Chesapeake Energy and Southwestern Energy have agreed to merge and create the largest U.S. natural gas producer. Is the blockbuster deal a good omen for the midstream sector? The outcome is likely to depend on how several factors play out.

The two producers formalized the long-rumored tie-up on Jan. 11. Under the agreement, Southwestern shareholders will see their stock converted into 0.0867 shares of Chesapake Energy. The deal values Southwestern Energy at $7.4 billion, or a $17 billion combined market cap based on Chesapeake Energy's share price prior to the announcement. The to-be-named Chesapeake-Southwestern combo will have 7.9 Bcf/d of raw natural gas production as of the third quarter of 2023, and would be the top gas producer in the Northeast and ArkLaTex (Haynesville).

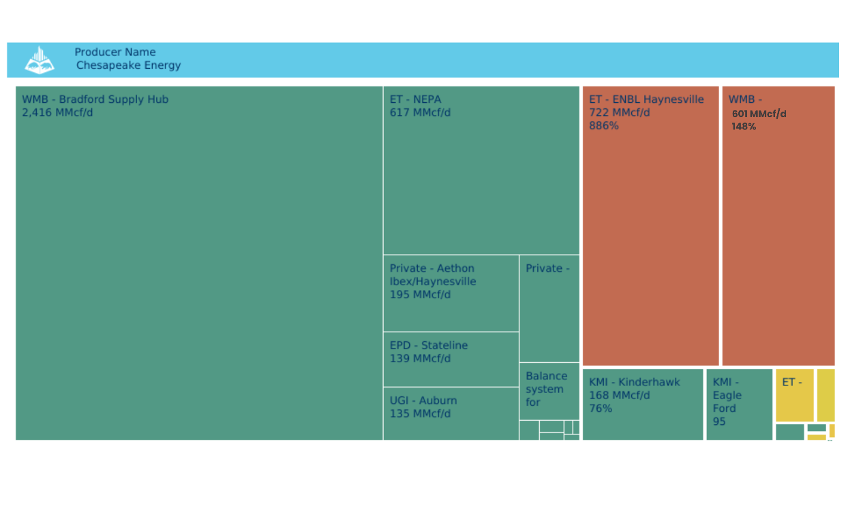

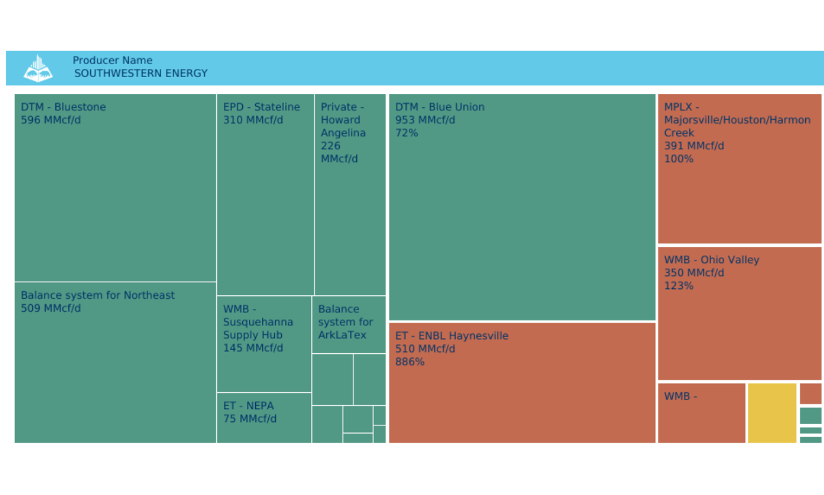

East Daley Analytics expects the blockbuster deal to shift the risk and reward outlook for several names that provide midstream services for the producers. According to data in our Energy Data Studio platform, the largest midstream companies serving Chesapeake and Southwestern include Energy Transfer, Williams and DT Midstream.

The two figures below show midstream counterparties for Chesapeake and Southwestern from producer-to-system analysis available in Energy Data Studio. WMB’s Bradford Supply Hub in Northeast Pennsylvania (NE-PA) is the largest gathering system for Chesapeake by volume, gathering nearly 2.1 Bcf/d of natural gas for the producer (see figure 1). Williams is also the largest gas gatherer for Chesapeake in the ArkLaTex Basin, handling over 600 MMcf/d on the Louisiana/Magnolia system.

Figure 2 shows the midstream breakdown for Southwestern Energy. DT Midstream’s Blue Union system in the Haynesville is the largest gatherer for Southwestern with volumes of 1.2 Bcf/d (see figure 2). DT Midstream is also a significant midstream provider for Southwestern on the Bluestone system in the Northeast Pennsylvania Marcellus.

Gathering Volumes for Southwestern Energy, by G&P System (Source: East Daley Analytics)

In the Haynesville, Chesapeake operated 5 rigs at the start of 2024 compared to Southwestern’s 7 rigs. According to East Daley Analytics' rig allocations, Chesapeake mostly splits its gas in the Haynesville between Williams’ Magnolia and Energy Transfer’s Enable-Haynesville systems, though recently the producer’s rigs have been more weighted towards the Energy Transfer system (3 rigs vs 1). Southwestern Energy sends most of its Haynesville gas to DT Midstream's Blue Union system. However, like Chesapeake, the producer has been more active of late on Energy Transfer’s Enable-Haynesville system (4 rigs vs 2 rigs).

In the Northeast, Chesapeake was running 4 rigs at the start of 2024 vs Southwestern’s 3 rigs. Chesapeake primarily operates in Northeast Pennsylvania, sending mostly dry gas production to Williams’ Bradford Supply Hub.

Southwestern Energy is more diversified in Appalachia with 1 rig in NE-PA, 1 in the wet gas window in the Southwest Marcellus/West Virginia area and 1 rig in the Utica. Southwestern Energy’s 3 Northeast rigs are on DT Midstream’s Bluestone, MPLX’s Majorsville/Houston/Harmon Creek, and Williams’ Ohio Valley systems, according to allocations in Energy Data Studio. The producer usually operates 1 rig on Energy Transfer’s NE-PA dry gathering system, though East Daley is not tracking any rigs currently.

The bear case for midstream from the Chesapeake-Southwestern merger

The recent trend toward upstream consolidation has not been kind to the midstream sector. East Daley has tracked upstream merger and acquisition (M&A) activity in 2023, mostly focused on adding scale in the Permian Basin. These deals have led to rig cuts of ~30% once producers merge.

From a midstream perspective, a bear case for the Chesapeake-Southwestern merger assumes the new producing giant also takes a scalpel to its drilling budget. However, in the Permian consolidation dynamic, most of the rig attrition has involved publicly held producers acquiring private operators, which is not the case here. On the investor call following the announcement, Chesapeake and Southwestern management noted the two producers are aligned and not trying to grow natural gas production currently given the oversupplied market. Executives also highlighted the flexibility to adjust rig activity based on where natural gas prices trend. The companies have guided to $400MM of reductions from overhead and synergies.

Therefore, gas price dynamics are likely to drive the outcome. If natural gas prices stay stuck in a $2/MMBtu range, then a bear case for the Chesapeake-Southwestern deal becomes more likely. Among the basins, East Daley does not expect rig cuts in the Northeast given the basin’s low break-even rates. The ArkLaTex in our view will be a more interesting basin to monitor as it is a swing basin in the U.S. natural gas market, and therefore more vulnerable to cuts if gas prices stay low, or to upside when prices increase again.

We see drilling on Energy Transfer’s Enable–Haynesville system as most vulnerable in a downside case, particularly since both producers have been active of late on that system, so there is more room to cut. However, Chesapeake and Southwestern have commitments to several new pipeline expansions that could mitigate downside in the Haynesville. These projects include DT Midstream’s staggered LEAP project and Energy Transfer’s Gulf Run Pipeline expansion. The Chesapeake-Southwestern combo may want to maintain Haynesville supply to fill these projects and feed new LNG demand coming online at the end of the year.

LNG drives upside case for merger

In the long term, U.S. producers will see macro tailwinds from the massive growth expected in LNG demand. The additional upside case for a Chesapeake-Southwestern merger is tied to global LNG markets, and whether the new larger company can execute in the LNG space. Chesapeake said it plans to build a marketing operation in Houston to trade in global gas and LNG markets once the companies merge.

LNG deals typically require long-term contracts, and counterparties with solid credit to assure lenders. These hurdles historically have kept the E&P sector locked out as investors in the LNG export boom. The Chesapeake-Southwestern combo creates a producing company with more resources to lock down long-term deals, and a better balance sheet to credibly compete in the LNG space with global trading firms.

If a Chesapeake-Southwestern combo can execute in global markets and expose more of its gas production to higher international prices, then low U.S. gas prices may not matter so much. In an optimistic scenario, the new company could underpin new LNG exports projects as both a supplier and investor, growing long-term gas demand and raising volumes for midstream names with exposure.

Recommended Reading

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

Matador Bolts On Additional Interest from Advance Energy Partners

2024-02-27 - Matador Resources carved out additional mineral and royalty interests on the acreage it acquired from Advance Energy Partners for $1.6 billion last year.

Berry Bolts On More California Assets as Kern County M&A Continues

2024-03-06 - As Berry Corp. continues its aggressive hunt for growth opportunities outside of California, the E&P made a second bolt-on acquisition in Kern County in the fourth quarter.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.