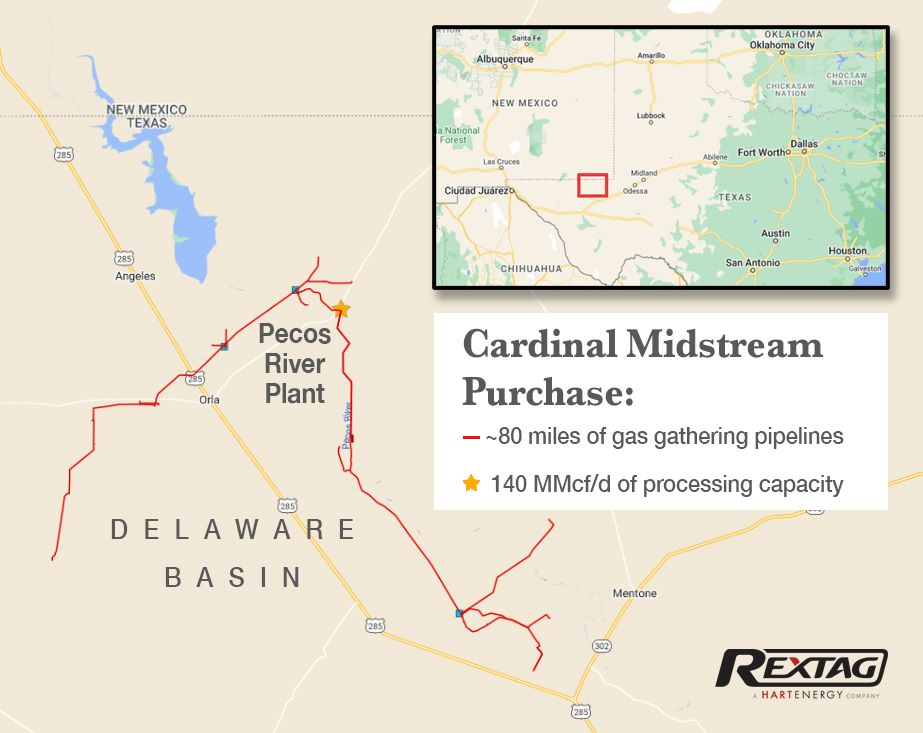

Cardinal Midstream Partners closed its acquisition of Medallion Midstream’s natural gas gathering and processing assets in the Delaware Basin, Cardinal said on Feb. 6.

The operations in Reeves and Loving counties, Texas, include about 80 miles of high- and low-pressure natural gas gathering pipelines and a 140 MMcf/d natural gas processing facility.

“We are excited to have completed this transaction as it positions us for significant growth and future bolt-on opportunities in the heart of one of the most prolific basins in the United States,” said Cardinal CEO Doug Dormer. “These assets are an ideal cornerstone for our business and we look forward to meaningfully growing our footprint over time.”

The Dallas independent was formed in April 2022 with $300 million in funding from EnCap Flatrock Midstream. It is focused on midstream acquisition and development across North America, specifically natural gas gathering and processing, and carbon capture and sequestration.

Recommended Reading

US Interior Department Releases Offshore Wind Lease Schedule

2024-04-24 - The U.S. Interior Department’s schedule includes up to a dozen lease sales through 2028 for offshore wind, compared to three for oil and gas lease sales through 2029.

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Mexico Presidential Hopeful Sheinbaum Emphasizes Energy Sovereignty

2024-04-24 - Claudia Sheinbaum, vying to becoming Mexico’s next president this summer, says she isn’t in favor of an absolute privatization of the energy sector but she isn’t against private investments either.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.