In 2020, the Permian Basin, which spans parts of West Texas and eastern New Mexico, produced 50% of total associated gas in the U.S., according to the EIA. (Source: Hart Energy)

Associated natural gas production in major U.S. shale plays declined in 2020, following three years of growth, according to a recent report by the Energy Information Administration (EIA).

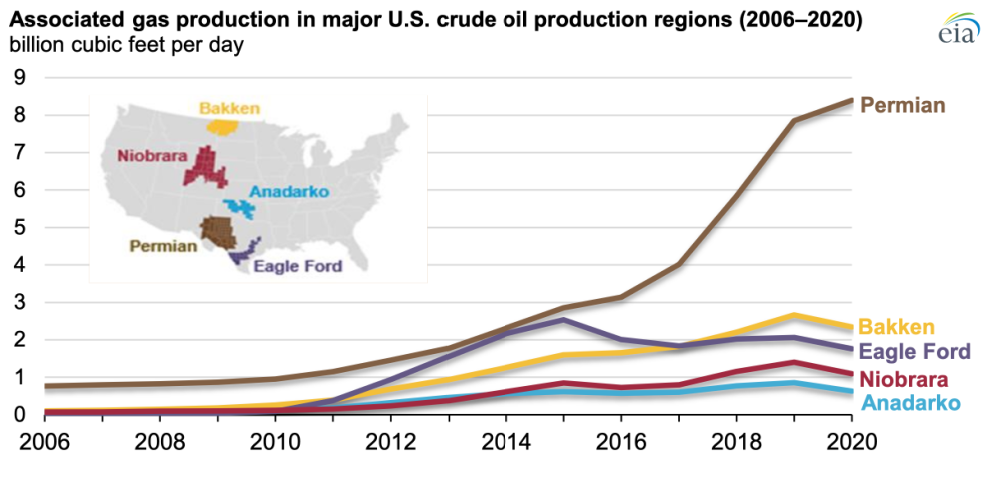

Between 2016 and 2019, associated gas production in the combined five major U.S. onshore crude oil-producing regions comprising the Permian, Bakken, Eagle Ford, Niobrara and Anadarko grew at its most rapid pace (6.1 Bcf/d). However, as the demand for crude oil decreased last year following responses to the COVID-19 pandemic, both crude oil and associated gas production in the U.S. declined, the EIA noted in its report on Aug. 23.

Only the Permian Basin increased its production of both crude oil and associated gas in 2020, the EIA said, but these increases did not offset declines in both crude oil and associated gas production in the other four regions.

In 2020, the Permian region, which spans parts of West Texas and eastern New Mexico, produced 50% of total U.S. associated gas.

“Some of this increase in associated gas production can be attributed to greater natural gas takeaway capacity in the Permian region,” the EIA wrote in its report.

Overall, the share of associated gas produced in the combined five regions (Permian, Bakken, Eagle Ford, Niobrara and Anadarko) declined by 1.5% year-over-year and averaged 37.7% of natural gas production in the regions.

U.S. associated gas production averaged 14.2 Bcf/d in 2020 (a 4.1% decline from 2019) amid a drop in oil production in these regions.

Despite the decline last year in associated gas, years of rising associated gas production in the U.S. led to record high volumes in 2020 of natural gas plant liquids such as ethane, propane, normal butane, isobutane and natural gasoline production, driven by high ethane demand.

“Ethane consumption has been growing steadily both domestically and through exports since 2014,” the EIA added.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

Weyerhaeuser, Lapis Energy Enter Carbon Sequestration Exploration Pact

2024-02-29 - The exploration agreement covers 187,500 acres across three states with five potential carbon sequestration sites.