Deutsche Banc Alex. Brown analysts believe President Bush might allow the expiration next year of the Iran-Libya Sanctions Act, which has prohibited U.S. companies from doing business with these OPEC members for most of the past 20 years. The law also calls for penalties against non-U.S. firms that do business with these countries, if they also do business in the U.S. Whether the rules are continued next year by executive order will affect U.S.-based Amerada Hess Corp.'s acquisition of U.K.-based Lasmo Plc. The latter has interests in both Iran and Libya. Amerada will have to dispose of the Middle Eastern and North African assets, if it cannot get around the law. The most convenient situation would be U.S. discontinuance of the rules. Royal Dutch/Shell and TotalFinaElf SA already have Iranian interests; BP Plc and several Japanese firms are negotiating deals, according to the DBAB analysts. Iran hopes to increase its current oil production capacity to 4.75 million barrels per day, from 3.75 million now. Libya's current capacity is 1.55 million barrels per day and the DBAB analysts don't see that increasing significantly during the next five years. The state-owned Agoco, Waha, Sirte and Zueitina firms produce about two-thirds of current output. Italy's Eni and Spain's Repsol-YPF produce most of the rest. "Realizing that Libya needs foreign investment, the regime has tried to change the country's terrorist image," the analysts report. Additional volumes are expected from Lasmo's Elephant field (140,000 barrels per day) and Repsol-YPF's El Sharara (180,000). "Although these additions are high, it will be a struggle to offset declines at mature fields. Further volumes will depend on the improvement of upstream terms, as well as an end to U.S. and U.N. sanctions," the analysts add

Recommended Reading

Despite LNG Permitting Risks, Cheniere Expansions Continue

2024-02-28 - U.S.-based Cheniere Energy expects the U.S. market, which exported 86 million tonnes per annum (mtpa) of LNG in 2023, will be the first to surpass the 200 mtpa mark—even taking into account a recent pause on approvals related to new U.S. LNG projects.

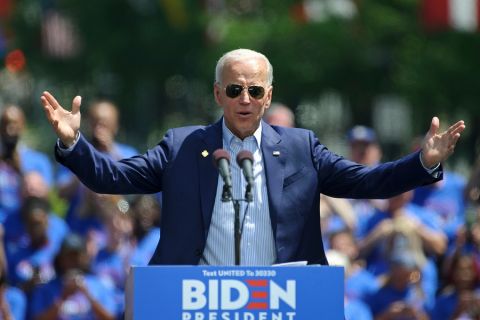

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

EQT’s Toby Rice: US NatGas is a Global ‘Decarbonizing Force’

2024-03-21 - The shale revolution has unlocked an amazing resource but it is far from reaching full potential as a lot more opportunities exist, EQT Corp. President and CEO Toby Rice said in a plenary session during CERAWeek by S&P Global.

Everywhere All at Once: Woodside CEO Touts Current Global Portfolio

2024-03-05 - Meg O’Neill, the CEO of Australian energy giant Woodside Energy, is overseeing the “next wave” of growth projects around the globe, including developments in the Gulf of Mexico, offshore Senegal and further LNG expansion.

US Asks Venture Global LNG to Justify Filing of Confidential Documents

2024-03-13 - The FERC request comes days after Venture Global LNG customers had challenged the company's request for a one-year extension of its startup and urged the regulator to make Venture Global release the confidential commissioning documents.