Transocean Norge drilled the appraisal well in 308 m water depth in the Norwegian Sea. (Source: Transocean)

Wintershall Dea is considering subsea development options after an appraisal well at its Bergknapp discovery in the Norwegian Sea firmed up reserves estimates.

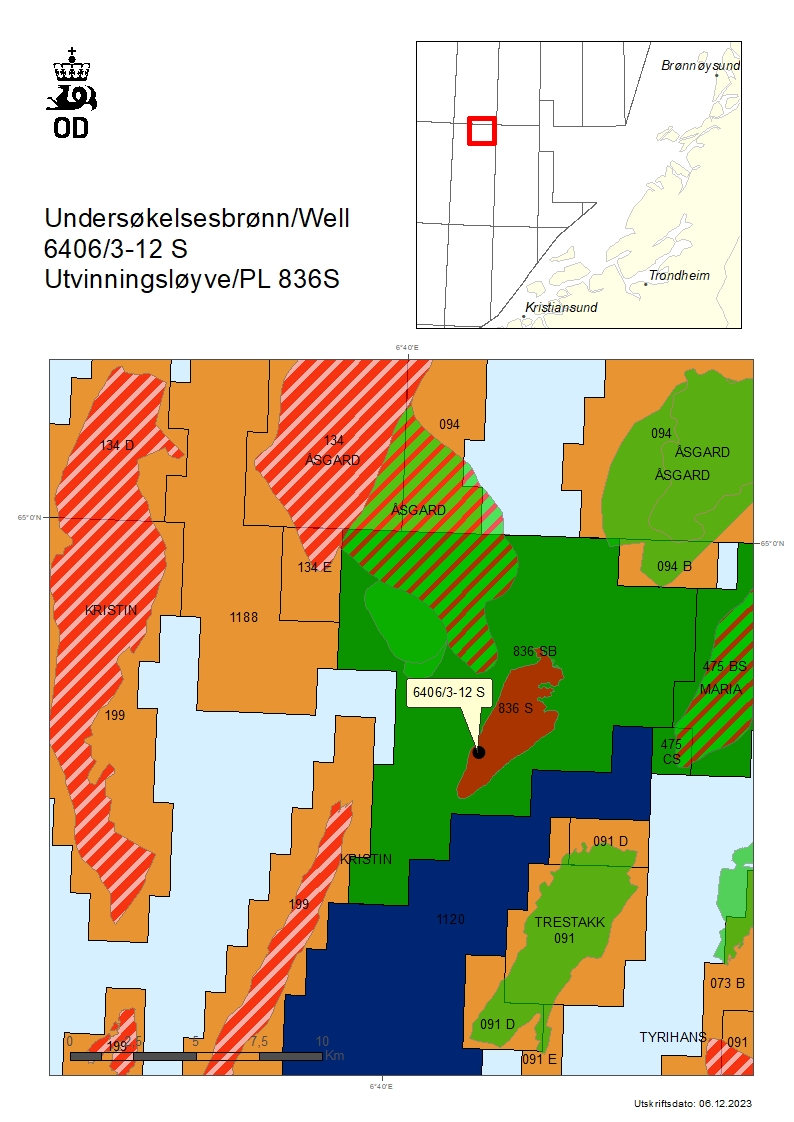

Bergknapp is in PL836S, which is 8 km west of Wintershall’s operated Maria field and close to several other producing fields.

According to the Norwegian Petroleum Directorate (NPD), the oil discovery at Bergknapp was proven in 2020, with the gas discovery following in 2021. The recent appraisal well is the third in PL836S, which was awarded in 2015.

Transcoean Norge drilled the appraisal well in 308 m water depth intended to reduce subsurface uncertainties at the Bergknapp discovery.

Wintershall updated recoverable resource estimates for the oil discovery in the Garn, Ile and Tilje formations at between 44 MMboe and 75 MMboe, and estimates for the underlying Åre Formation, discovered by a sidetrack in 2021, between 6 MMboe and 25 MMboe. In total, the recoverable resources are estimated between 50 MMboe and 100 MMboe.

The well was not formation-tested, but extensive data acquisition and sampling were carried out, the NPD said. The well has been permanently plugged and abandoned.

“In recent years, we have had achieved significant success with our strategy of exploring areas where we have in-depth subsurface knowledge and access to existing infrastructure. The focused exploration strategy maximizes our chances of making commercial discoveries and also shortens the time required for their development,” Michael Zechner, Wintershall Dea Norge managing director, said in a press release.

The Transocean Norge rig, under a long-term contract for Wintershall Dea and OMV, will move to the nearby Wintershall-operated PL211 CS license, where it will drill another appraisal well on the Adriana and Sabina discoveries.

Wintershall Dea operates the PL836S Bergknapp license with 40% interest on behalf of partners Equinor and DNO Norge, each with 30% interest.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.