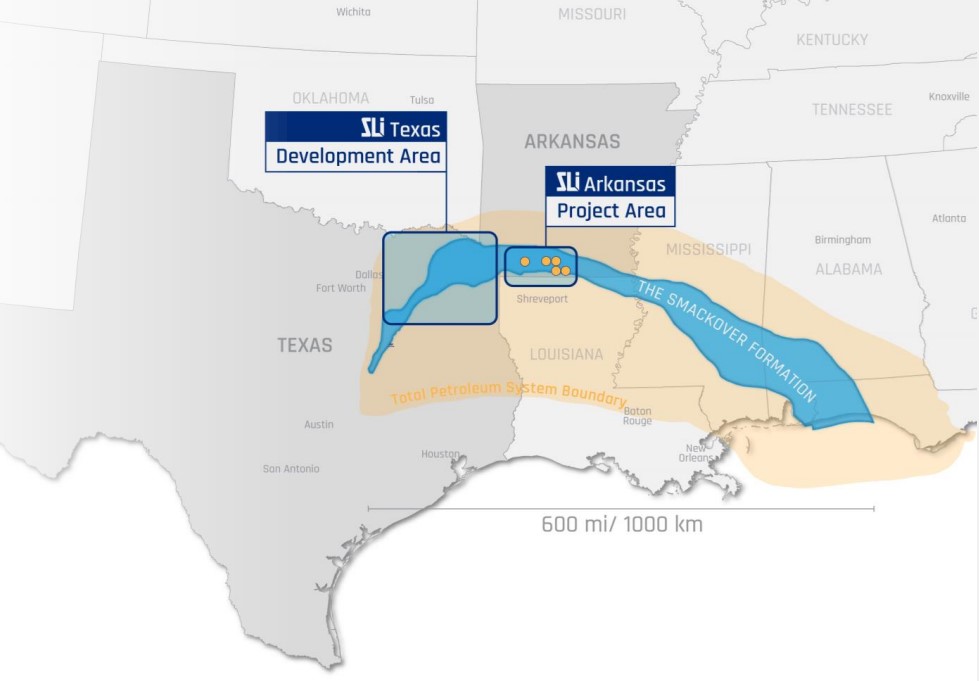

But the U.S. oil and gas giant has also quietly evaluated opportunities to produce lithium from brine water in the Smackover formation, Woods said.

“It fits very well with our capabilities and on the cost of supply curve,” Woods said during Exxon’s third-quarter earnings call with analysts. “It’s very competitive, so it looks attractive.”

RELATED

CEO Darren Woods: Exxon Mobil Can Produce Lithium at ‘Much Lower Cost’

So far, Exxon has kept its plans around lithium production close to the chest.

The company acquired drilling rights for more than 100,000 gross acres in southern Arkansas for lithium brine production, The Wall Street Journal reported in May. An Exxon subsidiary, Saltwerx LLC, signed a memorandum of understanding with services company Tetra Technologies Inc. to develop Smackover acreage for potential lithium production, Reuters reported.

Woods said Exxon has challenged Dan Ammann, president of its Low Carbon Solutions segment, to develop a business plan for lithium production that can effectively compete for capital in Exxon’s project portfolio.

“As Dan and his team develop that concept and that potential business, that’s looking more and more promising,” he said. “We see an opportunity to really leverage the things that we’re pretty good at in the base case, and it’s very synergistic with our traditional businesses.”

Other players are also seeing opportunities for lithium production in the Smackover Formation. In early October, Canadian firm Standard Lithium confirmed it found what is believed to be the highest grade lithium brine in North America in the East Texas portion of the Smackover Formation.

Permian Basin giant Pioneer Natural Resources—which Exxon inked a deal to acquire in a $60 billion megadeal last month—has reportedly experimented with mining lithium from wastewater produced from oil and gas extraction, per Bloomberg.

RELATED

The ‘White Gold Rush:’ Extracting Lithium from Alberta’s Wastewater

Closing Denbury deal

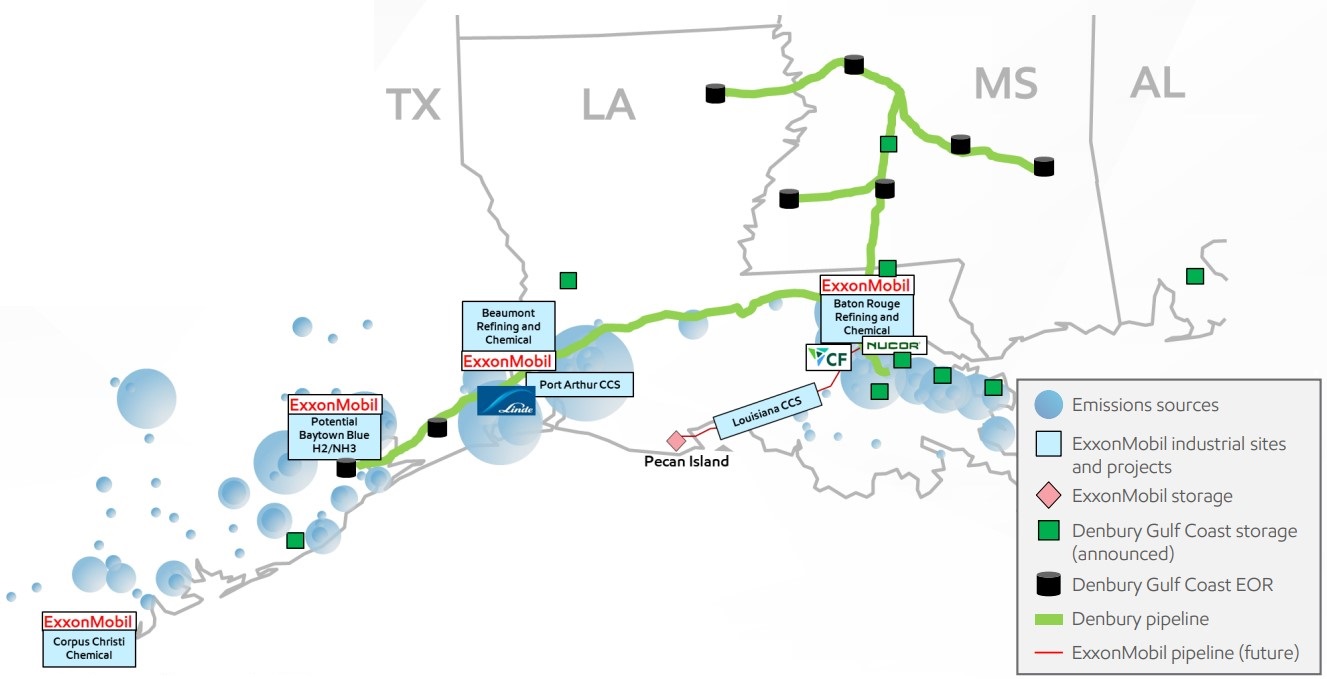

On Nov. 2 Exxon Mobil closed its $4.9 billion acquisition of Denbury Inc.—a deal bolstering Exxon’s capabilities in carbon capture, utilization and storage.

Denbury’s portfolio includes the nation’s largest network of CO2 pipelines and access to 10 onshore sites for permanent CO2 sequestration.

Plano, Texas-based Denbury uses its 1,300-mile CO2 pipeline network, somewhat paradoxically, as part of a process to produce barrels of oil. The company’s core business is EOR, where CO2 is injected under pressure into oil-bearing reservoirs to maximize oil recovery from a field.

Exxon was more interested in the existing pipeline network and storage sites, rather than Denbury’s relatively small amount of incremental oil production. But adding Denbury’s EOR assets is expected to provide Exxon immediate cash flow of about $600 million per year.

Denbury reported that its shareholders overwhelmingly approved the combination with Exxon during a special stockholder meeting held Oct. 31.

“We see the potential to drive strong returns with the capacity to reduce the nation’s carbon emissions by 100 million tons per year,” Woods said.

“That’s 20 times our current CO2 offtake agreements with CF Industries, Linde and Nucor, which by themselves could reduce CO2 emissions by an amount equivalent to replacing 2 million cars with EVs, roughly the same number of electric vehicles currently on U.S. roads,” he said.

RELATED

Permits, Policy, Profit: The Hang-ups with Large-scale CO2 Projects

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.