When Jeff Voncannon formed an E&P company in 1992 at the age of 30 with $1,000, a card table, phone and fax machine, and a prayer, little did he know he would sell it a decade later for more than $20 million. A private Houston-based investor bought the company, Redman Energy Corp., and its 27.8 billion cubic feet of gas equivalent (Bcfe) of East Texas and South Louisiana reserves. Voncannon made the sale through investment-banking firm PetroGrowth Advisors, Dallas. Starting the company was not easy. At the time, he had a wife and three small children to support, now four. Voncannon began his career at Prairie Producing Co. as an engineer and held various management positions. When Prairie was sold to Unocal, he worked as an operations manager and helped run Prairie for about a year. Within Unocal he wanted a corporate planning position and through his persistence, he was offered a post even though he didn't have the typically required MBA and 15 years of experience. While helping to write business plans for Unocal, he learned everything he could about the business. He thought he would start his own production firm at age 50 but with the exposure he had gained at Unocal, he was ready at 30. Finding and development costs were cheap, on an historical basis, and he saw favorable long-term trends in the natural gas industry. "I knew I was an entrepreneur at heart," Voncannon says. "I felt I was ready." He had a meeting with his wife, parents and in-laws and said, "Please just give me a year. If it doesn't work out, I'll find a job." He received support on all fronts and his entrepreneurial dream was coming into focus. But he needed a name for the company. "In school everyone called me Red because of my red hair. I was golfing with a good friend of mine. We got ready to tee off and he said, 'Red man, what are you going to name your new company?' I paused and knocked the ball about 250 yards straight down the middle," he explains. So, Houston-based Redman Energy was born. "It was nice when I first began because people would assume there was a Mr. Redman, someone behind Jeff Voncannon." He had already developed a strategy, including an exit plan, but he knew he had to start small. So small in fact, he used a cardboard box to set his fax machine on, and other boxes until he could afford to buy chairs. "For quite a while I sat on a folding chair because it motivated me and reminded me to work hard." He managed to build the company without debt, or private equity. He didn't want to start off too quickly and assume large amounts of debt-a different approach than that used by many in the industry. "I had a portfolio of niche plays-sour gas, low-resistivity tight gas, and deep overpressured water-drive reservoirs in Louisiana and East Texas. That's what I learned as an intern: stick with what you know. Prairie and Unocal were developing those kinds of fields in East Texas and South Louisiana." He began by acquiring a small asset from his former employer, Unocal, and he focused on one or two wells at a time. He would put a deal together, form a partnership, then buy and operate the wells. He also did some consulting work, meanwhile. "I showed my first drilling venture 104 times. It had two prospects. The first well was in Freestone County in the Smackover, and it ended up producing 13 million cubic feet per day." The next well came in at 5 million cubic feet per day. "I was persistent-people said, 'Who is this red-haired kid anyway?' But the exposure to 104 companies was a great marketing tool-when the wells hit, people knew who we were and saw our success." He used cash flow to grow the company's assets. "I built the company without debt, the first five years. But to grow the company further we needed some debt." He chose Wells Fargo as the company's banker and says this was an important business decision. "One of the key ingredients of building a successful company is having a great banking relationship." By 1997, Voncannon had larger deals under way to acquire working interests in properties he was operating but did not own. "It's a process. Everybody wants to start out where I sold, but you can't always do it that way. It takes a while to build a strong portfolio and to create equity." Voncannon's philosophy "You need substance and style," he says of his company-development philosophy. "If you lack on anything, then lack on style, because you have to have substance and upside." Here's his test for acquisitions: "When we look at any deal, I ask my staff, 'What's the joy in it? Is it financial or technical? Is this going to develop us or defeat us?' If there is no joy, or it is going to defeat us, we pass on it." More advice: "You have to treat your people well. Every once in a while, I would shut down the office for the afternoon, and we would all go bowling, or on a picnic. Treat people well and they will work hard for you." He also believes that any management should always keep the eventual exit in mind when buying assets, and that the extra work put into the company will pay off in the end. "When we looked at niches we had to have strategy in each and to portfolio-manage within. We chose interests and projects that separated us from other independents. We found what required a little more capital and a little more engineering intensity, and were focused." The company would spend approximately 15% on drilling exploitation wells with higher risk, 40% on enhancements-laying a pipeline, workovers, putting what Voncannon calls the "Redman Magic" over it-and the remainder on buying PDP reserves. Voncannon always had audited financials and third-party engineering reports, to be prepared for any deal that came along. "You always have to know how your business is doing. I was organized from the start for any dataroom when it was time to sell." After 10 years of growth, he called Grant Swartzwelder, managing director, PetroGrowth Advisors, with whom he had discussed his options for many years. "I was playing black jack in Las Vegas and I knew what I had started with. When I cashed the chips in, it felt good to have money in my hand and still be playing the game," he says. He then realized it was time to cash in some of Redman. PetroGrowth was retained to look at Redman's liquidity options and value the company. Swartzwelder says, "We start all of our engagements with a blank sheet of paper. Most clients have already determined what action they would like to take, but it is important to step back and really understand all of the options available, and costs and benefits of each. To that end, we worked with Jeff to review all of the options to achieve his ultimate objective-liquidity." Redman's 27.8 Bcfe of reserves were 67% gas and 82% developed, split between East Texas and the Gulf Coast, mainly Louisiana. Daily production was about 32,000 barrels of oil equivalent. Alternatives like recapitalization, selling into a private partnership like those provided by GE Capital, or selling some or all of the company were analyzed with Redman's tax consequences and Voncannon's personal goals in mind. Initially Voncannon wasn't looking to sell the company but with guidance from PetroGrowth it was ultimately decided it was the best option, given the financial and divestiture market in 2002. "An ounce of preparation is worth a pound of value," says Swartzwelder. He explains that, from the beginning, Voncannon instituted all of the back-office and documentation work that helps make a company more attractive. "Spending a little money up-front for good title, engineering reports and such items will produce significant value at the end." Greater value could be achieved, having so much data already developed. Says Voncannon, "It's not the will to win, but the will to prepare to win." Swartzwelder says, "The biggest challenge in the sales process is accumulating the company's information and packaging it all coherently. A client's lack of organization or foresight can delay the process. That wasn't the case here." Also helping with the sale was the uniqueness of Redman's assets-sour gas in East Texas and the Gulf Coast. "People are either players in those areas or they are not," Swartzwelder says. The rewards of keeping the exit in mind when acquiring assets may be slower to come but the pay-off can be much larger. There were 15 dataroom visitors and seven bidders-a roughly 50% bid rate, reflecting a highly targeted marketing to prospective buyers. The transaction closed about three months after the offering memorandum was out. Voncannon, now 40, is starting again. He has formed a new limited liability company, Redman Enterprises LLC, with 10 years of experience behind him. Voncannon compares the current environment for an E&P start-up to be similar to that of 1992: very good. His philosophy remains the same: "We will continue to do what we know, which is East Texas, and the Gulf Coast of Texas and Louisiana. We will look outside those spots, but these areas have been very good to me and we understand them." At press time, he was working on a deal for East Texas assets. "I would like to be able to do what I did again, and I think I have learned a lot in these 10 years," says Voncannon. "I have taken it from a card table to where I am now. The exit is the key, to come full circle." By the way, Voncannon was a winner in Vegas. In fact, he more than doubled his money.

Recommended Reading

TGS Starts Up Multiclient Wind, Metaocean North Sea Campaign

2024-05-07 - TGS is utilizing two laser imaging and ranging buoys to receive detailed wind measurements and metaocean data, with the goal of supporting decision-making in wind lease rounds in the German Bright.

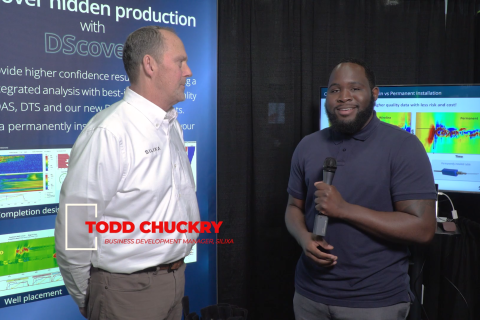

Exclusive: Silixa’s Distributed Fiber Optics Solutions for E&Ps

2024-03-19 - Todd Chuckry, business development manager for Silixa, highlights the company's DScover and Carina platforms to help oil and gas operators fully understand their fiber optics treatments from start to finish in this Hart Energy Exclusive.

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Cyber-informed Engineering Can Fortify OT Security

2024-03-12 - Ransomware is still a top threat in cybersecurity even as hacktivist attacks trend up, and the oil and gas sector must address both to maintain operational security.

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.