The current market is putting more focus on regualtory filing and transparency in oil and gas company’s filings and reporting, according to ESG Dynamics, which offers environmental data and compliance audits to quickly assess whether oil and gas companies are reporting ESG metrics consistently to the public. (Source: Shutterstock.com)

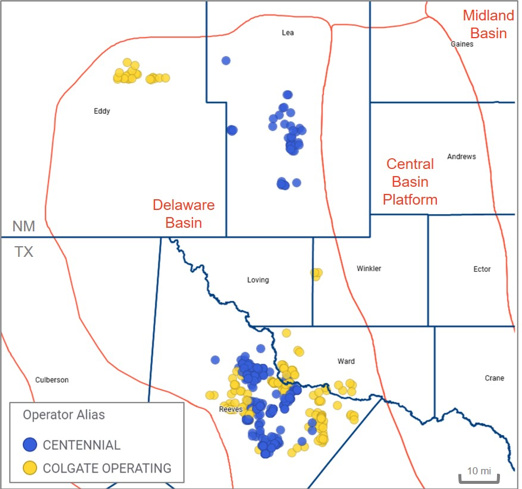

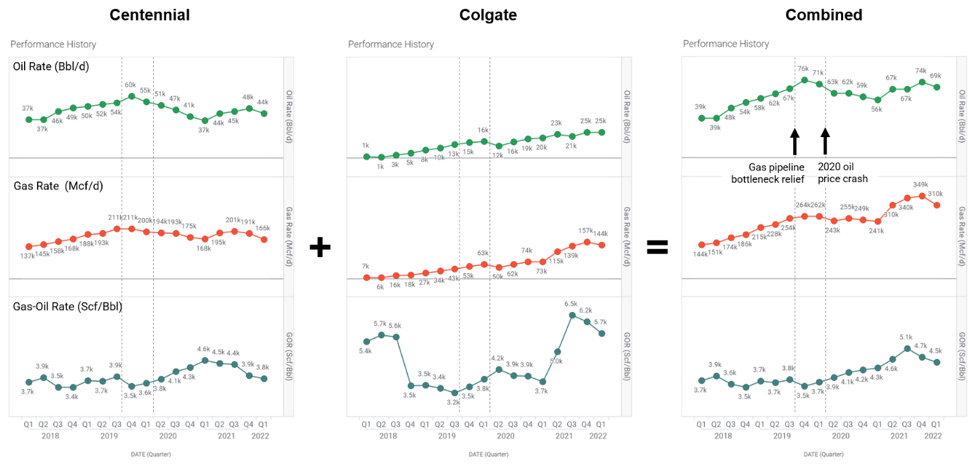

Centennial Resource Development and Colgate Energy plan to combine in “a merger of equals” valued at $7 billion. Both producers focus on the Wolfcamp core in Reeves and Ward counties in Texas with some New Mexico production. The new company becomes the largest pure-play Delaware Basin oil and gas operator.

The deal joins two compatible operators from an ESG perspective as Centennial emphasized in its investor presentation. Analysis of public data shows that both companies have reduced flaring emissions over the past two years. The combined entity holds fewer unplugged inactive wells compared to other top producers in the basin. Yet, oil spills have increased since 2018. Environmental regulatory reporting appears incomplete and data inconsistencies remain across various public sources. Will bigger be better when it comes to ESG performance?

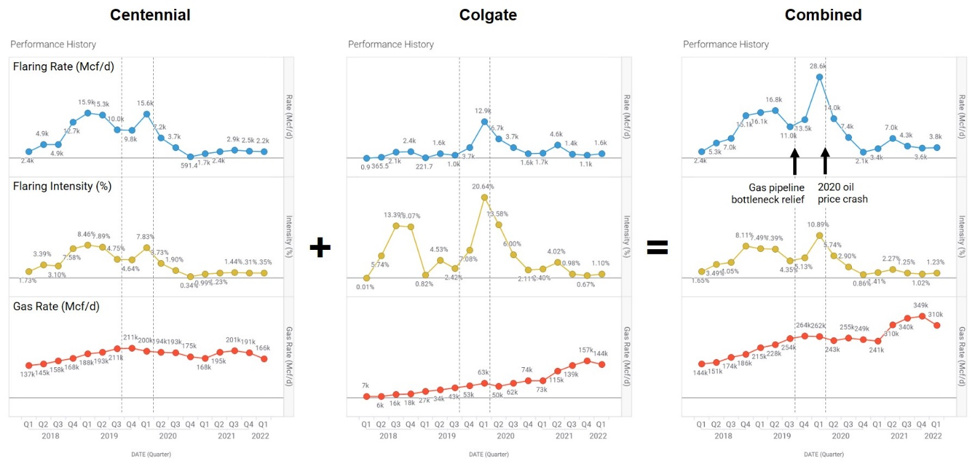

Reversing the gas flaring trend

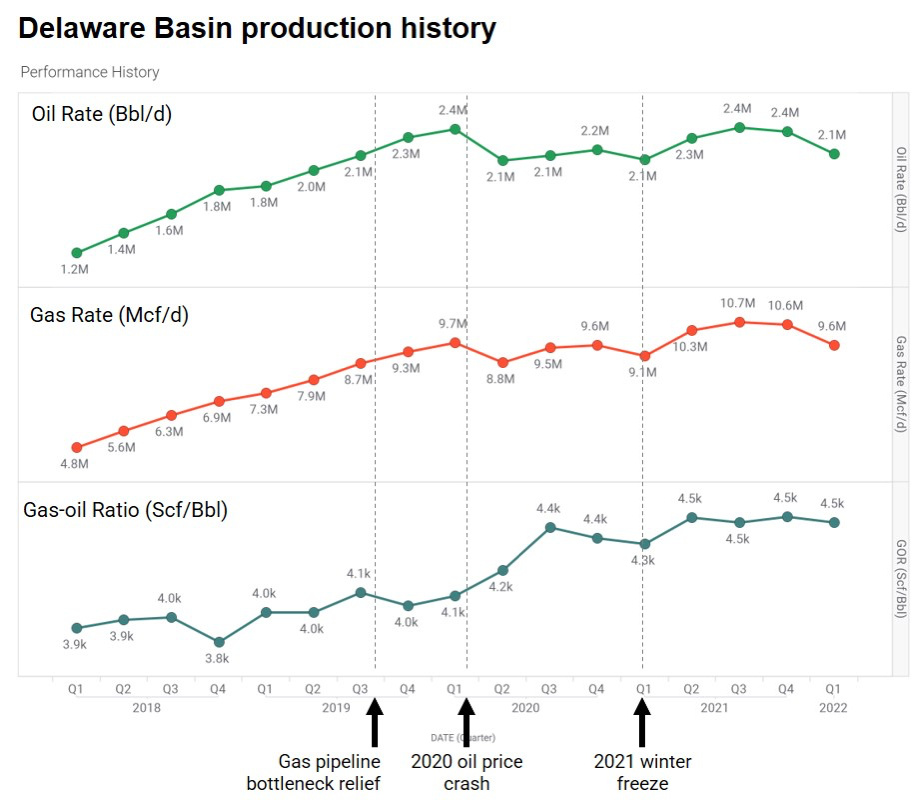

Centennial and Colgate flaring levels follow Delaware Basin historical patterns. Flaring rates rose from 2017 to mid-2019 as increasing drilling and completion activity and rising gas-oil ratio exceeded gas pipeline capacity. Flaring peaked in June 2019 at 389.6 MMcf/d, burning nearly 5% of produced gas. Centennial was flaring 15.3 MMcf/d then, above the basin average at a 7.9% intensity.

By September 2019, opening the Gulf Coast Express and other pipelines eased the bottleneck, relieving routine flaring by 30%. Shuttered activity with extremely low 2020 oil prices further reduced flaring by 40% that year.

Since November 2020, flaring stayed low across the Delaware Basin despite recovering rig activity. Year-end 2021 flaring reached a low of 52 MMcf/d and averaged less than 1% intensity. That’s 83% lower than pre-pandemic rates. More broadly, Permian Basin flaring intensity fell from 4.8% at year-end 2018 to 1.4% in early 2022, corresponding with increased gas production.

Centennial severely curtailed production in 2020, shutting in wells and laying down all rigs for several months. Oil production fell 40% throughout the year to 2018 levels, and has yet to fully recover. Both flared volumes and rate also dropped sharply. The company cut flaring intensity more than 95%, matching the basin average 0.75% in January 2022.

As a newer operator, Colgate’s flaring history also reflects asset acquisitions, along with regional pressures. With nearly continuous production growth, flaring intensity peaked in Feb 2020 at 30% of produced gas, or 19.5 MMcf/d flared volumes. The operator cut that to 6% a year later. Colgate continued to reduce flaring intensity to align with the basin average at 0.75% by year-end 2022, positioning itself to attract buyers.

Spilling more oil

Oil spill events and volumes have increased in Centennial operations since 2017, according to its 2021 sustainability report. Public data suggests that larger spills dominantly occur at tank batteries, caused by equipment failure. Centennial notes that it uses root-cause analysis to prevent future spills and reversing the upward trend may require further action. No spill data was found for Colgate operations.

Centennial’s sustainability report doesn’t compare directly with spills reported to the Texas Railroad Commission, due to data inconsistencies and different minimum volume thresholds for the two reports. Investors and other stakeholders commonly face these types of data challenges when evaluating ESG reports. Consistency matters as ESG disclosures gain attention, particularly under coming SEC requirements.

Remaining unplugged

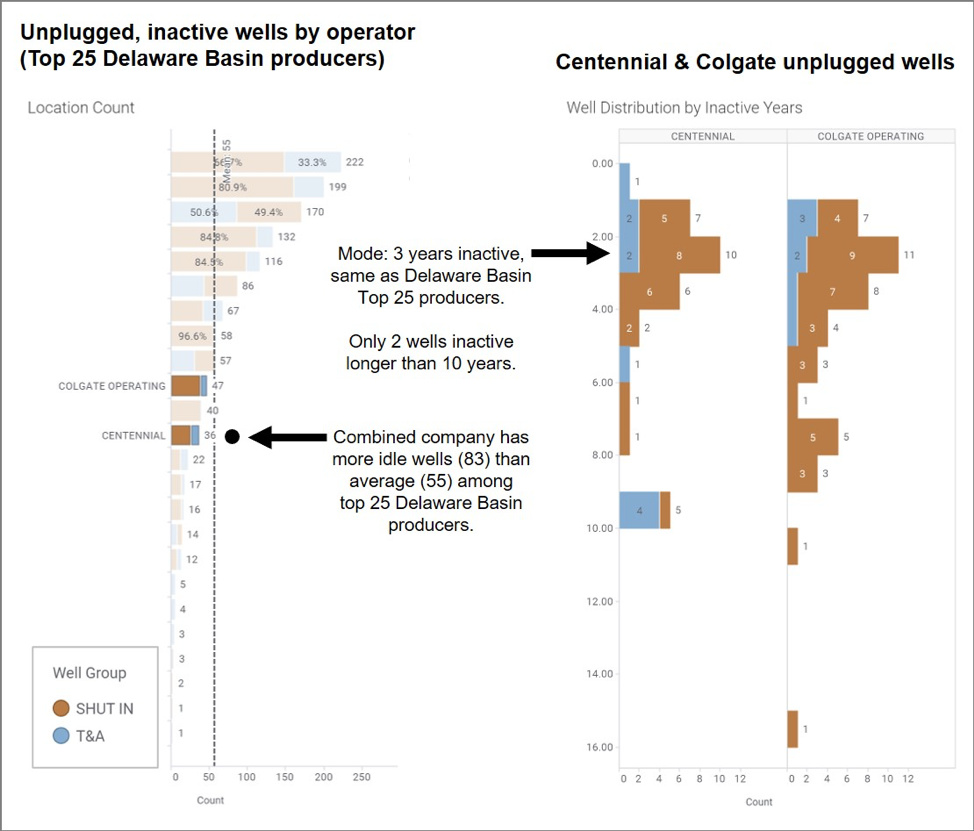

Each operator keeps fewer unplugged inactive wells than top Delaware Basin producers (Centennial: 36 and Colgate: 47). Together though, the new company will exceed the average (55) unless some wells are returned to production or properly abandoned. Of the combined 83 idle wells, most have been inactive less than four years. Only two remain unplugged after 10 years without production. This aligns with basin-wide norms.

Inactive wells can pollute air and groundwater as they deteriorate, if not plugged and abandoned. The Delaware Basin contains nearly 3000 non-producing wells, dominantly in Texas. Almost 20% of those remain unplugged after 10 years of inactivity. The largest concentration of Permian Basin inactive wells lies in older oil fields of the Central Basin Platform.

Moving toward sustainability

Like many smaller oil companies, Centennial and Colgate are in the early days of the ESG journey. Each published a 2021 sustainability report, though Colgate’s is not publicly available.

ESG Dynamics analysis of diverse public oil and gas data suggests both operators have room for improvement on environmental regulatory compliance and data consistency. Both companies should carefully review their filings and data sets—like oil spills, H2S, greenhouse gas and other air emissions—as they work through the merger. New SEC disclosure regulations will raise the profile of any ESG reporting differences for the fully public company.

About ESG Dynamics: ESG Dynamics offers environmental data and compliance audits to quickly assess whether oil and gas companies are reporting ESG metrics consistently to the public. We designed our ‘Health Check’ consulting service for operators like Centennial and Colgate, to benchmark ESG performance and identify environmental compliance gaps or violations before an asset transaction. By identifying and resolving issues early, companies can attract new assets and funding or sell to ESG-minded buyers. Our cloud-based Energy Explorer data analytics modules unite information from diverse sources to provide an integrated view of ESG performance.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.