After closing a $2.2 billion deal this summer to add significant scale in the Eagle Ford, Calgary-based Baytex Energy is shedding some of its assets in southwestern Saskatchewan. (Source: Shutterstock.com)

Baytex Energy is divesting some of its crude oil assets in Western Canada, the company announced on Nov. 27.

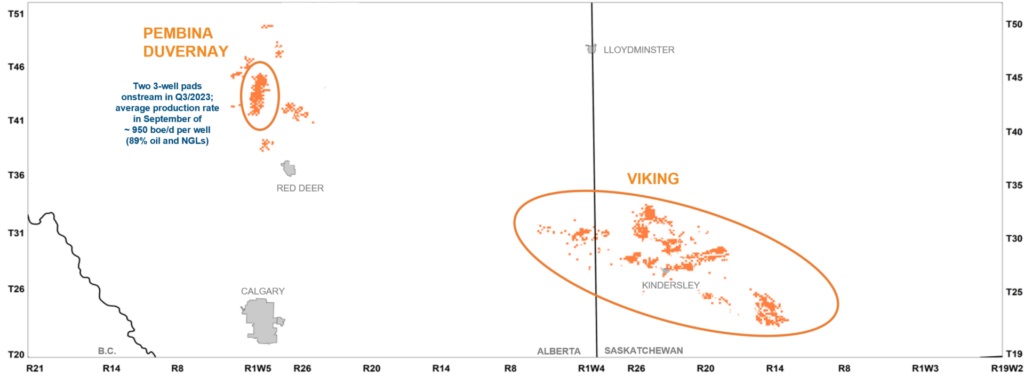

Calgary-based Baytex Energy Corp. agreed to sell a portion of its Viking assets, located at Forgan and Plato in southwestern Saskatchewan, for nearly US$113 million (CA$153.8 million).

Production from the assets is approximately 4,000 boe/d (100% light and medium crude oil).

The transaction is expected to close before the end of the year. The buyer was not disclosed.

Proceeds from the sale are expected to be applied toward repaying Baytex’s outstanding bank debt, the company said.

Baytex had total debt of US$1.98 billion (CA$2.7 billion) and a debt-to-EBITDA ratio of 1.1x as of Sept. 30, the company reported in third-quarter earnings.

Baytex has a $1.1 billion revolving credit facility with a maturation date of April 1, 2026. The company repaid a $150 million term loan during the third quarter.

Scale in South Texas

The third quarter was also Baytex’s first full quarter of combined operations after closing its acquisition of Eagle Ford Shale E&P Ranger Oil Corp.

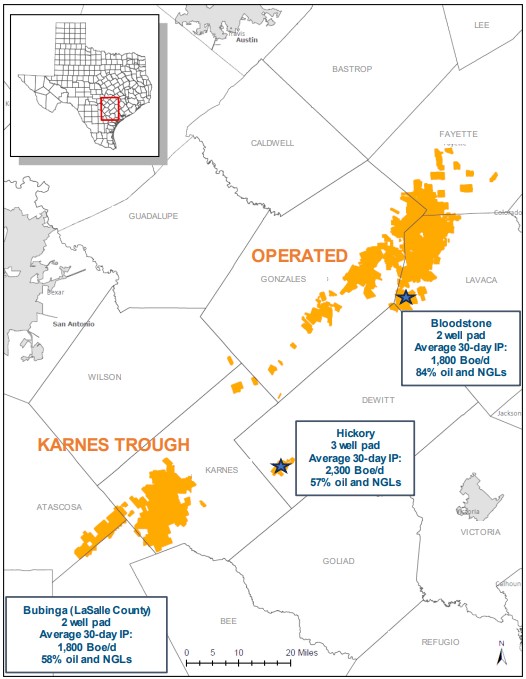

The $2.2 billion acquisition added 162,000 net acres and 741 undeveloped drilling locations in the crude oil window of the Eagle Ford—which complemented Baytex’s existing non-operated position in the Karnes Trough.

Third-quarter production in the Eagle Ford averaged 87,311 boe/d (85% oil and NGL).

Baytex’s companywide production averaged 150,600 boe/d during the third quarter, up 81% from an average of 83,194 boe/d during the same quarter a year ago.

RELATED: Baytex Closes $2.2 Billion Acquisition of Eagle Ford’s Ranger Oil

Recommended Reading

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.